Compare financial ratios are among the most essential tools in fundamental analysis, helping investors, analysts, and business owners understand a company’s performance at a deeper level. Yet ratios alone don’t provide meaningful insight unless they are compared — across companies, across time periods, and against industry benchmarks. Comparing financial ratios reveals whether a business is improving, lagging behind competitors, or signaling potential risk. This guide explains how financial ratios work, why comparing them matters, and how to interpret them using practical examples. Visit tipstrade.org and check out the article below for further information.

What Are Financial Ratios?

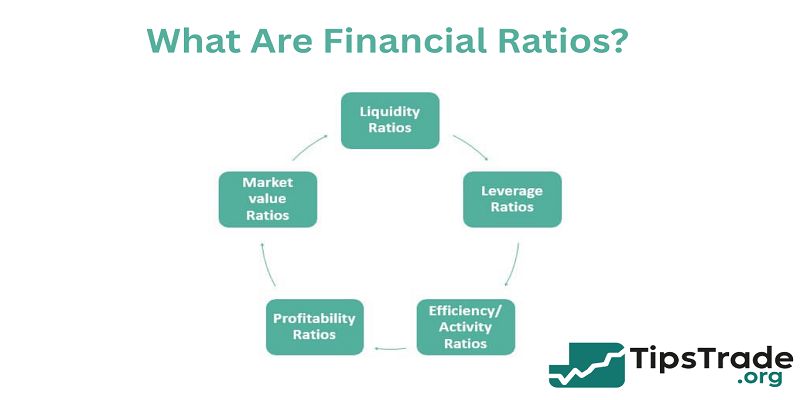

Financial ratios are numerical values calculated from financial statements such as the balance sheet, income statement, and cash flow statement.

They help measure key aspects of performance including profitability, liquidity, solvency, efficiency, and valuation.

For example, metrics like the current ratio, profit margin, debt-to-equity, and return on assets (ROA) reveal insights that raw financial figures cannot show directly. Analysts use ratios to evaluate how efficiently a company operates, whether it generates enough revenue relative to assets, or whether it carries too much risk.

Ratios also offer a standardized way to compare different businesses despite differences in size or revenue levels.

Experience from financial professionals shows that ratios often provide early signals of underlying issues before they appear in earnings or stock price movement.

Why Financial Ratios Matter

Financial ratios matter because they transform large amounts of numerical data into simple, actionable insights. Instead of reading through hundreds of financial line items, investors can quickly understand a company’s strengths or weaknesses through key metrics.

Research from the CFA Institute highlights that ratio analysis improves decision quality by assessing performance indicators that directly influence valuation.

For example, declining liquidity ratios often warn of potential cash flow problems, while improving margins signal stronger operational efficiency.

Ratios also enable cross-company comparisons, which is essential when evaluating competitors or choosing stocks within the same sector.

For business owners, ratios serve as internal control tools, helping identify inefficiencies and guiding strategic improvement. Their reliability comes from being calculated from audited financial statements, making them trustworthy indicators of financial health.

Why Comparing Financial Ratios Matters

Comparing financial ratios is more powerful than looking at standalone values.

For example, an improving return on equity (ROE) suggests better management performance, while a rising debt-to-equity ratio may signal elevated financial risk.

Ratio comparisons also guide valuation decisions, helping determine whether a stock is undervalued, fairly priced, or overpriced relative to peers. Experts note that companies with consistently superior ratios often maintain stronger long-term performance.

Benefits of Ratio Comparison

Comparing financial ratios provides several important benefits:

- Detecting performance trends: Multi-year comparison helps identify improvement or deterioration.

- Understanding competitive position: Benchmarking against competitors reveals market strength.

- Evaluating financial health: Liquidity and solvency comparisons highlight risk levels.

- Guiding investment decisions: Investors can confirm whether a stock aligns with return and risk objectives.

- Supporting management decisions: Businesses use comparisons to optimize operations and allocate resources.

Financial research consistently shows that ratio comparison is one of the most predictive elements of fundamental analysis when identifying outperforming companies.

Types of Financial Ratios

Financial ratios fall into several main categories, each measuring different aspects of performance. Analysts commonly group ratios into profitability, liquidity, solvency, efficiency, and valuation categories.

Understanding the meaning of each type helps investors compare companies more accurately.

Profitability ratios measure earnings relative to sales or assets, showing how efficiently a business generates profit. Liquidity ratios assess short-term financial stability, while solvency ratios evaluate long-term debt risk.

Efficiency ratios reflect asset utilization and operational productivity. Valuation ratios help investors assess whether a company’s stock is fairly priced relative to earnings, book value, or cash flow. Each category plays an essential role in comprehensive financial analysis.

Profitability Ratios

Profitability ratios show how effectively a company generates profit from revenue, assets, or equity. Key ratios include net profit margin, return on assets (ROA), and return on equity (ROE).

For example, ROE highlights how well management uses shareholder capital to generate returns. A higher ROE generally signals operational effectiveness.

However, comparing profitability ratios only makes sense when looking at similar industries, because margin expectations differ widely across sectors.

According to financial studies by OECD, higher long-term profitability ratios often correlate with stable stock performance. Investors often compare multi-year profitability ratios to identify trends that reflect improving efficiency or competitive advantages.

Liquidity and Solvency Ratios

Liquidity ratios, such as the current ratio and quick ratio, measure a company’s ability to meet short-term obligations. Solvency ratios, including debt-to-equity and interest coverage, assess long-term financial stability. These ratios are essential when comparing risk levels between companies.

For example, a firm with a high debt-to-equity ratio may generate strong profits but also carry higher risk during economic downturns. Analysts often use liquidity and solvency comparisons to predict resilience.

Research from Investopedia indicates that companies with stronger liquidity positions typically experience lower volatility in turbulent markets. Comparing these ratios across competitors provides insight into overall financial risk.

Efficiency and Valuation Ratios

Efficiency ratios measure how well a company uses assets and resources. Examples include asset turnover and inventory turnover.

Higher efficiency ratios typically indicate stronger operational management. Valuation ratios such as price-to-earnings (P/E), price-to-book (P/B), and price-to-sales (P/S) help investors assess whether a stock is undervalued or overvalued.

Comparing valuation ratios across companies within the same sector provides insight into relative market expectations.

According to market research platforms, stocks with low valuation ratios relative to their peers often represent value opportunities — especially when supported by solid fundamentals.

How to Compare Financial Ratios Across Companies

Comparing ratios across companies requires a structured approach. Analysts begin by selecting companies within the same industry to ensure meaningful comparisons.

They then identify the most relevant ratios for the comparison — for example, technology companies focus on efficiency and profitability, while banks require liquidity and solvency metrics.

After collecting multi-year data, analysts compare ratios side-by-side to evaluate strengths, weaknesses, and competitive positioning. Industry benchmarks and averages provide further context.

This method helps investors determine which companies outperform peers and which face potential risks. A reliable comparison also requires adjusting for company size, business model differences, and market conditions.

Benchmarking Against Industry Standards

Benchmarking involves comparing a company’s ratios to industry averages. Industry benchmarks are available through financial databases, stock exchanges, and economic reports.

By using benchmarks, analysts can immediately see whether a company is performing above or below standard.

For example, if the typical industry ROA is 8%, but a company reports 12%, it indicates strong asset efficiency. Conversely, a liquidity ratio significantly below industry norms may signal risk.

Benchmarking provides a more accurate context because performance standards differ across industries.

Trusted sources such as the CFA Institute regularly emphasize the importance of industry benchmarking in ratio interpretation.

Using Ratios for Company Comparison

When comparing companies, analysts look at multiple ratio categories rather than focusing on a single metric.

A company may show strong profitability but weak liquidity, indicating unbalanced financial health. Another competitor might have moderate profitability but excellent solvency, suggesting long-term stability.

Analysts often create comparison tables to evaluate strengths and weaknesses across different drivers.

Experience shows that comparing multi-year ratios produces more reliable insights than single-year snapshots because it highlights trends.

This method helps investors identify companies with consistent performance rather than short-term fluctuations.

Common Mistakes When Comparing Ratios

Despite the usefulness of ratio comparison, many analysts and investors make avoidable mistakes.

One common error is comparing companies from different industries, which leads to misleading conclusions due to differing operating structures. Another mistake is relying on a single ratio rather than a full set of performance indicators.

Short-term trends can also distort ratio interpretation — for example, temporary revenue spikes may inflate profitability ratios.

Inflated or manipulated accounting figures can skew ratios, which is why analysts must consider footnotes and accounting methods. Recognizing these pitfalls helps investors avoid inaccurate comparisons.

Misinterpreting Ratios Without Context

Ratios mean little without proper context. A company may have a high debt-to-equity ratio that appears risky, but in capital-intensive industries, this can be normal.

Similarly, a low profit margin may seem negative until compared with industry averages. Analysts emphasize that interpreting ratios without context leads to incorrect conclusions.

Financial statements sometimes reflect unusual events such as one-time charges or asset sales, which can distort ratios for a single year.

This is why multi-year analysis and industry comparison are critical for accurate interpretation.

Comparing Different Industries

Comparing ratios across industries is one of the most frequent mistakes. Each sector has unique cost structures, risk levels, and operating models.

For example, grocery retailers typically have thin margins but high turnover ratios, whereas software companies enjoy high margins but lower turnover.

A meaningful comparison requires selecting competitors within the same sector and similar business models.

Only then do ratios accurately reflect strengths or weaknesses. Experts consistently warn that cross-industry ratio comparison leads to false assumptions and poor investment decisions.

Tools to Compare Financial Ratios

Several financial tools and platforms simplify ratio comparison. Websites like Yahoo Finance, Morningstar, MarketWatch, and TradingView allow users to compare multi-year ratios, visualize trends, and benchmark companies.

Professional tools like Bloomberg Terminal or S&P Capital IQ offer deeper analysis, including sector dashboards and forecasting models.

For beginners, free financial websites provide adequate data for comparison. Many tools include built-in comparison tables, graphs, and sector rankings.

Using the right tools enhances accuracy and provides a more comprehensive understanding of company performance.

Online Tools and Platforms

Online tools such as Yahoo Finance, Macrotrends, Finviz, and TradingView provide essential ratio comparison features including:

- Multi-year ratio charts

- Side-by-side company comparison

- Sector benchmarking

- Valuation and profitability dashboards

These tools help investors evaluate companies quickly and visually. They also pull data from reputable financial databases, improving reliability. Financial educators often recommend these platforms for beginners because they offer both simplicity and depth.

Manual Comparison Methods

Analysts who prefer manual comparison often use spreadsheets to track multi-year ratios. This approach allows customization and deeper insight into trends. For example, creating a 5-year comparison table for profitability, liquidity, and valuation ratios can reveal patterns not obvious in single-year data. Manual analysis also encourages a more thoughtful review of financial statements, including footnotes and accounting policies. Although more time-intensive, this method provides superior understanding and reduces reliance on incomplete automated tools.

Conclusion

Comparing financial ratios is one of the most effective ways to evaluate company performance, assess risk, and make informed investment decisions. By examining profitability, liquidity, solvency, efficiency, and valuation metrics together — and comparing them across companies, industries, and time periods — investors gain a deeper and more accurate understanding of financial health. Whether you are a beginner or an experienced analyst, ratio comparison provides a reliable foundation for decision-making.