CFD Leverage is considered one of the most powerful tools that allows traders to maximize their capital efficiency and take advantage of price movements. Through leverage, traders can open positions significantly larger than their actual account balance, increasing their profit potential. However, along with these benefits comes substantial risk if leverage is not properly understood or managed. Let’s explore the concept of leverage in CFD trading, including how it works and how to use it productively!

What is CFD leverage?

CFD Leverage is a trading mechanism that enables traders to control larger positions using only a small portion of capital, known as margin. Essentially, you deposit a fraction of the trade value while the broker provides the remaining exposure.

See more:

- What is CFD? Contracts for Difference Explained for Beginners

- What is Margin CFD? A Complete Guide to Margin in CFD Trading

- CFD Capital Management: Effective Principles and Strategies

- Common CFD Asset Types and How to Choose the Right One for Traders

How CFD leverage works

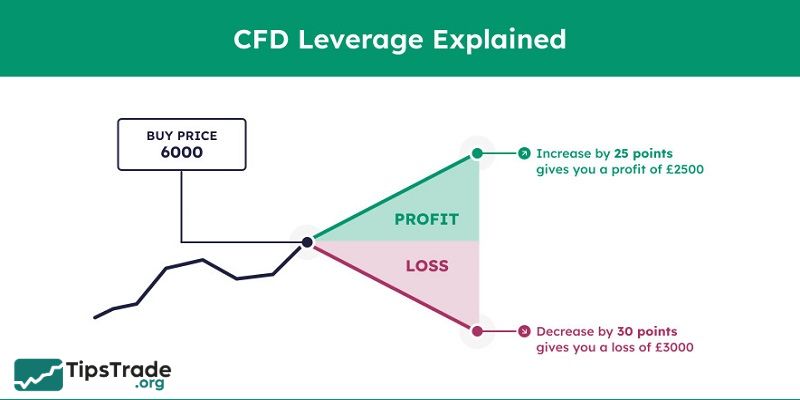

CFD leverage is usually expressed as a ratio or multiplier. Common leverage ratios given by brokers include 2:1, 10:1, 50:1, or even 100:1 or 25x, 75x or 100x, depending on the asset and the terms set by the broker.

Below is an example explaining how CFD leverage works:

- Let’s say you’re diving into the world of trading and start with INR 1,000 in your account.

- If your broker offers you a leverage of 100:1 or 100x, you can act as if you have INR 1,00,000 to trade with.

It’s kind of like having a superpower in the trading arena! With this 100x leverage, for every Rupee you put in, you’re able to control a hundred rupees in the market.

- This opens up the opportunity to make more substantial profits with even small fluctuations in prices.

- Picture it like this: if the market moves just a little in your favor, those small gains can add up quickly because you have more money on the line.

However, it’s essential to keep in mind that while this leverage can lead to exciting profit potential, it also brings a higher risk. If the market moves against you, the losses can grow just as quickly. That’s why it’s crucial to have a solid plan for managing risks. Trading with leverage can be thrilling, but it’s important to stay smart and be aware of the risks involved.

Benefits & Risks of CFD leverage in trading

Any type of financial trading instrument has certain inherent benefits and risks. And the CFD leverage tool is no exception. Here are the benefits and risks of CFD leverage that you need to understand before you start using it:

Benefits of CFD leverage

Here are some of the main benefits of trading with CFD leverage:

- Access to bigger market exposure without needing large capital

- Flexibility – you can allocate capital to multiple positions

- Scalability – ability to adjust trade size to strategy and risk appetite

- Low-volatility markets – Even small price shifts in a low-volatility market can result in amplified gains or losses.

Risks of using CFD leverage

While CFD leverage can offer attractive benefits, it also carries inherent risks that traders must be aware of.

- Losses are magnified just like profits

- Margin calls: If your losses exceed available margin, positions may be closed automatically

- Emotional trading: Larger positions can lead to fear or overconfidence

- Volatile assets + high leverage = fast liquidation risk

How to make use of CFD leverage for successful trading?

CFD leverage can be an excellent tool for Contract for Difference traders but should be used with care. Below are some key ways to ensure that you will make the most of CFD leverage and avoid risky situations.

Start small and scale up gradually

It is best to begin with a small position size when you first enter leveraged trading. The advantage of starting small is that it allows you to learn and understand the impact of leverage on your trades without risking too much capital. Make sure that you only increase your position size and leverage level gradually once you truly feel comfortable and confident.

Use stop-loss orders

Using stop-loss orders is another way to stay safe when trading leveraged positions. The principle behind a stop-loss order is to automatically close your position as soon as the price moves against your prediction by a predetermined amount. For example, if you set your stop-loss order to sell at a 5% loss, your broker will execute and sell your position once it reaches that level in the market.

In this way, you can limit potential losses – which is extremely important when using CFD leverage, as even small losses can accumulate very quickly.

Monitor market conditions

When trading with leverage, market volatility can significantly impact your trading results. Even a small price movement can trigger a margin call if your leverage ratio is too high. Therefore, closely monitoring market conditions and adjusting your leverage appropriately is essential.

Apply technical analysis and stay updated with market news to make informed decisions. Leverage works best when used wisely, combined with a thorough understanding of market trends and the assets you are trading.

Diversify your investment portfolio

It can be extremely risky to use leverage on a single trade, especially when the market moves against your expectations. Therefore, you should consider managing risk through diversification. By allocating capital across different assets or asset classes, you reduce the likelihood of losing your entire investment in just one trade. In this context, diversification helps stabilize your portfolio, allowing you to maximize the benefits of leverage while minimizing the risk of significant losses.

Final thoughts

CFD leverage is a powerful trading tool that allows investors to maximize capital efficiency and increase potential returns in financial markets. When used wisely, leverage can be a significant advantage, particularly in short-term trading strategies that capitalize on price fluctuations.

However, leverage is a double-edged sword. Excessive or careless use can quickly lead to substantial losses. Traders should begin with lower leverage levels, develop a clear trading strategy, and strictly follow sound risk management principles. With the right knowledge, discipline, and experience, CFD Leverage can become a valuable ally in achieving long-term trading success.

See more: