CFD Forex is a very familiar form of trading that anyone participating in the foreign exchange market has likely heard of; however, not everyone fully understands this concept. Having a clear understanding of what CFD Forex is, how it works, and its underlying mechanisms can be extremely beneficial for traders in the forex market. If you are interested in CFD Forex, be sure not to miss this article from Tipstrade.org!

What is CFD Forex?

CFD Forex is a derivative financial contract in which two parties (the trader and the broker) agree to exchange the price difference of a currency pair between the time the position is opened and the time it is closed.

For example:

- If you buy a EUR/USD CFD and the price rises, you make a profit.

- If the price falls, you incur a loss.

- Conversely, when you sell a EUR/USD CFD and the price falls, you earn a profit.

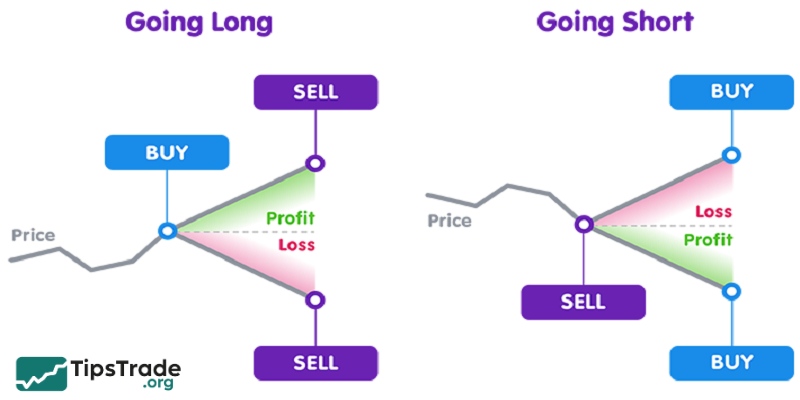

How does CFD Forex work?

The operating mechanism of CFD Forex is based on reflecting the value of the foreign exchange market:

- Opening a long position (Buy): Traders make a profit if the exchange rate rises and incur a loss if it falls.

- Opening a short position (Sell): Traders make a profit if the exchange rate falls and incur a loss if it rises.

- Closing a trade: This is done by placing an order opposite to the one used to open the position.

Benefits and risks of CFD Forex

Benefits of CFD Forex

- Access to multiple markets from a single account: With one CFD Forex account, traders can trade forex, indices, commodities, and global stocks. This makes it easier to diversify their portfolios.

- Two-way trading: Unlike traditional investing, which typically involves buying with the expectation of rising prices, CFD Forex allows traders to open short positions, enabling them to profit even when the market falls.

- Flexible leverage: Leverage allows traders to control large positions with a relatively small amount of capital, helping optimize capital efficiency.

- No need to own the underlying asset: There is no requirement to hold the actual currency or securities; all trades are based solely on price movements.

Risks of CFD Forex

In addition to their advantages, CFD Forex also involve significant risks:

- Leverage risk: Traders may lose their entire margin very quickly if prices move against your expectations.

- Trading costs: In addition to spreads, traders may incur overnight fees or commissions.

- Not suitable for everyone: CFD Forex are complex instruments that require solid knowledge and effective risk management skills.

- High volatility: The forex market is inherently volatile, and the use of leverage further increases risk.

According to statistics, up to 76% of retail investor accounts lose money when trading CFD Forex, a figure that clearly reflects the level of risk traders need to consider carefully.

What is leverage in CFD Forex?

One of the key features of CFD Forex is financial leverage.

- Leverage allows traders to control a large trading position with a relatively small amount of capital.

- For example, leverage of 1:20 means you only need to deposit 5% of the contract value as margin.

Specific example:

- Buy 1,000 Barclays share CFDs with a total value of GBP 2,500.

- With leverage of 1:5, traders only need to post a margin of GBP 500.

- If the price rises by 4%, the return on the margin is 20%.

However, high potential returns come with high risks. Leverage can quickly magnify losses if the market moves against your expectations.

Why do traders choose CFD Forex trading instead of direct trading?

Asset ownership:

- Traditional forex: Requires holding the actual currency.

- Forex CFDs: Only involve trading on price differences.

Short-selling capability:

- Traditional forex: Often limited.

- Forex CFDs: Make it easy to open short positions.

Leverage:

- Traditional forex: Offers lower leverage.

- Forex CFDs: Provide higher and more flexible leverage, but with greater risk.

List of best CFD Forex brokers right now

Below are the list of best CFD Forex brokers right now for investors to refer to:

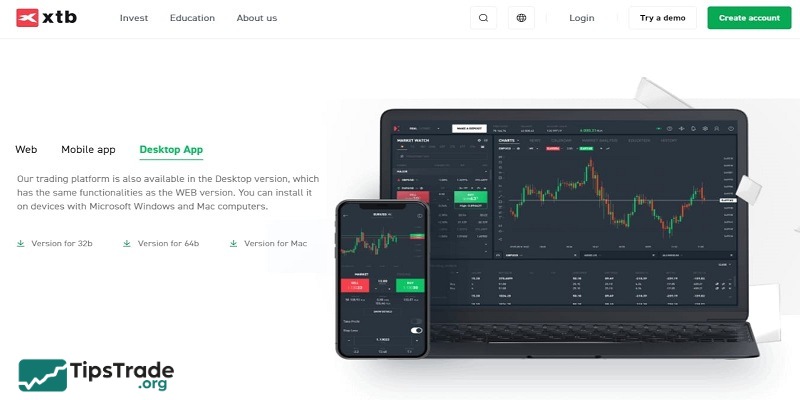

XTB

Overview

- XTB is one of the largest Forex & CFD brokers globally, serving more than 1 million clients. The broker is listed on the Warsaw Stock Exchange (Poland) and is regulated by FCA and CySEC.

Advantages

- XTB stands out with an extremely diverse product portfolio – over 6,100 instruments, including 71 Forex pairs, more than 3,000 stocks, indices, ETFs, and global commodities.

- The xStation platform is highly rated for its user-friendly interface, rich technical analysis tools, and full Vietnamese language support. The broker is not blocked in Vietnam.

- Some products are offered with a swap-free (no overnight fee) policy.

- XTB also has a customer support team in Vietnam, providing consultation through multiple channels, including Zalo.

Disadvantages

- Spreads typically range from 0.1 to 0.5 pips, but they may widen significantly during major news events.

- Currently, XTB does not support cryptocurrency trading in Vietnam.

Suitable for

- Suitable for professional traders who need access to a wide variety of trading instruments.

- Ideal for macro investors looking to trade international stocks, ETFs, and commodities.

Exness

Overview

- Exness is one of the most popular Forex brokers in Vietnam, with more than 800,000 clients. The broker is regulated by FCA, CySEC, and FSA, and regularly publishes transparent financial reports.

Advantages

- Exness offers some of the lowest spreads in the market, especially on Raw Spread and Zero accounts, starting from 0–0.1 pips.

- The broker applies a swap-free (no overnight fee) policy to many trading instruments.

- Deposits and withdrawals are extremely fast and fee-free, making it suitable for traders who trade frequently.

- The No Dealing Desk (NDD) model allows orders to be executed directly in the market, enhancing transparency.

Disadvantages

- Exness’ product range is not very extensive, mainly focusing on Forex, gold, cryptocurrencies, and a limited number of stocks.

- The Exness Terminal interface is sometimes not fully optimized and may be blocked by some internet service providers in Vietnam.

Suitable for

- Suitable for beginners with small capital due to low trading costs and ease of use.

- Ideal for retail traders who do not require a highly diversified product portfolio.

FxPro

Overview

- FxPro is one of the largest brokers in the market, serving more than 7.8 million clients. The broker is regulated by FCA, CySEC, and FSCA, and is particularly well known for its cTrader platform, a top choice among many professional traders.

Advantages

- FxPro supports MT4, MT5, and cTrader, offering flexible trading experiences for all trading styles.

- The broker operates under a No Dealing Desk (NDD) model, ensuring transparent order execution without broker intervention.

- FxPro has a strong CFD stock offering, with more than 2,000 shares from the US, UK, and Germany.

Disadvantages

- Trading costs are somewhat higher compared to Exness.

- All positions held overnight are subject to swap fees.

- The minimum deposit requirement is USD 100, which may not be suitable for traders with small capital.

Suitable for

- Suitable for experienced traders, especially those who prefer using cTrader or trading CFD stocks.

- Ideal for traders who prioritize execution quality and platform performance over the lowest possible trading fees.

IC Markets

Overview

- IC Markets is one of the few true ECN brokers in the market, well known for its ultra-low spreads. The broker is regulated by ASIC, CySEC, and FSA, serving more than 200,000 clients worldwide.

Advantages

- IC Markets offers some of the lowest spreads in the market, making it especially suitable for short-term trading strategies.

- The broker supports all major trading platforms, including MT4, MT5, and cTrader.

- It provides a wide range of trading instruments, including Forex, CFD stocks with over 2,100 shares, bonds, cryptocurrencies, and many global indices.

Disadvantages

- The minimum deposit requirement is relatively high at USD 200, which may not be suitable for beginners with limited capital.

- All overnight positions are subject to swap fees.

Suitable for

- Best suited for scalpers and day traders due to low spreads and fast order execution.

- Ideal for traders who need access to multiple currency pairs and global indices.

Final thoughts

The above article has provided you with information on what CFD Forex is, their advantages and disadvantages, as well as how CFD Forex trading works. Tipstrade.org hopes that you now have a clear understanding of this type of instrument and can develop a well-structured investment plan while carefully assessing the associated risks.