Understanding how to conduct market trend analysis helps traders make more accurate decisions. However, there are many ways to evaluate and forecast market movements. This article introduces the three most common market trend analysis methods. Let’s explore them in the following article! What is market trend analysis? Market trend analysis is the process of evaluating […]

Category Archives: Technical analysis

In financial investment, trading psychology is a key factor determining success or failure. However, most traders don’t pay enough attention to emotional management throughout the investment process. The following article will help you identify the basics of trading psychology and guide you on how to effectively control them in trading. What is trading psychology? Trading […]

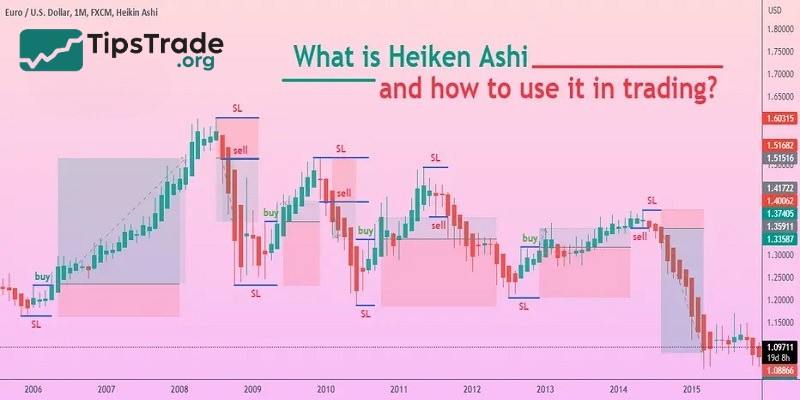

The Heikin-Ashi chart, along with Japanese candles, are two types of price candles developed by the Japanese. The Heikin-Ashi chart is an indicator, not another type of price chart. This candle has the potential to absolutely identify trends for investors to use. So, what is the Heikin-Ashi chart? What are the advantages and disadvantages of […]

The Accumulation/Distribution line is considered a variant of the OBV indicator. It allows traders to identify buying and selling pressure in the market while also spotting reliable trend reversal points. So, what exactly is the A/D line, and how to use it in trading for getting trading signals? Let’s explore it in more detail in […]

Indicator combination to help traders understand and control the market. Relying solely on a single indicator can lead to unconfirmed signals and increased risk. According to Tipstrade.org, combining multiple indicators will help reduce and increase the win rate, laying the foundation for the first orders. The following article will provide detailed instructions on how to […]

Chaikin Money Flow (CMF) is a technical indicator used by many investors to identify buying and selling pressure and find reasonable entry points. So, what exactly is Chaikin Money Flow? How is it calculated? And how can you trade effectively using this indicator? All these questions will be answered in today’s article by Tipstrade.org. Let’s […]

Are you wondering what the Ichimoku indicator is and why it’s used by many traders around the world? Ichimoku Kinko Hyo is one of the powerful technical analysis tools that helps investors visually identify trends, support and resistance zones, and trading signals. This article will explain in detail what Ichimoku is, its components, and how […]

Bollinger Bands are a technical indicator that “F0” investors should learn about. This technical indicator is not complex, and its effectiveness is no less than that of other indicators. So, what are Bollinger Bands? How are the parameters in Bollinger Bands calculated? How to use the indicator will be covered in the following article! What […]

The Momentum indicator is a popular technical analysis tool used by many traders to measure market momentum. It helps them identify the strength of price trends, thereby seeking potential trading opportunities and managing risks more effectively. In this article, Tipstrade.org will provide you with useful knowledge and trading strategies to make the most of the […]

Volume Oscillator is a fairly simple technical indicator used to track market trading volume to determine future trends. In the article below, Tipstrade.org will introduce Top 5 best of volume oscillator that you shouldn’t miss in trading. Let’s get started! What is the volume oscillator? The Volume Oscillator (VO) is a technical indicator used to […]