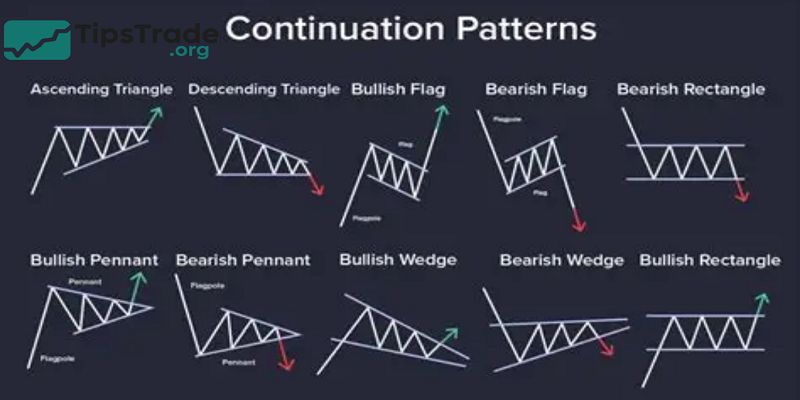

Continuation patterns are one of the most powerful concepts in technical analysis. They signal that an existing trend is taking a pause—before continuing in the same direction. Understanding these formations helps traders identify optimal entry points, manage risk, and ride the momentum more confidently. Visit tipstrade.org and check out the article below for further information […]

Category Archives: Stocks

Investor psychology plays a crucial role in shaping investment decisions and market dynamics. It refers to the emotional and mental factors that influence how investors behave, often leading to decisions driven more by fear, greed, or cognitive biases than by rational analysis. Understanding investor psychology helps explain why markets sometimes move irrationally and how emotions […]

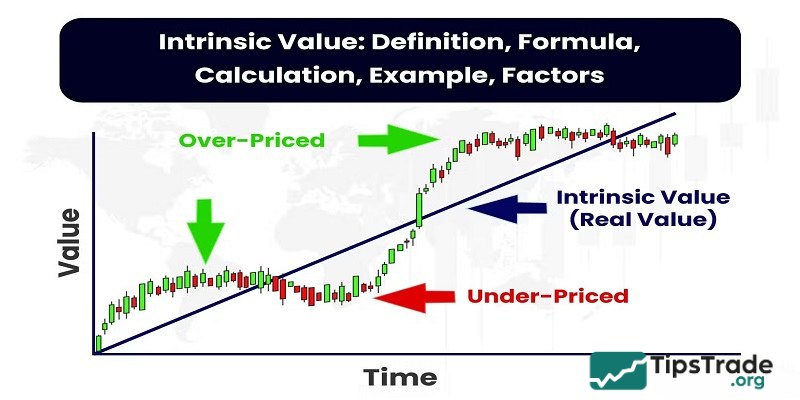

Fundamental analysis stock investing is a method used to evaluate a stock’s true value by examining a company’s financial health, earnings, growth potential, and industry position. This approach focuses on determining whether a stock is undervalued or overvalued compared to its intrinsic worth based on factors such as revenue, debt, and management quality. By performing […]

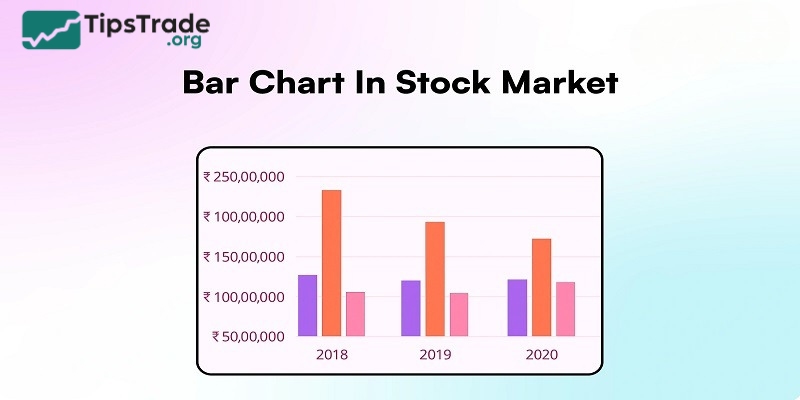

A bar chart is an important tool in stock analysis. It helps investors gain an overview of price fluctuations and trading volume. So, what is a bar chart & how to read? Let’s refer to the following article with Tipstrade.org to avoid missing out on useful knowledge! What is bar chart? A bar chart is […]

How to start stock investing is a vital step for anyone who wants to build wealth and secure their financial future in today’s dynamic market environment. Understanding the basic concepts, such as how the stock market operates, different types of stocks, and risk management, is essential before making any investment decisions. Equipping yourself with this […]

The intrinsic value of a company is one of the key factors when conducting fundamental analysis of a company. So, let’s learn about the term “Intrinsic Value” with Tipstrade.org in the following article. What is intrinsic value? Intrinsic value is used to talk about the real value, originating from within the enterprise, different from the […]

Stock investing apps are digital platforms that allow users to buy, sell, and manage stocks conveniently from their mobile devices. These apps provide easy access to the stock market, real-time updates, lower fees, and greater control over investment decisions. By eliminating the need for traditional brokers, stock investing apps empower investors with fast transactions and […]

Financial statements are an important concept in the field of stock investment. So, what are financial statements? How do you read financial statements? Everything will be answered in detail by Tipstrade.org in the article below! What are financial statements? In stock invesment, financial statements are official records that summarize a company’s financial performance and position […]

Index investing is a passive investment strategy aimed at matching the performance of a market index. Investors buy funds that replicate the index, offering low costs, broad diversification, and steady returns over the long term. This approach simplifies investing by reducing the need for active management and individual stock selection. Visit tipstrade.org and check out […]

Stock prices fluctuate constantly, and there is virtually no fixed formula for accurate prediction. But, understanding the impact of macroeconomic factors on stocks will help investors “read” the market better, avoid being swayed by rumors, and make more informed investment decisions. So, which macroeconomic factors impact the stock markets? Let’s learn about it with Tipstrade.org […]