Market Trend Resources is essential for any trader or investor. Price movements rarely move randomly — markets tend to develop bullish, bearish, or sideways trends. Identifying these trends early can help you make better trading decisions, reduce risk, and maximize profit potential. Market trend resources encompass tools, indicators, and information platforms that enable traders to […]

Category Archives: Market trends

Volume analysis is one of the most essential yet often overlooked aspects of technical analysis. While price movements show what happened, volume shows how many participants are driving those moves, providing insights into the strength, conviction, and reliability of trends. In this guide, we will break down the principles, indicators, strategies, real-world examples, and common […]

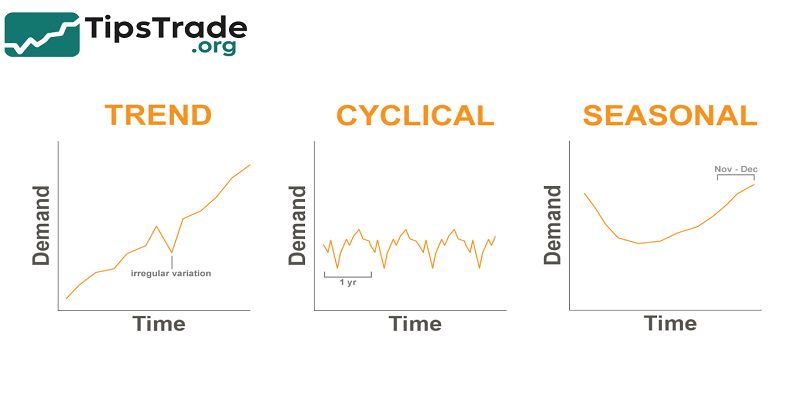

Cyclical trends describe the repeating patterns of expansion and contraction that shape economies, markets, industries, and consumer behavior. Even though technology changes fast, human psychology, supply–demand dynamics, credit cycles, and business behaviors consistently move in waves. Investors, business owners, and economists rely on cycle analysis to avoid avoidable risks and capture opportunities before the majority […]

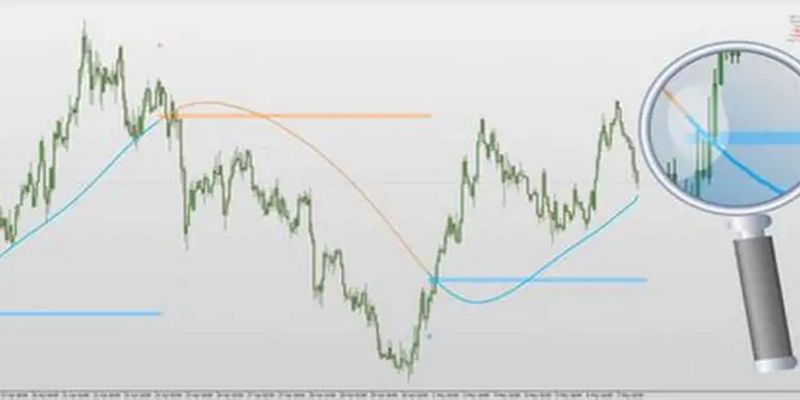

Trendlines in technical analysis are essential tools that help investors identify market trends visually and effectively. Using trendlines allows traders to spot support and resistance levels, leading to more accurate trading decisions. Understanding how to draw and apply trendlines enhances technical analysis skills and improves risk management in investments. Visit tipstrade.org and check out the article below […]

Sideways trend is a market condition characterized by prices moving within a narrow horizontal range without a clear upward or downward direction. This trend occurs when supply and demand forces are nearly balanced, resulting in price fluctuations between defined support and resistance levels. The sideways trend often represents a period of consolidation or indecision in […]

Downtrend represents a sustained period during which the price of an asset consistently falls over time. This trend reflects increasing selling pressure and bearish sentiment among traders and investors. Understanding how to recognize a downtrend early is essential for managing risk and making informed decisions in declining markets. Visit tipstrade.org and check out the article below for […]

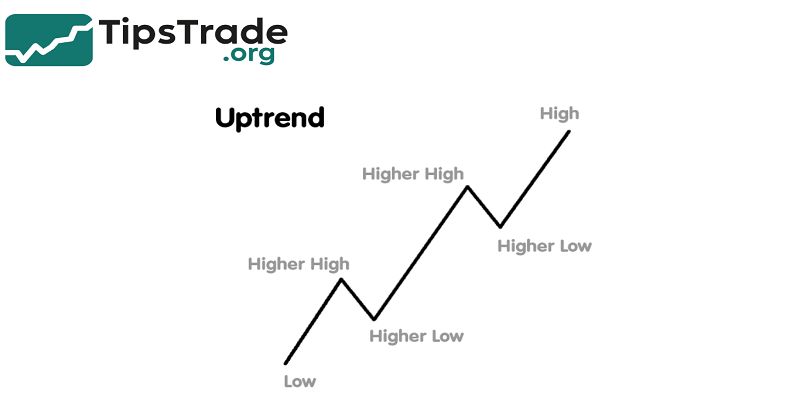

Uptrend represents a sustained period during which the price of an asset consistently moves higher, creating optimism among traders and investors. In financial markets, identifying an uptrend is crucial because it signals a favorable environment for buying opportunities and profit potential. Understanding the characteristics and signals of an uptrend allows investors to align their strategies […]

What are market trends? When trading in the financial market, you have probably heard the phrase “The trend is your friend,” right? Have you truly understood this “friend”? In this article, we will explore what market trends really are and how to effectively identify market trends through the structure of market trends. What is a […]

- 1

- 2