Equity hedge funds are one of the most widely used hedge fund strategies, playing a central role in the broader alternative investment landscape. For investors researching equity hedge funds, questions often revolve around long/short equity strategies, active stock selection, risk management, and how these funds differ from traditional equity mutual funds. Whether the goal is […]

Category Archives: Funds

Risks of Hedge Fund are often associated with high returns, complex investment strategies, professional fund managers, and alternative assets, but they also come with significant risks that are not always fully understood by investors. Unlike traditional mutual funds, hedge funds operate with greater flexibility, limited transparency, and higher leverage, which can amplify both gains and […]

Hedge funds regulations in Europe and Asia play a critical role in shaping how alternative investment funds operate, raise capital, and protect investors. Unlike retail investment products, hedge funds are subject to region-specific regulatory frameworks, cross-border marketing rules, regulatory compliance obligations, and investor protection standards that vary significantly between jurisdictions. Explore the detailed article at Tipstrade.org to […]

Hedge funds disclosure requirements mandate comprehensive reporting of strategies, risks, holdings, and performance to protect investors and ensure market stability. Unlike traditional mutual funds, hedge funds have historically enjoyed lighter regulation due to their sophisticated, accredited investor base, but post-2008 reforms like Form PF and SEC Rule 506 have imposed stricter transparency obligations. These disclosures […]

How to invest in hedge funds requires understanding their unique strategies, risks, and accessibility for individual investors. Hedge funds represent an alternative investment vehicle that aims to generate high returns regardless of market conditions, often employing sophisticated tactics like leverage, derivatives, and short-selling. Unlike mutual funds, they are typically available only to accredited investors due […]

Hedge Funds Report is one of the most valuable resources for understanding the hedge fund industry, providing deep insights into hedge fund performance, investment strategies, assets under management (AUM), and market outlook. For institutional investors, analysts, and sophisticated individuals, these reports help evaluate risk-adjusted returns, identify emerging hedge fund strategies, and assess how funds perform […]

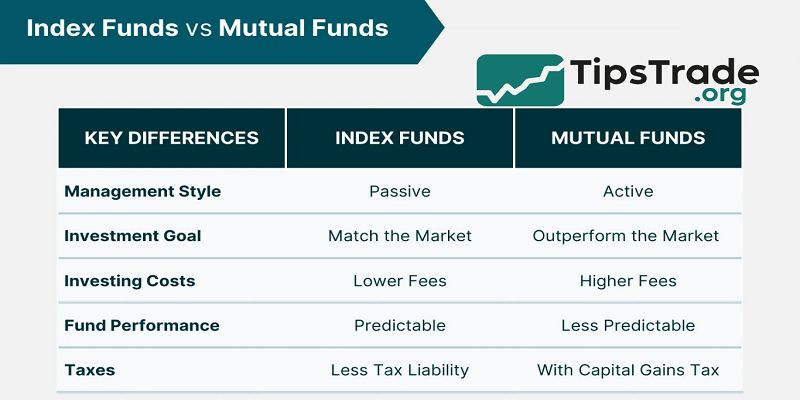

Index Funds vs Mutual Funds reveals key differences that can shape your investment strategy, with index funds offering passive, low-cost tracking of market benchmarks and mutual funds relying on active management by professionals. Index funds like Vanguard’s VTI shine with minimal fees and broad diversification, often outperforming mutual funds over time due to lower expenses. […]

Advantages of index funds make them a top choice for investors seeking low-cost, diversified growth in today’s volatile markets. These passive investment vehicles track major benchmarks like the S&P 500, delivering consistent returns without the high fees of active management. From superior long-term performance to built-in diversification across thousands of stocks, index funds simplify wealth […]

Top Index Funds represent the cornerstone of passive investing, offering everyday investors a low-cost way to mirror the performance of major market benchmarks like the S&P 500. These funds have surged in popularity due to their simplicity, diversification benefits, and historical ability to outperform most actively managed alternatives over the long term. By tracking broad […]

Risks in Index Funds, while often overshadowed by their low costs and simplicity, deserve careful scrutiny for any investor building a diversified portfolio. These passive vehicles track market indices like the S&P 500, offering broad exposure but exposing holders to systemic vulnerabilities such as market downturns, concentration in mega-cap stocks, and lack of adaptability during […]