Market ratios are a group of financial indicators that compare a company’s stock price to various fundamental metrics such as earnings, sales, book value, or economic growth. Investors often use these ratios to understand whether a stock is fairly priced, overvalued, or undervalued relative to its performance and market conditions. This makes them essential tools […]

Category Archives: Financial ratios

The quick ratio holds significant importance in corporate and organizational finance, as it helps assess a company’s ability to promptly and flexibly meet its short-term obligations without relying on inventory. Let’s explore this financial metric in detail in the following article! What is the quick ratio? The quick ratio, also known as the Acid test […]

ROA, or Return on Assets, is an important metric that provides investors with essential information to make informed investment decisions. So, what is ROA? What does it signify? How is return on asset calculated? Let’s explore this in the article below with Tipstrade.org! What is ROA? ROA (short for Return on Assets) is a financial […]

Financial ratios books are essential tools for anyone interested in analyzing a company’s financial health. They help investors, analysts, and managers evaluate liquidity, profitability, leverage, and efficiency. However, understanding these ratios correctly requires proper guidance. Books on financial ratios provide structured learning, real-world examples, and exercises that help readers master ratio analysis effectively. Visit tipstrade.org and check […]

Inventory turnover ratio is one of the most important efficiency metrics that measures how effectively a business manages its stock. In simple terms, it tells you how many times a company sells and replaces its inventory during a specific period. A high inventory turnover ratio indicates that products are selling quickly, while a low ratio […]

Financial ratio tools are essential instruments used by investors, analysts, and business managers to assess a company’s financial health and performance. These tools provide insights into profitability, liquidity, efficiency, and solvency by comparing various financial statement items through standardized ratios. Using Financial Ratio Tools, stakeholders can make informed decisions, identify trends, and benchmark companies against industry […]

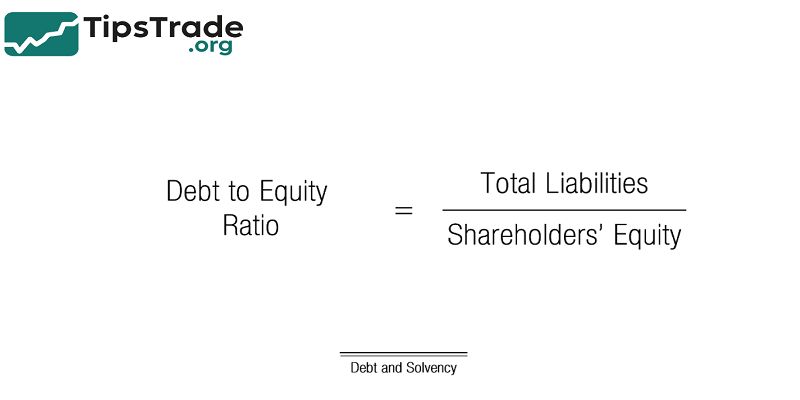

Debt To Equity Ratio is one of the most essential financial metrics investors and analysts use to evaluate a company’s financial leverage. Understanding this ratio helps businesses maintain a healthy balance between debt and equity, ensuring long-term stability and sustainable growth. Whether you are a business owner, investor, or financial analyst, knowing how to interpret […]

The current ratio is an important financial metric in corporate financial analysis. Let’s explore what the current ratio is and how to calculate it in financial analysis with Tipstrade.org in the following article! What is the current ratio? The current ratio (or working capital ratio) is a type of liquidity ratio that measures a company’s short-term solvency. […]

Liquidity ratios are among the important financial metrics that economists need to consider when assessing a company’s financial capacity. In this article, we will examine the most common liquidity ratios and explain how they apply in real-world situations. What are liquidity ratios? Liquidity ratios are financial metrics that indicate a company’s ability to repay short-term […]

Profitability Ratios are essential financial metrics used to evaluate a company’s ability to generate profit relative to its revenue, assets, or equity. These ratios help investors and managers assess the efficiency and effectiveness of a business in creating value. Understanding Profitability Ratios is crucial for making informed decisions about investment, management strategies, and financial health. […]