Book Building IPOs represent a modern and dynamic approach to pricing shares in an initial public offering, allowing companies to gauge demand before finalizing the offer price. This method facilitates better price discovery by involving institutional investors in the bidding process. As a result, it helps minimize the risks of underpricing or overpricing shares, making it a preferred technique in many capital markets worldwide. For a detailed understanding of these risks, you may also explore resources at Tipstrade.org which provide expert insights and comprehensive analysis on IPOs.

Understanding Book Building IPOs

Definition of Book Building

- Book building is a price discovery mechanism where the final price of shares is determined by collecting bids from investors.

- The process involves setting a price range (price band)—for example, $18 to $22 per share—and allowing investors to submit bids within that range.

- At the end of the bidding period, all bids are compiled in an electronic order book.

- The issuer and its underwriter analyze these bids to determine the cut-off price, which is the price at which the shares will be allotted.

This approach reflects real market demand, enabling a fair valuation for both the company and investors.

Why Book Building Exists

- Traditional IPOs faced one major issue: mispricing. Companies risked underpricing (leaving money on the table) or overpricing (leading to poor market debut).

- Book building solves this by engaging investors directly in the valuation process.

- The demand-driven nature of book building aligns price with market expectations, reducing post-listing volatility.

In essence, book building makes the IPO more transparent, efficient, and market-oriented.

See more:

- IPO Process: Step-by-Step Guide to Going Public

- How To Buy Stocks in 4 Steps: Quick-Start Guide for Beginners

- Long-Term Stock Investing: Benefits and Key Principles to Understand

- Day Trading Stocks: Benefits, Risks, and Effective Investing Strategies

How the Book Building Process Works

Key Participants

The book building process involves several important players:

- Issuer: The company offering its shares to the public.

- Lead Bookrunner (Underwriter): Usually an investment bank managing the process, setting the price band, and marketing the IPO.

- Institutional Investors: Such as mutual funds, pension funds, or hedge funds that place large bids.

- Retail Investors: Individual investors who may also participate through brokers or online platforms

- Regulators and Stock Exchanges: They oversee compliance and ensure investor protection.

The Step-by-Step Process

Here’s how a typical book-built IPO unfolds:

Appointment of the Lead Underwriter

- The issuing company appoints a lead bookrunner to handle documentation, roadshows, and coordination.

Filing the Prospectus and Setting the Price Band

- The company files a draft red herring prospectus (DRHP) with regulators (like the SEC in the U.S. or SSC in Vietnam).

- A price band is then set, usually with a 20% spread—for example, $20–$24 per share.

Marketing and Roadshows

- The management team and underwriters present the company’s financials, growth prospects, and valuation to potential investors through roadshows and webinars.

Bidding Period

- Investors submit bids within the price band through an electronic system. Each bid includes the quantity of shares and the price.

- Institutional bids often guide pricing due to their volume and expertise.

Book Closure and Price Discovery

- Once the book closes, all bids are aggregated. The underwriter determines the cut-off price—the price where demand matches the number of shares offered.

Allotment and Listing

- Shares are allotted based on bid priority (institutional first, then retail).

- Refunds are issued to unallotted investors, and shares are listed on the exchange.

Post-Listing Performance

- The share begins trading. Ideally, prices remain stable because the market has already established fair value during the book building phase.

Example of Book Building in Action

Let’s illustrate with an example:

Suppose TechNova Ltd. launches an IPO with a price band of $18–$22. During the bidding period:

- Total demand at $22 = 10 million shares

- Total demand at $21 = 15 million shares

- Total demand at $20 = 22 million shares

If the company is offering 20 million shares, the cut-off price would likely be around $20.50–$21, where total bids match available shares. Investors who bid below that price won’t receive allotment.

This method ensures the final price reflects true investor demand, not arbitrary pricing.

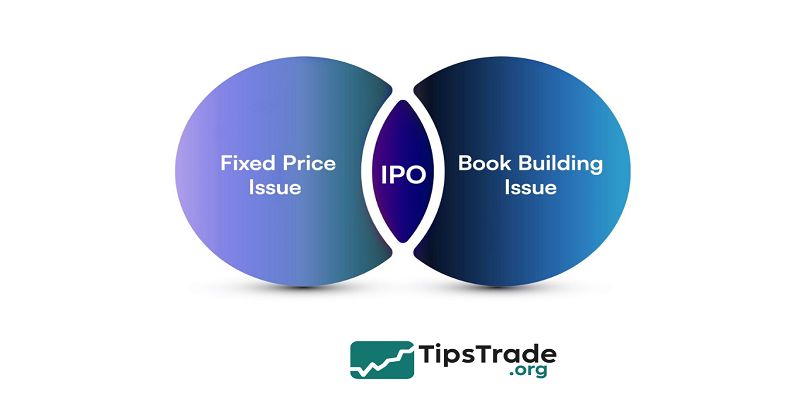

Book Building vs. Fixed-Price IPOs

While both methods aim to raise capital, they differ fundamentally in approach:

| Criteria | Book Building IPO | Fixed-Price IPO |

| Price Discovery | Market-driven through bids | Pre-set by the issuer |

| Demand Visibility | Known before allotment | Unknown until listing |

| Investor Participation | Primarily institutional, some retail | Mostly retail |

| Transparency | High | Moderate |

| Efficiency | Better capital allocation | Risk of under/overpricing |

| Post-Listing Volatility | Lower | Often higher |

In short:

Book building focuses on price discovery, while fixed-price IPOs emphasize simplicity. For sophisticated investors, book building offers more insight into market sentiment.

Advantages and Disadvantages of Book Building

Advantages

Market-Based Pricing:

- The price is determined by real investor demand, ensuring fairness.

Efficient Allocation:

- Capital flows to companies that investors genuinely believe in.

Reduced Volatility:

- Because prices are market-driven, the risk of post-listing swings is lower.

Transparency:

- All bids are visible to underwriters and regulators, fostering trust.

Attracts Institutional Investors:

- Professional investors prefer data-driven pricing, improving credibility.

Disadvantages

Complexity:

- Retail investors may find bidding systems confusing.

Higher Costs:

- Roadshows, underwriter fees, and compliance raise expenses.

Longer Process:

- Compared to fixed-price IPOs, book building takes more time to execute.

Information Asymmetry:

- Institutional investors often have deeper knowledge, potentially disadvantaging smaller investors.

Despite these drawbacks, book building remains the global standard, as its benefits far outweigh its limitations.

Global and Local Practices

International Trends

Globally, markets such as the U.S., UK, Singapore, and Japan have embraced book building as the default IPO pricing mechanism.

According to PwC’s Global IPO Watch 2024, over 90% of large-cap IPOs in these regions relied on book building. This shift reflects investor preference for data-driven valuation.

For instance:

- Alibaba (2014) raised $25 billion using book building—one of the largest IPOs ever.

- Saudi Aramco (2019) used a hybrid book-building model to balance institutional and retail demand.

- Airbnb (2020) adopted book building to fine-tune its IPO pricing amid strong market interest.

These examples highlight how book building enables flexible, market-responsive pricing in real-world scenarios.

Vietnam and Emerging Markets

- In Vietnam, book building was introduced as part of financial reforms to modernize capital markets.

- The State Securities Commission (SSC) encourages listed companies and state-owned enterprises to use this model.

- Recent IPOs such as Vietcombank, PV Gas, and VNDirect have successfully applied book building to determine fair share prices and attract foreign investors.

- Although still developing, Vietnam’s book-building framework improves market transparency and investor confidence, making it a key step toward integration with global standards.

What Investors Should Know Before Participating

Book building offers exciting opportunities—but only if investors understand the mechanics. Here’s what individual investors should consider before bidding in an IPO.

Study the Prospectus Carefully

The draft red herring prospectus (DRHP) contains essential information about the company’s business, risks, and valuation metrics. Before participating, review:

- Financial performance (revenue, net income, EPS)

- Use of IPO proceeds

- Competitive landscape

- Management background

- Valuation ratios (P/E, P/B compared to industry peers)

Investors who skip this step may overpay for overhyped offerings.

Understand the Price Band

- The price band indicates the valuation range expected by the issuer.

- For instance, a narrow band ($18–$20) signals confidence in pricing, while a wide band ($15–$25) may suggest uncertainty.

- Always check the valuation multiples implied by the upper and lower bands to judge if the IPO is overpriced.

Know the Allotment Policy

Typically:

- Institutional Investors (QIBs): 70–75% of shares

- Retail Investors: 10–15%

- High-Net-Worth Individuals (HNIs): 10–15%

Retail investors can bid at the cut-off price, which increases their chances of allotment if the issue is oversubscribed.

Assess Market Sentiment

Pay attention to:

- Oversubscription levels

- Analyst reports

- Industry trends

- Grey market premiums (in some regions)

While these indicators aren’t foolproof, they offer clues about market demand and potential listing gains.

Manage Expectations

- Even though book building enhances price discovery, not all IPOs perform well post-listing.

- A study by Deloitte 2023 found that 30% of IPOs traded below issue price within three months of listing, often due to broader market corrections.

- Investors should focus on long-term fundamentals, not short-term hype.

Conclusion

Book Building IPOs have transformed the way companies go public by enabling more accurate valuation and efficient allocation of shares. This process benefits both issuers and investors by enhancing transparency and reflecting true market demand. Ultimately, Book Building IPOs contribute to healthy capital markets and support sustainable growth for newly listed companies.