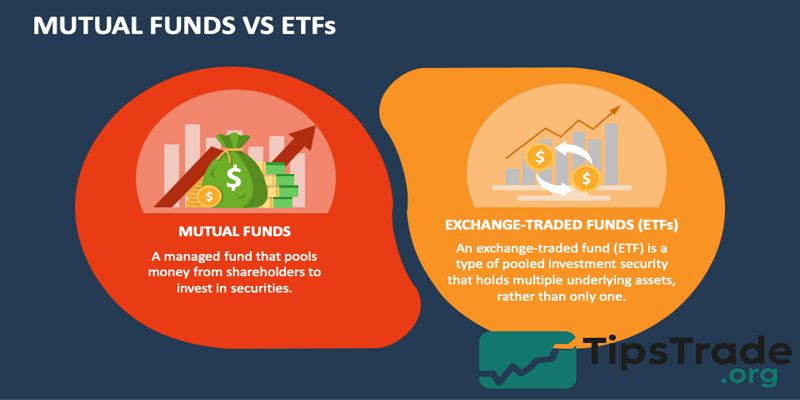

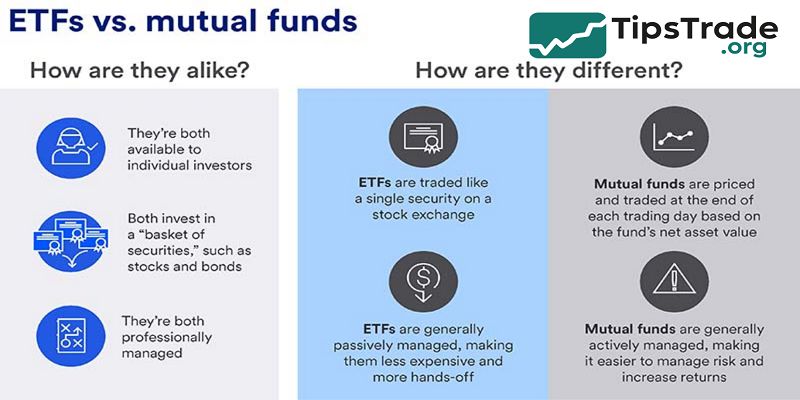

Mutual Funds vs ETFs? Both are pooled investment vehicles that allow individuals to gain exposure to a diversified portfolio of assets, but they differ in structure, trading flexibility, cost, and tax efficiency. According to Morningstar, global mutual fund assets reached $55 trillion in 2023, while ETF assets surpassed $10 trillion, reflecting the growing preference for […]

Author Archives: LeMy

FCA funds regulation by overseeing fund managers and enforcing strict compliance rules, the FCA ensures that investors are protected from fraud, mismanagement, and systemic risk. According to the FCA Annual Report 2023, over 50,000 financial firms fall under its supervision, with thousands of funds requiring authorization before offering services to retail or professional clients. Understanding […]

ETFs vs Mutual Funds are two of the most commonly chosen investment vehicles for individuals building long-term portfolios. For someone who wants hands-off investing, Mutual Funds may feel familiar. Meanwhile, investors who appreciate flexibility and lower expense ratios often lean toward ETFs. This article explains how each product works, uses simple comparisons, and includes real-world examples, […]

Hedge funds vs private equity funds is essential for investors exploring the alternative investment universe. Although both belong to the same asset class, they operate with fundamentally different strategies, risk levels, liquidity profiles, and performance expectations. Many investors compare the two because they want to balance short-term portfolio flexibility with long-term capital growth. By the […]

US fund regulations are essential for anyone navigating today’s complex financial markets. With rising expectations for investor protection, market transparency, regulatory compliance, risk management, mandatory disclosures, and fund governance standards, investors increasingly search for clear, trustworthy information that explains how US-regulated funds actually operate. This guide offers a comprehensive, practical breakdown of all major rules […]

Fund Investment Strategies introduces the various approaches used by funds to achieve their investment goals. These strategies range from equity-related, event-driven, and relative value approaches to diversified multi-manager and opportunistic tactics, each tailored to different risk profiles and market conditions. Understanding these strategies helps investors align their choices with their risk tolerance and return expectations. […]

“Index Funds vs Active Funds“ highlights the fundamental differences between these two investment types. Index funds aim to replicate the performance of a market index, offering lower fees and consistent market returns. In contrast, active funds seek to outperform the market by using professional management and active decision-making, but they usually come with higher costs […]

Advantages of funds clearly enhance investment efficiency and accessibility for many people. They simplify the investing process and spread risk across different holdings, which can lead to more stable growth over time. Therefore, understanding the benefits of funds is essential for anyone seeking to build a balanced and effective portfolio. Explore the detailed article at tipstrade.org to […]

SEC funds regulation, refers to the framework of laws, rules, and disclosure requirements that the U.S. Securities and Exchange Commission (SEC) applies to mutual funds, ETFs, hedge funds, private equity funds, and money market funds. These rules help ensure that investors receive accurate information, fund managers behave ethically, and financial markets remain fair. Understanding this […]

Private equity funds have become one of the most influential forces in global finance, shaping industries, accelerating company growth, and delivering significant returns to institutional and high-net-worth investors. These funds pool capital from accredited investors and allocate it into privately held businesses or public companies targeted for buyouts. This guide provides a detailed, expert-based overview […]