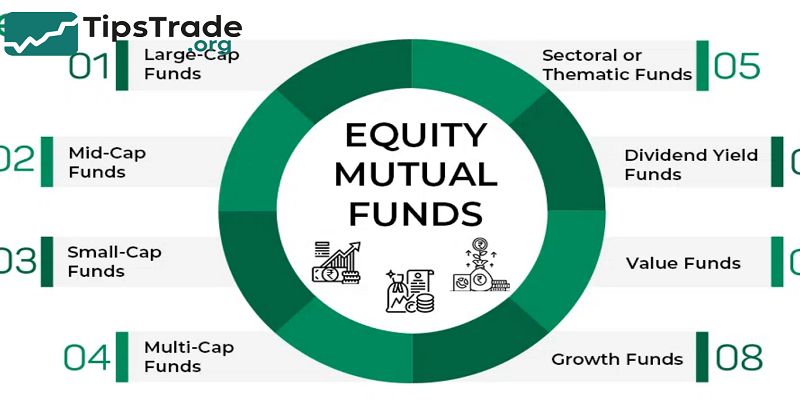

Equity mutual funds are among the most popular investment vehicles for investors seeking long-term wealth creation. These funds pool money from many individuals and invest primarily in stocks, offering diversification, professional management, and access to the stock market without requiring deep trading knowledge. This guide provides a comprehensive breakdown of how equity mutual funds work, […]

Author Archives: LeMy

Mutual fund investment strategies are essential for guiding investors in choosing how to allocate their money to achieve specific financial goals. These strategies range from growth-focused and income-oriented approaches to balanced and sector-specific investments. Understanding different strategies helps investors build diversified portfolios that align with their risk tolerance, time horizon, and market outlook. Explore the […]

Active vs Passive Mutual Funds represent two distinct approaches to investing that cater to different investor preferences and goals. Active mutual funds aim to outperform the market by relying on professional fund managers who actively select stocks and adjust the portfolio based on market conditions. In contrast, passive mutual funds track a specific market index, […]

Mutual funds reports are essential tools for investors who want to make informed decisions and monitor their investment performance. These reports provide a detailed snapshot of a fund’s portfolio, including Net Asset Value (NAV), fund performance, expense ratios, holdings, sector allocation, benchmark comparisons, and risk metrics. This guide explains all critical components of a mutual […]

Mutual funds fees represent the costs investors pay for professional management and fund operations, significantly influencing net returns over time. These fees encompass various types, including management fees, shareholder fees like sales loads, and annual operating expenses such as 12b-1 distribution fees. Grasping these fee structures helps investors select cost-effective funds that align with their […]

Mutual funds manager plays a crucial role in managing pooled investment assets to achieve specific financial goals. This individual is responsible for selecting securities, balancing risk, and making strategic decisions to maximize returns for investors. Understanding the fund manager’s expertise and approach can help investors choose the right mutual fund that aligns with their risk […]

ESG funds are investment vehicles that integrate Environmental, Social, and Governance (ESG) factors into their investment strategies. These funds allow investors to pursue financial returns while supporting companies with positive social and environmental impacts. By incorporating ESG criteria, fund managers aim to select companies with strong governance, ethical business practices, and sustainable growth potential. This […]

Funds are pooled investment vehicles where multiple investors contribute capital, which is then professionally managed and allocated across different asset classes. They provide an accessible way for individuals and institutions to diversify their investments while benefiting from expert management. Investors choose funds to reduce risk, achieve consistent returns, and participate in markets they may not […]

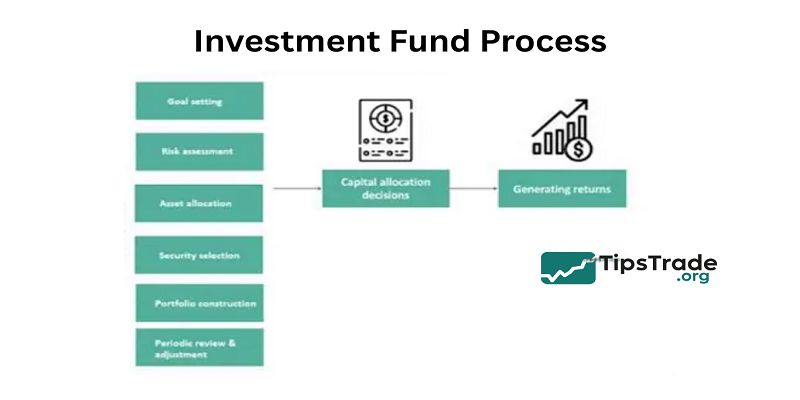

IInvestment fund process encompasses a structured sequence of stages from inception to ongoing management, ensuring compliance, capital efficiency, and investor protection. It begins with defining objectives and legal structuring, followed by fundraising through commitments and capital calls, then proceeds to investment deployment, portfolio monitoring, and eventual wind-down or liquidation. This systematic approach enables fund managers […]

Top investment funds offer investors diverse opportunities to grow their wealth through professionally managed portfolios. These funds pool capital from many individuals to invest across various asset classes, aiming to balance risk and return. Understanding the characteristics and performance of leading investment funds helps investors make informed choices and optimize their investment strategy. Explore the […]