ADR stocks, also known as American Depositary Receipts (ADRs), are a key gateway for investors who want to access foreign companies, participate in global investing, and expand their investment diversification without leaving U.S. exchanges. By trading ADRs, investors gain exposure to international markets through familiar stock trading platforms, eliminating currency conversion and complex regulations. This […]

Author Archives: LeMy

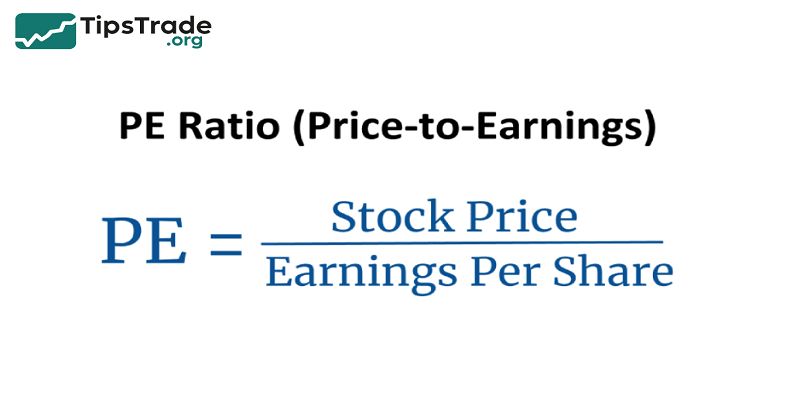

P/E ratio (price-to-earnings ratio) is essential for anyone analyzing stocks or making long-term investment decisions. This simple yet powerful metric helps investors determine whether a company’s stock is overvalued or undervalued based on its earnings performance. In this comprehensive guide, you’ll learn what the P/E ratio means, how it’s calculated, how to interpret it, and […]

Technical analysis for stocksis one of the most widely used approaches to understanding market behavior and making informed trading decisions. Unlike fundamental analysis, which focuses on a company’s financials, technical analysis studies price movements, trading volume, and market psychology to forecast potential trends. Whether you are a beginner or an experienced trader, mastering stock technical […]

ETF investing has become one of the most accessible and effective ways to build long-term wealth in modern finance. With global assets under management (AUM) exceeding $11 trillion by 2025 (BlackRock Global ETF Report), ETFs allow investors—both beginners and professionals—to own diversified portfolios at low cost and high transparency. What Is an ETF? An Exchange-Traded […]

Stock charts play a crucial role in the world of investing and trading by providing a visual representation of a stock’s price movements over a specific period. They allow investors to analyze historical trends, identify patterns, and make informed predictions about future price behavior. Stock charts come in various types, such as line charts, bar […]

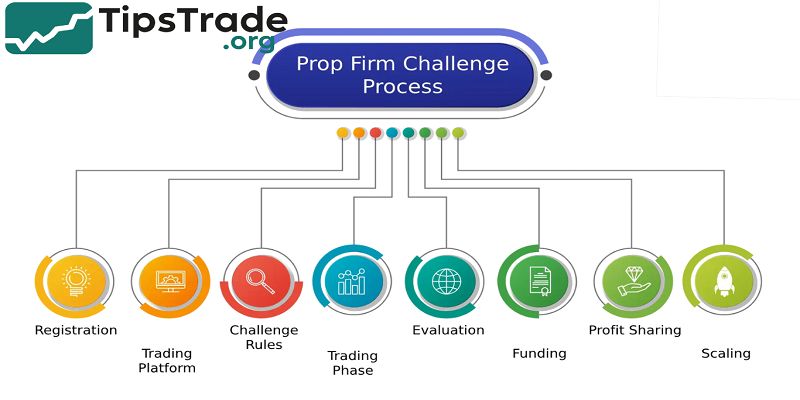

Prop Firm Process is a structured evaluation pathway that traders must complete to qualify for trading with a proprietary trading firm’s capital. This process allows traders to demonstrate their trading skills, risk management, and consistency without risking their own funds. By passing a series of challenges and verification steps, traders earn access to a funded […]

Prop Firm Scam refers to deceptive practices or fraudulent activities conducted by certain proprietary trading firms that take advantage of aspiring traders. As the popularity of prop firms has grown, so has the number of dishonest companies that lure traders with false promises—such as instant funding, exaggerated profit splits, or risk-free evaluations. These scams often […]

Hybrid Prop Firm represents a new generation of proprietary trading firms that combine the best elements of traditional and funded trading models. Unlike standard prop firms that strictly follow either a challenge-based or instant funding structure, hybrid prop firms offer a more flexible approach—allowing traders to enjoy both profit opportunities and reduced risk. This innovative […]

Prop firm trading has rapidly evolved into one of the most exciting and accessible pathways for independent traders. Instead of risking their own money, traders can now access large amounts of capital provided by proprietary trading firms—companies that back skilled individuals and share the profits generated. The article above from Tipstrade.org has just provided you […]

Future of Prop Firms is set to be transformative, driven largely by advancements in technology, evolving regulations, and a broader global trader base. Proprietary trading firms are increasingly integrating AI and machine learning to enhance risk management and strategy development, while offering more accessible, flexible funding options that cater to traders at all levels. These […]