Rights issue stocks refer to shares offered by a company to its existing shareholders at a discounted price, allowing them to purchase additional shares in proportion to their current holdings. This process is a way for companies, especially joint-stock companies, to raise additional capital for business expansion, debt restructuring, or other corporate purposes. By participating […]

Author Archives: LeMy

investment strategies stock price are the cornerstone of successful wealth creation, yet few investors fully understand how these strategies directly influence stock prices. Every buy or sell decision, whether based on valuation metrics or market sentiment, contributes to price movement .Whether you are a long-term investor, an active trader, or someone looking to build a […]

Tech stock prices have become the heartbeat of the global equity market, influencing everything from investor sentiment to market volatility. As the world’s largest technology firms—like Apple, Microsoft, and Nvidia—continue to set new valuation records, traders and analysts are closely tracking every shift in earnings forecasts, market capitalization, and stock performance. This article explores how […]

Investor sentiment stocks represent one of the most fascinating intersections between psychology and finance. While traditional investing relies on fundamentals like earnings and valuation, investor sentiment—the overall mood or attitude of investors toward the market—can drive dramatic short-term price movements and even long-term market trends. Understanding how investor senltiment influences stocks helps traders and long-term […]

Interest rates are one of the most influential forces driving stock market performance. When central banks like the Federal Reserve adjust interest rates, it can ripple across every corner of the economy—from business borrowing costs to investor confidence. Understanding how interest rates affect stocks helps investors make smarter portfolio decisions, manage risk, and identify opportunities […]

Sustainable stocksrepresent one of the fastest-growing trends in modern investing. As global awareness of climate change and social responsibility rises, investors are shifting capital toward companies that prioritize environmental, social, and governance (ESG) principles. In this comprehensive guide, we’ll explore what sustainable stocks are, how they work, how to evaluate them, and how to start […]

Preferred stock is a unique type of equity that combines the best of both worlds — the consistent income of bonds and the growth potential of common stocks. It offers investors priority on dividends and liquidation proceeds, but usually comes with limited voting rights. This hybrid nature makes preferred shares a popular choice among income-seeking […]

The mechanism plays a crucial role in understanding how complex systems function by explaining the processes and interactions involved. It serves as the foundation for analyzing the inner workings of various devices, biological systems, or organizational structures, allowing us to grasp the cause-and-effect relationships that drive their behavior. The article above from Tipstrade.org has just […]

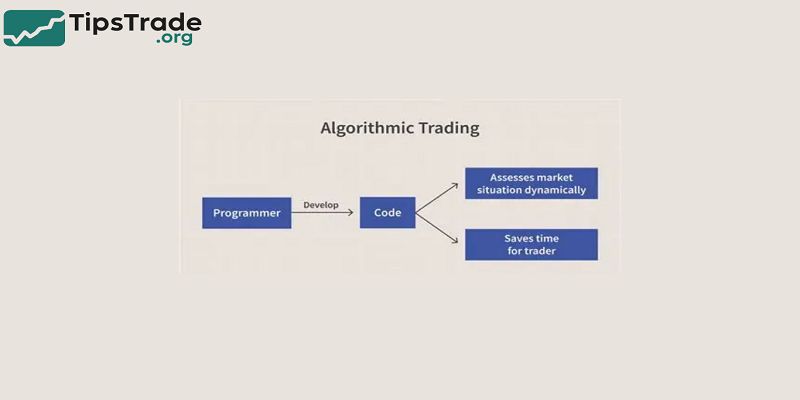

Algorithmic trading often called algo trading or automated trading—has transformed how modern financial markets operate. In simple terms, it involves using computer algorithms to execute trades automatically based on predefined rules such as timing, price, volume, or mathematical models. Instead of humans manually placing trades, machines do it in milliseconds, bringing efficiency, discipline, and scalability. […]

Growth stocks are among the most popular vehicles for investors seeking capital appreciation in dynamic sectors. These are shares of companies expected to expand earnings and revenues at a rate notably higher than the market average. But with high potential comes higher risk. In this comprehensive guide, we’ll explore what growth stocks are, how to […]