Income investing is a strategy that focuses on building a portfolio that pays you steady cash flow—monthly, quarterly, or yearly—through dividends, interest, or rental income. Instead of only waiting for the price of a stock to go up, income investors choose assets that consistently generate money even while they hold them. For beginners, it feels […]

Author Archives: LeMy

Risks of Fundamental Analysis primarily stem from its reliance on financial data and assumptions that may be incomplete or outdated. This method can expose investors to errors caused by inaccurate information, changing market conditions, or unforeseen economic events. Understanding these risks is essential for applying Fundamental Analysis Aeffectively in investment decisions. Visit tipstrade.org and check out the article […]

Fundamental Analysis and Technical Analysis represent two main approaches to evaluating financial markets. Fundamental Analysis examines the underlying economic and financial factors affecting an asset’s value, while Technical Analysis studies past market data and price patterns to predict future movements. Visit tipstrade.org and check out the article below for further information What is Fundamental Analysis (FA)? Fundamental […]

Free Cash Flow (FCF) has become one of the most important financial metrics for investors, analysts, and business owners in modern markets. Unlike accounting-based profit, which can be influenced by amortization, tax rules, or revenue recognition methods, FCF shows how much real cash a business generates after paying its operating expenses and capital investment. Visit tipstrade.org and […]

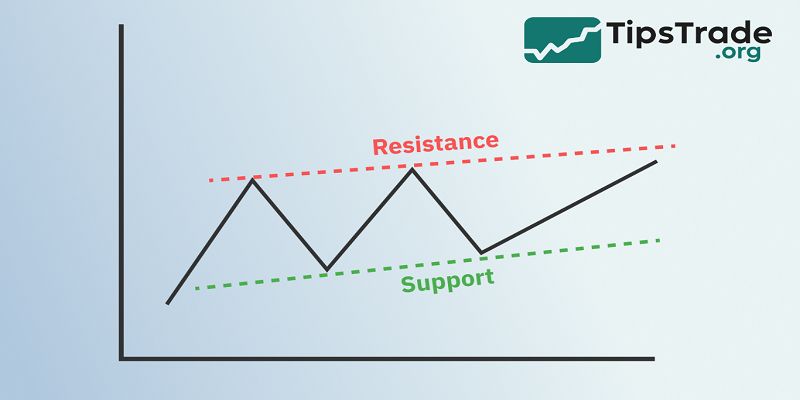

Support and resistance are among the most essential concepts in technical analysis, shaping how traders interpret market behavior and forecast potential price movement. Whether in forex, gold, stocks, or cryptocurrencies, these price zones represent psychological and structural turning points in the market. New traders often see the market as random and unpredictable, yet price frequently […]

Forex volume analysis is a crucial technique that helps traders understand market dynamics by examining the relationship between trading volume and price movements. By analyzing volume patterns, traders can confirm trends, anticipate reversals, and identify key points of supply and demand in the Forex market. Volume analysis adds depth to price action and provides insights […]

Risk management is a structured process that helps organizations identify, analyze, and control potential events that may affect performance, assets, or reputation. In business and finance, uncertainty is a constant factor. Prices change, regulations evolve, technology disrupts industries, and human mistakes can happen at any moment. A strong risk management system does not eliminate all […]

Forex Chart Types are essential tools that traders use to analyze currency price movements and make informed decisions in the foreign exchange market. These charts, such as line charts, bar charts, and candlestick charts, each provide unique insights into market trends and price behavior. Visit tipstrade.org and check out the article below for further information What Are […]

Forex Pattern Trading is a strategic approach that traders use to identify recurring formations in price charts, which help predict future market movements. By recognizing these patterns, traders can make more informed decisions, manage risks effectively, and increase their chances of profitable trades in the fast-paced forex market. What is Forex Pattern Trading? Forex pattern […]

Vietnam Stock Market Trends are a key indicator of the country’s expanding economy and increasing investor interest. Over the last decade, the country has transformed from a frontier market into a near-emerging market candidate, drawing attention from global funds, retail traders, and long-term investors. This article provides a deep and data-driven overview of current trends […]