Trend analysis mistakes is a cornerstone of technical trading. Accurately identifying trends helps traders enter at optimal points, manage risk, and maximize profits. However, many traders — both beginners and experienced — make mistakes that undermine their strategies. Common pitfalls include relying on single indicators, ignoring confirmation signals, misreading support and resistance, overtrading, and letting […]

Author Archives: LeMy

Market Trend Resources is essential for any trader or investor. Price movements rarely move randomly — markets tend to develop bullish, bearish, or sideways trends. Identifying these trends early can help you make better trading decisions, reduce risk, and maximize profit potential. Market trend resources encompass tools, indicators, and information platforms that enable traders to […]

Volume analysis is one of the most essential yet often overlooked aspects of technical analysis. While price movements show what happened, volume shows how many participants are driving those moves, providing insights into the strength, conviction, and reliability of trends. In this guide, we will break down the principles, indicators, strategies, real-world examples, and common […]

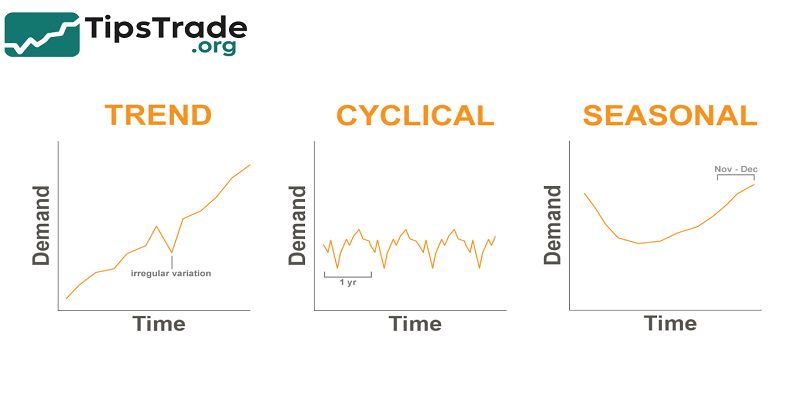

Cyclical trends describe the repeating patterns of expansion and contraction that shape economies, markets, industries, and consumer behavior. Even though technology changes fast, human psychology, supply–demand dynamics, credit cycles, and business behaviors consistently move in waves. Investors, business owners, and economists rely on cycle analysis to avoid avoidable risks and capture opportunities before the majority […]

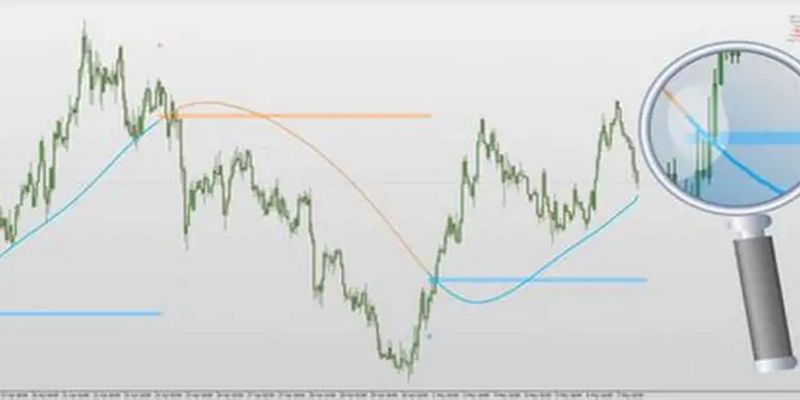

Trendlines in technical analysis are essential tools that help investors identify market trends visually and effectively. Using trendlines allows traders to spot support and resistance levels, leading to more accurate trading decisions. Understanding how to draw and apply trendlines enhances technical analysis skills and improves risk management in investments. Visit tipstrade.org and check out the article below […]

Trendlines are one of the most widely used tools in technical analysis because they visualize the direction of market movement, show momentum, and help traders identify potential trading opportunities. Whether a trader uses indicators, price action, or algorithmic systems, trendlines often become the foundation for understanding where price is heading. New traders usually learn trendlines […]

Sideways trend is a market condition characterized by prices moving within a narrow horizontal range without a clear upward or downward direction. This trend occurs when supply and demand forces are nearly balanced, resulting in price fluctuations between defined support and resistance levels. The sideways trend often represents a period of consolidation or indecision in […]

Downtrend represents a sustained period during which the price of an asset consistently falls over time. This trend reflects increasing selling pressure and bearish sentiment among traders and investors. Understanding how to recognize a downtrend early is essential for managing risk and making informed decisions in declining markets. Visit tipstrade.org and check out the article below for […]

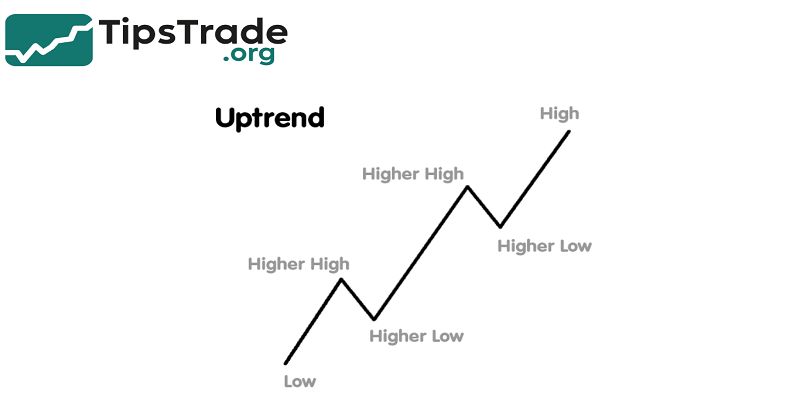

Uptrend represents a sustained period during which the price of an asset consistently moves higher, creating optimism among traders and investors. In financial markets, identifying an uptrend is crucial because it signals a favorable environment for buying opportunities and profit potential. Understanding the characteristics and signals of an uptrend allows investors to align their strategies […]

Resources are essential elements that individuals, companies, and countries depend on to work, produce value, and survive. In simple terms, resources refer to anything that can be used to create goods, provide services, or support daily life. They include natural elements like water or minerals, human resources such as knowledge and labor, financial assets, physical […]