Financial ratio tools are essential instruments used by investors, analysts, and business managers to assess a company’s financial health and performance. These tools provide insights into profitability, liquidity, efficiency, and solvency by comparing various financial statement items through standardized ratios. Using Financial Ratio Tools, stakeholders can make informed decisions, identify trends, and benchmark companies against industry […]

Author Archives: LeMy

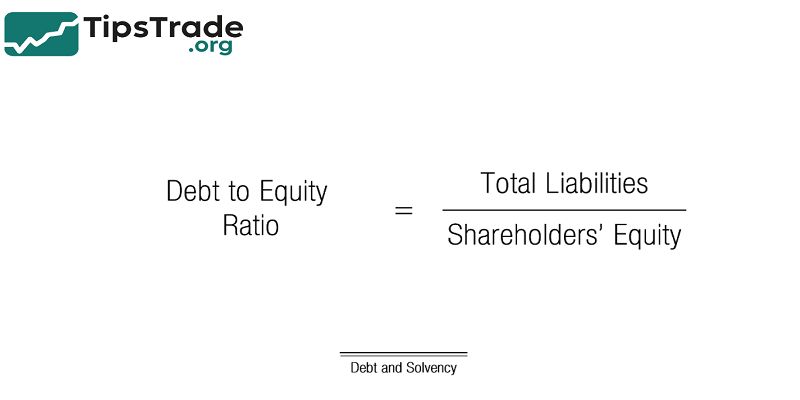

Debt To Equity Ratio is one of the most essential financial metrics investors and analysts use to evaluate a company’s financial leverage. Understanding this ratio helps businesses maintain a healthy balance between debt and equity, ensuring long-term stability and sustainable growth. Whether you are a business owner, investor, or financial analyst, knowing how to interpret […]

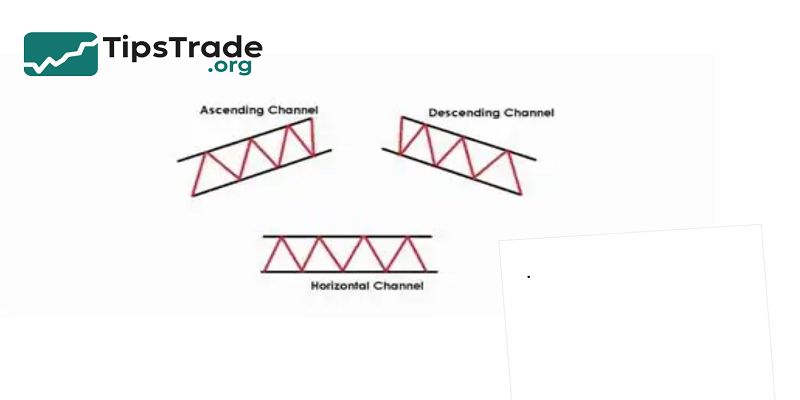

Price Channels are one of the simplest and most visual tools in technical analysis. Instead of relying on complicated algorithms, a price channel uses two parallel lines surrounding price movement: an upper line showing resistance and a lower line showing support. When price stays inside the channel, traders can easily see whether the market is […]

Profitability Ratios are essential financial metrics used to evaluate a company’s ability to generate profit relative to its revenue, assets, or equity. These ratios help investors and managers assess the efficiency and effectiveness of a business in creating value. Understanding Profitability Ratios is crucial for making informed decisions about investment, management strategies, and financial health. […]

Trend Analysis vs Fundamental Analysis explores two distinct approaches to evaluating financial markets and making investment decisions. Trend analysis focuses on studying historical price movements and patterns to predict future market behavior, while fundamental analysis examines economic indicators, company financials, and industry conditions to assess intrinsic value. Visit tipstrade.org and check out the article below for further […]

Trend Following Strategy is one of the oldest and most successful trading systems in financial markets. The idea is simple: traders follow the direction of the market instead of predicting tops or bottoms. If the price is trending upward, trend followers buy and hold. If the price is trending downward, they sell or short. This […]

Multi-timeframe trend analysis is one of the most reliable ways traders confirm trend direction, filter bad signals, and choose higher-probability trade entries. Instead of relying on a single chart, traders compare the price movement across higher and lower timeframes to understand the “bigger picture” and the short-term volatility inside it. This approach is widely used […]

Swing Trading is a short- to medium-term trading strategy that aims to capture gains from “swings” in price movements within an overall trend. Unlike day trading, which requires constant monitoring, swing trading allows traders to hold positions for days or even weeks, capitalizing on market fluctuations without the stress of intraday volatility. Visit tipstrade.org and check out […]

Reading trend charts is a fundamental skill for traders and investors. Trend charts visually represent price movements over time, helping market participants identify patterns, make informed decisions, and predict potential price movements. From beginners trying to understand basic price trends to professionals seeking confirmation signals, the ability to interpret charts effectively is essential. Visit tipstrade.org and check […]

Monitoring market trends is essential for both new and experienced traders. Markets rarely move randomly; they tend to follow identifiable patterns over time. Using the right market trend tools helps investors and traders recognize these patterns, anticipate price movements, and make informed decisions. Tools range from technical indicators and charting platforms to trend scanners and […]