The Dark Cloud Cover candlestick pattern is a bearish reversal signal on price charts. It is a pattern with relatively reliable signal quality, yet it is not widely known among investors. So, what exactly is the Dark Cloud Cover pattern? What are its key characteristics and how can it be traded effectively? All of these […]

Author Archives: KimHop

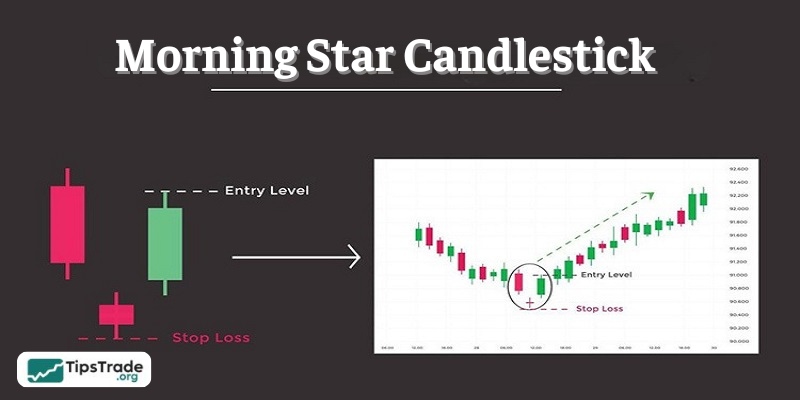

The Morning Star candlestick pattern is one of the most common reversal patterns in trading. With its distinctive structure and strong implications, this pattern not only helps identify a reversal from a downtrend to an uptrend but also provides effective trading opportunities when used correctly. In this article, we will explore in detail what the […]

The piercing candlestick pattern is one of the most popular patterns in trading. Let’s explore more about what the piercing candlestick pattern is and how to trade it effectively in the article below! What is the piercing candlestick pattern? The piercing candlestick pattern is one of the potential short-term price reversal patterns, signaling a shift […]

The Bearish Engulfing candlestick is usually formed after a prolonged price increase. It is a sign of exhaustion in buying pressure, and a reversal signal is about to occur. In today’s article, let’s explore the Bearish Engulfing candlestick in detail with Tipstrade.org! What is the Bearish Engulfing candlestick? The Bearish Engulfing candlestick is a candlestick […]

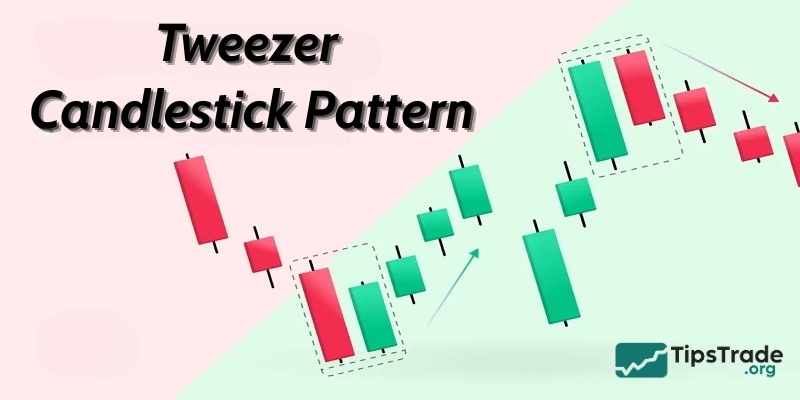

The Tweezer candlestick pattern is one of the key patterns commonly used by investors to identify potential price reversals in the market. In this article, Tipstrade.org will provide an in-depth analysis of the Tweezer candlestick pattern, explain how to recognize its key characteristics, and guide you on how to apply it effectively in trading. Let’s […]

The Bullish Engulfing candlestick pattern is one of the clearest price action signals on candlestick charts. Many traders use this pattern to identify potential price reversals in support of their trading strategies. In this article, Tipstrade.org will help you gain a comprehensive understanding of the Bullish Engulfing pattern and how to trade it effectively. What […]

The Marubozu candlestick is one of the special candle patterns favored by traders due to their ability to reflect market sentiment clearly. In this article, we will explore the meaning and role of the Marubozu candlestick, how to identify it, and trading strategies with this candle pattern. What is a Marubozu candlestick? The Marubozu candlestick […]

Among Japanese candlestick patterns, there is a rather distinctive one known as the Spinning Top candlestick. This pattern reflects market indecision, where neither buyers nor sellers have a clear advantage. So, what is the Spinning Top candlestick? What are its characteristics, and how can it be traded? Let’s explore these questions in this article. What […]

The Shooting Star candlestick is a popular reversal candlestick pattern in technical analysis when trading stocks, forex, and cryptocurrencies. This candlestick pattern helps investors identify potential reversal points to optimize profits and minimize risks. In this article, we invite you to explore with Tipstrade.org how to identify and trade the Shooting Star candlestick pattern in […]

The Hammer candlestick is one of the strongest reversal signals on a price candlestick chart. A new trend is often identified after this candlestick pattern appears. So, what is the Hammer candlestick? What types of Hammer patterns are there? And how can you trade effectively using this pattern? All of these questions will be answered […]