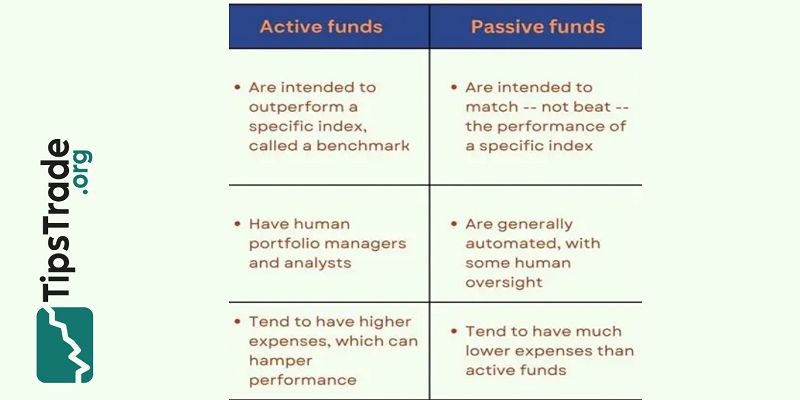

Active vs Passive Mutual Funds represent two distinct approaches to investing that cater to different investor preferences and goals. Active mutual funds aim to outperform the market by relying on professional fund managers who actively select stocks and adjust the portfolio based on market conditions. In contrast, passive mutual funds track a specific market index, seeking to replicate its performance with minimal intervention. Explore the detailed article at Tipstrade.org to be more confident when making important trading decisions.

What Are Active Mutual Funds?

Fund Management Style

Active mutual funds are professionally managed portfolios where fund managers make investment decisions based on research, market forecasts, and company analysis.

The goal is to outperform a specific benchmark index by selecting stocks, bonds, or other securities that they believe will deliver superior returns.

Example:

A large-cap active equity fund manager may overweight technology stocks based on growth potential while underweight sectors expected to underperform.

This active allocation allows managers to attempt alpha generation—returns above the benchmark.

Investors benefit from professional expertise, but performance depends on the manager’s skill.

Expense Ratio and Fees

Active funds generally have higher fees due to research, analysis, and active trading costs. The expense ratio typically ranges from 0.75% to 2.0% annually.

Bullet Points:

- Higher fees can reduce net returns over time.

- Management fees support market research and active portfolio adjustments.

- Some funds charge exit loads or performance-based fees.

Example:

- Investing $50,000 in a fund with a 1.5% expense ratio may reduce annual returns by $750 compared to a lower-cost fund, illustrating the impact of fees on long-term growth.

Performance Potential (Alpha)

Active funds aim to beat the market by achieving alpha, which measures excess returns compared to a benchmark.

- Alpha >0 indicates outperformance; alpha <0 indicates underperformance.

- Consistently generating alpha is challenging, especially in efficient markets.

Example:

- An active fund that delivered 12% annualized returns against a 10% benchmark shows a 2% alpha.

- Investors should evaluate performance over multiple years and market cycles.

What Are Passive Mutual Funds?

Index Funds and ETFs

Passive funds, including index funds and ETFs, replicate the performance of a specific market index. These funds do not attempt to beat the market but aim to provide returns closely aligned with the index.

Bullet Points:

- Minimal trading reduces costs and taxes.

- Highly transparent and easy to understand.

- Examples: S&P 500 Index Fund, NASDAQ-100 ETF.

Example:

- An investor purchasing units of an S&P 500 index fund gains proportional exposure to the 500 companies in the index, mirroring overall market performance.

Lower Cost Structure

Passive funds generally have lower expense ratios, often between 0.05% and 0.50%.

Bullet Points:

- Cost-efficiency enhances long-term returns.

- No active research or frequent trading required.

- Suitable for long-term investors prioritizing steady growth.

Example:

- A 0.10% expense ratio on a $100,000 investment costs $100 annually, significantly less than an active fund, leaving more capital invested for compounding.

Benchmark Tracking (Beta and Tracking Error)

Passive funds track benchmarks with minimal deviation. Tracking error measures the difference between fund returns and the benchmark.

- Low tracking error (<0.5%) indicates precise replication.

- Beta ≈1 shows performance moves closely with the index.

Example:

- A passive fund tracking the S&P 500 with a tracking error of 0.2% provides near-identical market returns, giving investors predictable exposure.

Key Differences Between Active vs Passive Mutual Funds

Management Approach

- Active: Fund managers actively select securities, aiming to outperform benchmarks.

- Passive: Funds track an index with minimal intervention.

Risk and Returns

- Active funds can deliver higher returns but carry higher manager-dependent risk.

- Passive funds offer market returns with lower volatility relative to active fund variability.

Cost Efficiency

- Active funds: Higher expense ratios reduce net returns.

- Passive funds: Low fees enhance compounding over long-term investments.

Historical Performance Comparison

- Studies by CFA Institute show that most active funds underperform their benchmarks after fees over a 10-year horizon.

- Passive funds generally provide consistent market returns, making them more predictable.

Advantages and Disadvantages

Active Funds Pros and Cons

Pros:

- Potential to outperform the market (alpha generation)

- Flexibility to adapt to market conditions

- Professional portfolio management

Cons:

- Higher fees and expenses

- Performance highly dependent on fund manager skill

- Potential for short-term underperformance

Passive Funds Pros and Cons

Pros:

- Low fees and cost-efficient

- Transparent and easy to understand

- Consistent returns in line with market index

Cons:

- Cannot outperform the market

- Limited flexibility to respond to market events

- Returns subject to market downturns

How to Choose Between Active and Passive Funds

Consider Your Investment Goals

- Long-term wealth creation → Passive funds may offer steady growth with low cost.

- Desire for alpha → Active funds may be suitable if willing to accept higher risk and fees.

Evaluate Risk Tolerance

- Conservative investors → Passive funds reduce manager risk.

- Aggressive investors → Active funds offer potential higher returns with higher variability.

Analyze Fees and Expense Ratios

- Compare net returns after fees.

- Long-term cost impact favors passive funds for most retail investors.

Diversify Across Fund Types

- Combining active and passive funds balances potential alpha with cost efficiency.

- Example: 70% passive index funds + 30% active funds for targeted growth opportunities.

Comparison Table: Active vs Passive Mutual Funds

| Feature | Active Fund | Passive Fund |

| Management | Actively managed by experts | Track an index |

| Goal | Outperform benchmark | Match benchmark |

| Fees / Expense Ratio | Higher (0.75%–2%) | Lower (0.05%–0.50%) |

| Risk | Manager and market dependent | Market risk only |

| Potential Returns | Higher if successful | Market returns |

| Flexibility | Can adjust holdings | Follows index |

| Transparency | Medium | High |

Conclusion

Active vs Passive Mutual Funds each offer unique advantages and challenges that investors must weigh carefully. While active funds provide the potential for higher returns through expert management, they often come with higher fees and increased risk. Passive funds generally offer lower costs and more predictable performance aligned with the overall market, but they may miss out on opportunities for above-average gains. Selecting between active and passive funds depends on individual investment goals, market outlook, and willingness to accept trade-offs between cost and potential reward.