Forex news trading is a powerful strategy that focuses on capitalizing on price movements triggered by major economic news and announcements. Forex news trading requires understanding how news events, such as central bank rate decisions or employment reports, influence currency prices, enabling traders to react swiftly and potentially gain profits from market volatility. Through this article, let’s explore in detail with tipstrade.org the most effective forex news trading strategies, risk management techniques, and key news events to watch for successful trading.

What is Forex News Trading?

- Forex news trading is a strategy where traders open positions in anticipation of, or as a reaction to, economic data releases, central bank announcements, or geopolitical developments.

- Unlike technical trading, which focuses on chart patterns, news trading is driven by fundamental events.

- For example, when the U.S. releases its monthly Non-Farm Payrolls (NFP) report, a stronger-than-expected result usually boosts the U.S. dollar. Conversely, weaker employment figures often trigger a sell-off.

- These reactions can move major pairs like EUR/USD by over 100 pips in minutes.

Key differences from technical trading:

- Time horizon: News trades are usually short-term, often closed within hours.

- Volatility: News events produce sudden, sharp moves instead of gradual trends.

- Risk profile: Spreads widen, and slippage is common during announcements.

Many traders are attracted to news trading because:

- Economic events are scheduled and predictable.

- Opportunities for fast, large profits exist.

- It helps traders understand the fundamental drivers of currencies.

But without preparation, this strategy can be a trap for beginners. Proper risk management is essential.

>>See more:

- What is Forex? The Complete Guide for Beginners

- What are exchange rates? How to read and analyze rates in Forex

- Top 10 best forex currency pairs to trade in 2025

- Essential Forex Orders every trader must know

- What is forex trading? A detailed guide to forex trading from A – Z

Why Does News Strongly Impact the Forex Market?

- Currencies represent the economic strength of nations. When fresh data or central bank guidance is released, traders instantly reassess supply and demand for a currency.

- Unlike equities, where news can take time to digest, Forex markets respond within seconds.

The Role of Economic Data

Key reports such as GDP, CPI, unemployment rates, and NFP provide real-time insight into a country’s economy. Stronger data often strengthens the currency by signaling growth and attracting investors.

- GDP growth rising → stronger local currency.

- High inflation (CPI) → central bank may raise rates, boosting currency.

- Weak job data → weaker demand for currency.

Example: A strong NFP release often strengthens the USD because it suggests the Fed may tighten monetary policy.

Economic data creates a chain reaction:

Data → Expectations → Central Bank Policy → Currency Value.

That’s why traders monitor the economic calendar and compare results to forecasts.

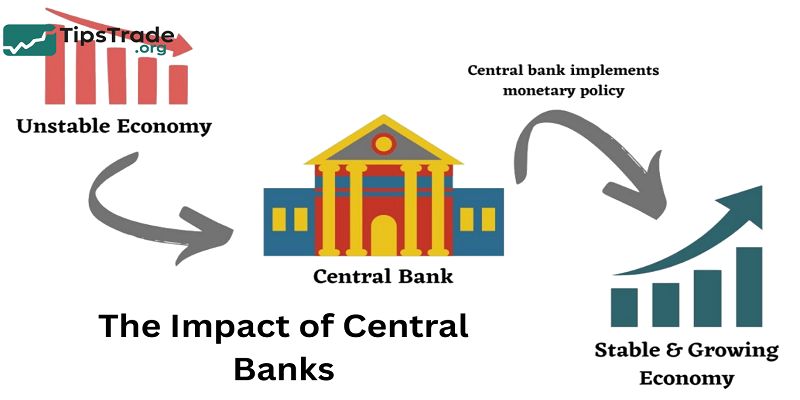

The Impact of Central Banks

Central banks like the Fed, ECB, BoJ, and BoE are the most powerful forces in Forex. They set interest rates and control monetary policy.

- Higher rates → stronger currency (investors seek higher yields).

- Lower rates or QE → weaker currency (more supply, lower returns).

But words matter as much as actions. Speeches and press conferences often move markets via forward guidance. Example: If the Fed Chair hints at future hikes, the dollar may rise even before policy changes.

News traders closely follow FOMC meetings, ECB statements, and BoJ policy updates because these events drive both short-term volatility and long-term trends.

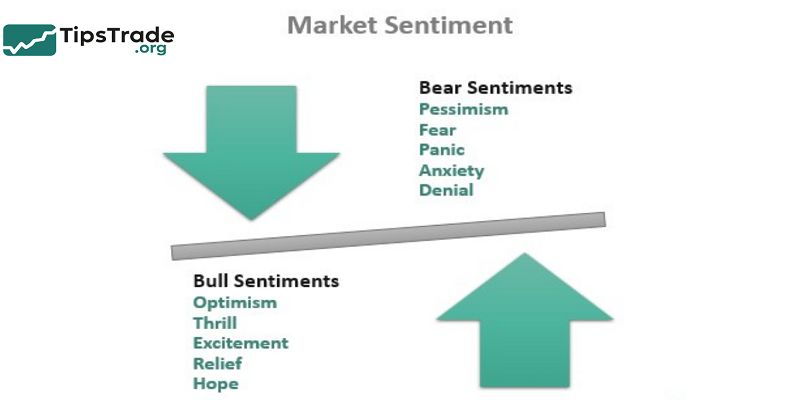

Market Sentiment and Expectations

- Markets don’t just react to numbers—they react to the gap between expectations and reality.

- Example: Forecast GDP = 3.0%, actual = 2.8%. Even though growth is positive, the currency may weaken because the result fell short.

- This phenomenon is called “priced-in expectations.” Traders often position themselves before releases, causing reversals once data is out.

- Geopolitical events also shape sentiment: wars, elections, and trade disputes push investors toward safe-haven currencies like the USD, JPY, or CHF.

- Successful news traders must therefore analyze not only the data but also the consensus forecast and market psychology.

The Most Important News Events in Forex Trading

Not all news moves markets equally. Traders focus on high-impact events (often marked in red on economic calendars).

Non-Farm Payrolls (NFP)

- Released monthly by the U.S. Bureau of Labor Statistics.

- Measures employment changes in non-farm sectors.

- Strong NFP = USD bullish, Weak NFP = USD bearish.

- Example: A surprise gain of +300k jobs can push EUR/USD down sharply.

Interest Rate Decisions & FOMC Meetings

- The Federal Reserve, ECB, BoE, and BoJ meet regularly to set rates.

- A rate hike makes currency more attractive; a cut weakens it.

- Press conferences often matter more than the decision itself.

Consumer Price Index (CPI)

- Measures inflation by tracking consumer prices.

- High CPI → central banks may raise rates → currency strength.

- Example: U.S. CPI above 6% in 2022 fueled Fed tightening, boosting USD.

Gross Domestic Product (GDP)

- Quarterly data showing economic growth.

- Strong GDP → higher currency demand.

- Weak GDP → signals recession → weaker currency.

PMI & Consumer Confidence

- PMI (Purchasing Managers’ Index) signals business activity.

- Confidence surveys reflect consumer spending outlook.

- Both serve as leading indicators of economic health.

Geopolitical Events

- Elections (e.g., U.S. 2016, Brexit referendum).

- Wars or conflicts → safe-haven demand (USD, JPY, CHF).

- Trade agreements or sanctions → impact export-driven economies.\

Pros and Cons of Forex News Trading

Advantages

- Quick profits: Large moves in short timeframes.

- Predictable schedule: Economic calendars provide clear dates.

- Skill development: Traders learn fundamentals and sentiment analysis.

Disadvantages

- High risk: Slippage and widened spreads common.

- Fast reaction needed: Split-second decisions required.

- Psychological pressure: Stressful for beginners lacking discipline.

Popular Forex News Trading Strategies

Post-News Trading

- Wait until after the news release. Once direction is clear, enter trades in line with momentum. This reduces risk of false breakouts.

Straddle Strategy

- Place Buy Stop and Sell Stop orders before news.

- Whichever side breaks is triggered. Risk: both sides may trigger in volatile whipsaws.

Pre-News Trading

- Trade based on forecasts and market positioning before release.

- Works when sentiment is strong, but risky if data surprises.

Scalping News

- Open quick trades within seconds to minutes after release.

- High risk, but attractive for advanced traders with fast execution tools.

Step-by-Step Guide to Trading News

- Check the Economic Calendar – Use ForexFactory, Investing.com, or TradingView.

- Identify High-Impact News – Focus on red-flag events affecting major pairs.

- Plan the Trade – Select pairs, strategy, and risk level.

- Manage Risk During Release – Keep lot size small, use tight stop-loss.

- Review and Journal – After each news trade, analyze outcomes for improvement.

Risks of Forex News Trading

- Slippage: Orders filled at worse prices.

- Spread widening: Brokers increase spreads during volatility.

- Stop-loss hunting: Sudden spikes may hit SL before reversing.

- Unexpected results: Data opposite forecasts can wipe accounts.

- Market manipulation: Large institutions may influence early moves.

Tools and Platforms for News Traders

- Economic Calendars: ForexFactory, MyFxBook, Investing.com.

- Trading Platforms: MT4/MT5 with news plugins and alerts.

- News Feeds: Bloomberg, Reuters, Dow Jones for real-time updates.

- Sentiment Tools: Market sentiment indicators from brokers or analytics platforms.

Practical Tips for Beginners

- Start with a demo account before risking real money.

- Avoid trading every news release—focus on 1–2 big events monthly.

- Never risk more than 2% of account per trade.

- Keep a trading journal to track patterns and mistakes.

- Accept losses as part of the process; focus on consistency.

News Trading vs. Technical Trading

- News Trading → High volatility, short-term focus, event-driven.

- Technical Trading → Based on chart patterns, longer trends.

- Best approach: Combine both. Use technicals to time entries, fundamentals to understand direction.

Money Management in News Trading

- Risk per trade ≤ 2% of account balance.

- Avoid opening multiple trades on the same event.

- Always set a stop-loss.

- Don’t chase the market after missing the initial move.

- Use trailing stops to lock in profits during strong moves.

Word Count

Forex news trading is an important strategy that allows traders to take advantage of market volatility caused by economic announcements and news events. By carefully analyzing and reacting to news, traders can capitalize on price movements and improve their profitability. In conclusion, forex news trading requires quick decision-making and thorough understanding of market impacts, making it a valuable approach for experienced traders seeking opportunities in dynamic markets.