The question “Is CFD difficult?” is a common concern for many people, especially new traders when they first start trading Contracts for Difference. To answer this question, let’s explore a detailed explanation with Tipstrade.org in the article below!

Understanding the basics of CFD trading

Before delving into the analysis of “Is CFD difficult?“, let’s first go over the basic knowledge of CFD trading.

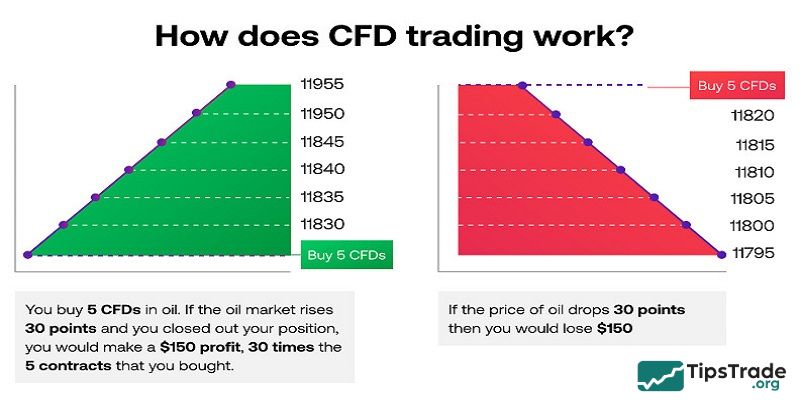

A Contract for Difference (CFD) is a financial derivative that allows you to speculate on price movements of an underlying asset without actually owning it. Instead of buying the asset itself, you trade based on whether you think the price will go up or down.

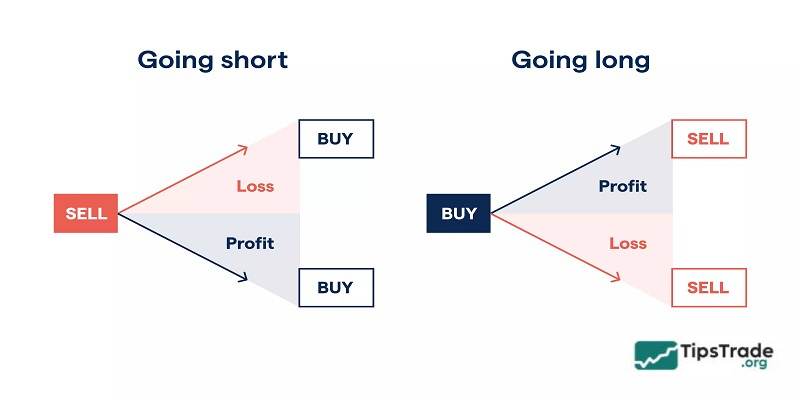

- If you expect the price to rise → open a Buy (Long) position

- If you expect the price to fall → open a Sell (Short) position

Your profit or loss is determined by the difference between the opening price and the closing price of the trade.

See more:

- What is CFD? Contracts for Difference Explained for Beginners

- What is Margin CFD? A Complete Guide to Margin in CFD Trading

- CFD Demo Account: An Essential Tool for Beginner Traders

- CFD Emotion Control: The Key to Success in the Contracts for Difference Market

Benefits of trading CFDs

Leverage

Is CFD difficult? The ability to use leverage is one of the main attractions of CFD trading. It means you can control a larger trading position with a smaller amount of capital. While leverage can amplify profits, it can also significantly increase the risk of substantial losses. Understanding how leverage works is a key factor in managing risk effectively.

Access to a wide range of markets

CFDs provide access to multiple markets and various asset classes. Whether you are interested in stocks, commodities, forex, or indices, CFDs allow you to diversify your portfolio without owning the underlying assets. This flexibility is especially attractive to traders who want to explore different opportunities.

Ability to trade Long or Short

CFDs allow traders to profit from both rising and falling markets. Simply put, you can open a long position if you expect prices to increase, or a short position if you anticipate prices will decline. This flexibility enables you to adapt your trading strategy to real market conditions.

Limitations of trading CFDs

High risk

Is CFD difficult? The use of leverage in CFD trading can help increase potential profits, but it also significantly raises the level of risk. You may incur losses that exceed your initial investment, especially in highly volatile markets. Therefore, it is essential to understand risk management techniques, such as setting stop-loss orders, to help protect your capital.

Costs and trading fees

CFD trading typically involves costs such as bid-ask spreads, commissions, and overnight financing fees. These expenses can add up over time, especially for frequent traders. Understanding your broker’s fee structure and how it affects your trading strategy is an important factor in trading CFDs effectively.

Limited regulatory oversight

Compared to some other financial instruments, CFD trading may be subject to less stringent regulation in certain regions, which can create potential risks. Traders should choose reputable brokers that operate transparently and comply with applicable legal requirements. Understanding the regulatory landscape can help reduce risks associated with CFD trading.

Is CFD difficult to learn for beginners?

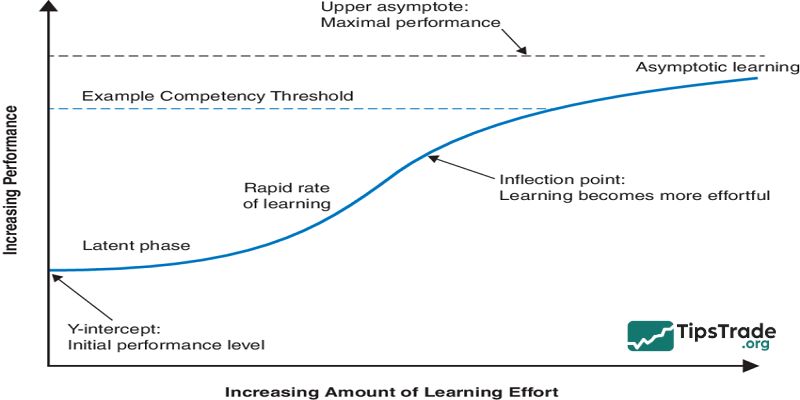

Learning curve

Depending on your existing knowledge of financial markets and trading, the learning curve for CFDs can vary. If you are already familiar with basic trading concepts, you may find it easier to understand CFDs. However, even beginners can learn the fundamental principles with dedication and consistent practice.

Educational resources

For those who want to learn about CFDs, there is a wide range of educational materials available. Many brokers offer tutorials, webinars, and demo accounts that allow you to practice trading without risking real money. Taking advantage of these resources can help improve your knowledge and build confidence when trading CFDs.

Practice and experience

Like any other trading approach, practice is essential. Starting with a demo account allows you to test different strategies and become familiar with the trading platform. Gaining experience over time will help improve your skills and enhance your decision-making ability.

Some tips to learn CFD trading easier for beginners

Risk management

A crucial aspect of CFD trading is understanding and implementing effective risk management strategies. This includes setting stop-loss orders, managing position sizes, and being aware of market volatility. Developing a solid risk management plan can help protect your capital and improve your overall trading experience.

Stay informed

Keeping up with market news and trends is essential for successful CFD trading. Market conditions can change rapidly, so staying informed helps you make timely decisions. Follow financial news, market analyses, and updates related to the assets you are trading.

Develop a trading plan

Creating a trading plan that clearly outlines your goals, strategies, and risk management approach is essential for maintaining consistency. A well-defined plan helps you stay disciplined and focused, reducing the likelihood of making emotional trading decisions.

Hopefully, with the insights shared above by Tipstrade.org, you now have a clearer answer to the question “Is CFD difficult to learn for beginners?” and can be better prepared before entering the field of Contracts for Difference trading.