CFD vs Spread Betting is a common topic that many traders research before starting their trading journey. Both methods allow traders to speculate on price movements without owning the underlying assets, while also offering leverage and the ability to trade in both rising and falling markets. However, each trading method has unique characteristics in terms of structure, costs, taxes, and suitability for different types of investors.

This article will help you understand the core concepts of CFD vs Spread Betting, analyze their advantages and disadvantages, compare key factors in detail, and provide guidance to help you choose the most suitable option based on your trading goals.

Introduction to CFD vs Spread Betting

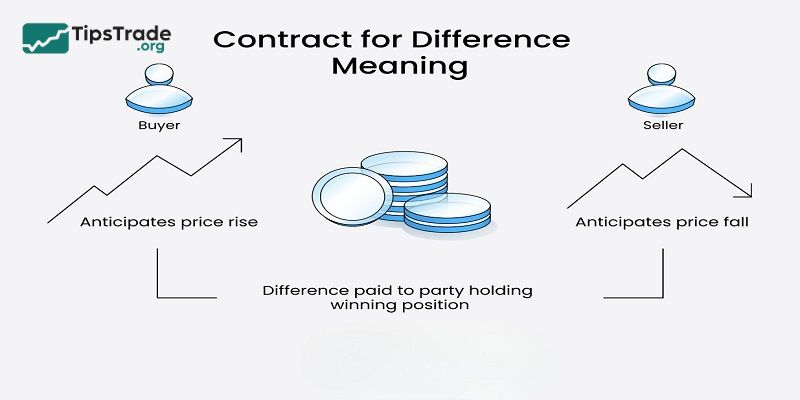

What is CFD?

A CFD (Contract for Difference) is a financial instrument that allows traders to speculate on price movements of assets such as Forex, stocks, indices, or commodities. When trading CFDs, you profit or lose based on the price difference between opening and closing a position.

Example: If you open a buy position on gold at $2000 and close it at $2050, your profit is calculated based on the $50 price increase.

- Explore the Top 10 best CFD brokers for maximum profit

- Common Types of CFD Cost and How They are Calculated

- Top 6 Best CFD Indicator Tools Every Trader Should Know

- Common CFD Asset Types and How to Choose the Right One for Traders

Advantages of CFD Trading

- Wide market access: Forex, crypto, stocks, indices, commodities

- Flexible strategies: scalping, swing trading, or long-term trading

- Advanced risk management tools: Stop Loss, Take Profit

- High liquidity: especially in Forex markets

Disadvantages and Risks of CFDs

- High leverage can lead to rapid losses

- Overnight fees (swap) for long-term positions

- Spreads and commissions can reduce profitability

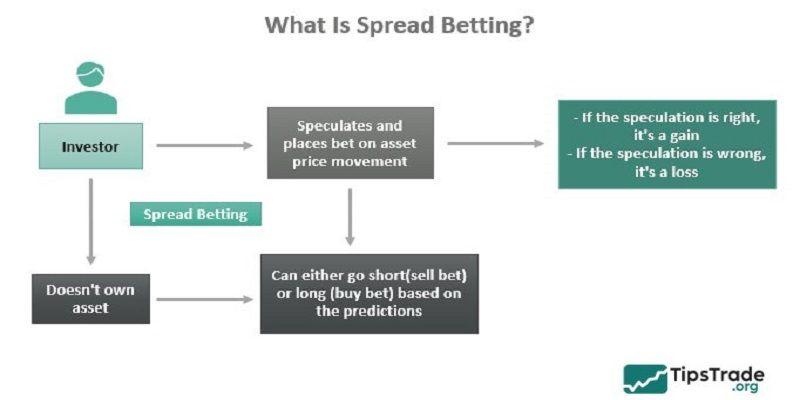

What is Spread Betting?

Spread Betting is a form of trading where you speculate on price movements by betting a certain amount of money per point of price movement. Instead of trading volume like CFDs, traders stake money based on the price change. Example: If you bet $10 per point on an index and the price rises by 20 points, you could earn $200.

Advantages of Spread Betting

- Potential tax benefits in some countries such as the UK

- Flexible stake sizing

- Suitable for short-term trading strategies

Disadvantages and Limitations

- Not widely available globally

- High risk if risk management is poor

- Sometimes misunderstood as gambling

Similarities Between CFD vs Spread Betting

The similarities between CFD vs Spread Betting are:

- As both products are leveraged, there is the potential to make large profits with a small investment. Perfect for those with a limited trading budget.

- Both spread betting and CFDs are exempt from stamp duties, as you do not physically own any assets.

- You can trade both long and short using a variety of indices, currency pairs, stocks and commodities.

- You can trade at any time of the day and week, depending on the trading platform.

- Spread betting and CFDs allow traders to enter the market and gain exposure and experience with leverage already in place.

- There are thousands of other online tools and platforms to plug into MT4 that support spread betting and CFD trading.

- Both spread betting and CFD support short, medium and long-term strategies.

- You might have to pay funding costs to hold your bets overnight.

Differences between CFD vs Spread Betting

The difference between CFD vs Spread Betting relates to the following factors:

- Tax efficiency – CFD trading is liable for capital gains tax or income tax. Spread betting is exempt from all taxes.

- Contracts – With spread betting, the contract is based on pound per point. With CFD trading, your contract is based on the amount of the underlying market.

- Profit – With spread betting, the profit is calculated as the difference of buy and sell multiplied by the stake. With CFD trading, the profit is the difference between the entry and exit price, multiplied by the number of CFDs, multiplied by the size of the contract.

- Duration – There are no expiry dates in CFD trading but there are in spread betting. These expiry dates are typically far into the future, however, you can have a very short expiration of a day, if you want.

- Location – Spread betting is only available in the UK and Ireland; CFD trading is global.

- Commission – Spread betting is commission-free, while CFD brokers may take a percentage of the profit for themselves.

- Payments – CFD trading profits are paid in the currency of the underlying market. Spread betting profits are paid in GBP.

Should You Choose CFD or Spread Betting?

When it comes to CFD vs Spread Betting, deciding which option to use and when comes down to research, knowledge and confidence.

CFD trading might be the better option if you:

- Want a corporate trading account

- Have the skills to hedge your trades for tax benefits

- Want physical assets in your investment portfolio

- Prefer traditional trading but don’t want ownership of the asset

Alternatively, Spread betting might work better in situations where you:

- Prefer not to pay any tax

- Want to make your trades in GBP

- Like more control over the size of your bet

- Don’t have the budget for minimum investments and commissions

- Want the freedom to choose when your bets close

The decision to choose either CFD vs Spread Betting is ultimately a personal one that depends on individual preferences, financial goals and risk tolerance. It’s essential to conduct thorough research, seek professional financial advice and carefully evaluate the risks and benefits before making a decision.

CFD vs Spread Betting: Final Thoughts

Through this detailed analysis of CFD vs Spread Betting, it is clear that both trading methods have unique advantages and are suitable for different types of traders. Regardless of your choice, the most important factors remain proper risk management, a clear trading strategy, and disciplined execution over the long term. Wishing all traders successful trading!

See more: