CFD risk is one of the most critical factors every trader must understand before entering the world of CFD trading. While CFDs offer opportunities to profit from both rising and falling markets, they also expose traders to various risks. Without proper knowledge and risk management strategies, even experienced traders can face significant losses.

In this article, we will explore the main types of CFD risk and provide practical methods to manage them effectively, helping you trade more confidently and sustainably in today’s fast-moving financial markets.

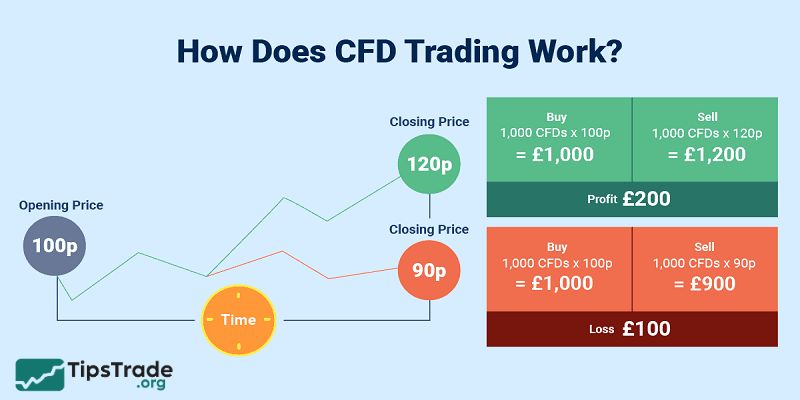

How does CFD trading work and risk relate to?

CFD stands for Contract for Difference. It is a speculative investment instrument that allows traders to trade in both directions. This means they can potentially profit from both rising and falling prices. In any case, whether trading CFD indices, commodities, or forex, the use of leverage increases both the potential profit opportunities and the risk of losses in proportion to the size of your position. For this reason, many traders often face position imbalances when they lack proper CFD risk management structures.

Becoming a CFD trader can be highly profitable, but first you need to understand the value of risk management. By applying accurate Contract for Difference trading strategies, you can minimize risks, protect your capital, and improve your decision-making process.

See more:

- CFD Leverage Basics All Traders Should Know

- CFD Capital Management: Effective Principles and Strategies

- Explore the Top 10 best CFD brokers for maximum profit

- Common CFD Asset Types and How to Choose the Right One for Traders

Why do traders need to understand CFD risk?

The CFD market is fast-moving and highly volatile. A single poor trading decision can result in significant losses within a short period. Many new traders are attracted by the potential for large profits but underestimate the dangers associated with leverage and poor risk management. So, understanding CFD risk helps traders:

- Build appropriate trading strategies

- Reduce the likelihood of account blowouts

- Maintain emotional control during volatile market conditions

Common types of CFD risk every trader should know

Below are the types of CFD risk explained that every trader should know:

Market risk

CFDs are affected by the markets in the same way as underlying assets are. For example, if you are trading stock CDFs, the price changes in the stock market will affect you, even if you don’t directly own the stocks. Things like interest rates, exchange rates or geopolitical events can trigger quick changes in the markets.

Liquidity risk

Liquidity risk happens when there is a lack of demand to buy assets. When this happens, there’s risk the CFD can become illiquid and that it will close out at set price.

It’s also possible that the price of a CFD can fall below the agreed price before it’s executed – this is also known as gapping. This means the holder of the CFD would get less profit than expected.

It’s important to note that even assets that are usually highly liquid, like forex and shares, can experience sudden changes in liquidity under extreme market conditions. However, this volatility is also what allows traders to capture profits – so it’s important to remain perseverant and protect your investments with thorough market analysis and risk management tools.

Margin risk

Leverage requires retaining a specified minimum margin level. Review your margin often and ensure to keep other funds to avoid the margin calls.

See more: What is Margin CFD? A Complete Guide to Margin in CFD Trading

Counterparty risk

The counterparty is another name for the company that provides the asset in a financial transaction. Counterparty risk refers to the possibility that one of the parties involved in a transaction can’t fulfil their contractual obligations.

When you buy or sell a CFD, you’re trading a contract issued by the broker. If the broker or their counterparties don’t meet their financial obligations, this could pose a risk to the trader. To limit counterparty risk, always make sure you trade with a broker is fully regulated and licensed by the financial authorities.

Factors that increase CFD risk

- Excessive use of leverage: Many new traders choose the highest leverage available in pursuit of fast profits, but this greatly increases the risk of severe losses from minor market movements.

- Lack of a clear trading strategy: Trading without a structured plan often leads to inconsistent decision-making and emotional reactions.

- Poor capital management: Placing oversized trades or failing to limit risk per trade is one of the most common reasons traders lose their accounts.

- Emotion-based trading instead of data-driven decisions: Following rumors or unverified signals often results in poor trading outcomes.

- Insufficient knowledge about CFD markets: Limited understanding of how CFDs work can cause traders to underestimate real market risks.

Effective ways to manage CFD risk

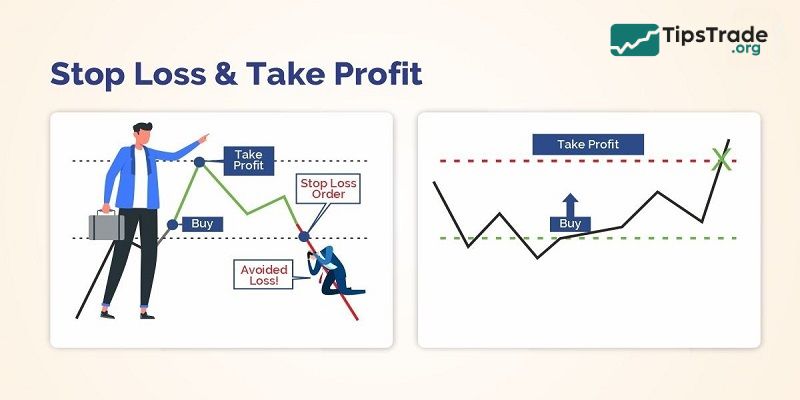

Use Stop-Loss/Take-Profit Orders

These are pre-set or quite reserved and close down your positions at pre-defined price level thus minimizing your losses. Closing orders in trading fix profit by exiting a position when it reaches some specific price.

Pros:

- One of the advantages is that it minimizes emotional decision-making in an organization.

- Prevents the rapid adverse movements in the market.

- Helps maintain a disciplined trading approach.

Diversify Your Portfolio

Leverage regular diversification by avoiding putting all your capital in one trade or one asset class. The tradable products divided among CFD indices, commodities, and forex reduce risks. Example: If you want to trade CFD indices then you may also want to include forex or commodities CFDs in your trading scope.

Common mistakes that increase CFD risk

- Overtrading: Executing too many trades in a short period often leads to emotional fatigue and increased transaction costs.

- Not using stop-loss orders: Trading without stop-loss protection exposes traders to unlimited downside risk.

- Allocating all capital to a single trade: Unexpected market movements can cause severe account drawdowns when risk is not diversified.

- Relying on unverified trading signals: Signals from unreliable sources can lead to poor trading decisions.

- Ignoring important economic news: Major events such as interest rate decisions, CPI releases, or employment data can trigger significant market volatility.

Conclusion

Understanding CFD risk is essential for anyone who wants to trade CFDs successfully and protect their capital over the long term. From market fluctuations and leverage exposure to emotional decision-making, each type of risk can significantly impact trading performance if left unmanaged.

By applying disciplined risk management strategies, controlling leverage, and maintaining a clear trading plan, traders can reduce CFD risk and improve their chances of consistent profitability. Ultimately, success in CFD trading is not about avoiding risk entirely but about learning how to manage CFD risk effectively and trade with confidence and discipline.

See more: