CFD index investing is a flexible solution attracting millions of global traders today. Instead of traditional stock ownership, this method allows you to profit from the price fluctuations of an entire stock index, such as the S&P 500 or Nasdaq, with lower capital requirements through the use of leverage. This article will guide you through exactly what CFD index investing is, how it works, and how to embark on your investment journey effectively.

What is CFD index investing?

CFD (Contracts for Difference) index investing is derivative instruments that allow traders to speculate on the price movements of a stock market index without owning the underlying asset. An index (such as the S&P 500 or FTSE 100) represents a group of stocks from specific sectors or regions, reflecting the overall performance of those markets.

Key characteristics of CFD index investing:

- Leverage: Index CFDs are often traded on margin, meaning traders can control a larger position with a smaller amount of capital. This leverage can amplify both gains and losses.

- No ownership of underlying assets: Traders do not own the actual stocks within the index. Instead, they are speculating on the price movement of the index itself.

- Variety of indices: Traders can choose from a wide range of indices, including major global indices, sector-specific indices, and emerging market indices.

See more:

- What is CFD? Contracts for Difference Explained for Beginners

- Stock CFDs: What is it and How to Trade?

- CFD Forex: Why Do Investors Choose CFDs Instead of Direct Trading?

- Compare CFDs and Stocks: Differences, Similarities, and Which to Choose?

How CFD index investing works

In CFD index investing, traders enter into a contract with their broker that includes the name of the index, its value, and the total number of units you are buying. When the price of the index CFD changes, traders make a profit or loss based on the difference between the opening price and the closing price.

When investing index CFDs, traders only need to deposit a small amount of money to enter a trade, known as margin. The broker sets the margin requirement and gives you greater market exposure because profits and losses are calculated on the full trade value rather than just the initial margin amount.

- For example: If you want to trade an Index CFD called ABC with a market price of 100 USD and the broker requires a 10% margin, you can open the trade by depositing only 10% of 100 USD, which is 10 USD. Now, suppose the market price of the XYZ Index CFD rises to 140 USD; this would give you a 40 USD profit from an investment of just 10 USD – making your total return four times your actual capital invested.

Methods for calculating index CFDs

Each index starts with a value of 100, and if the upward trend continues, this value will increase after each trading day. The return on each CFD is calculated daily and the index return is calculated by averaging the daily returns of the CFD. On the next trading day, traders can add the previous day’s returns to the new Index CFD’s value to find the current day’s returns on Index CFD.

Below are the three most common methods used to calculate an Index CFD’s value:

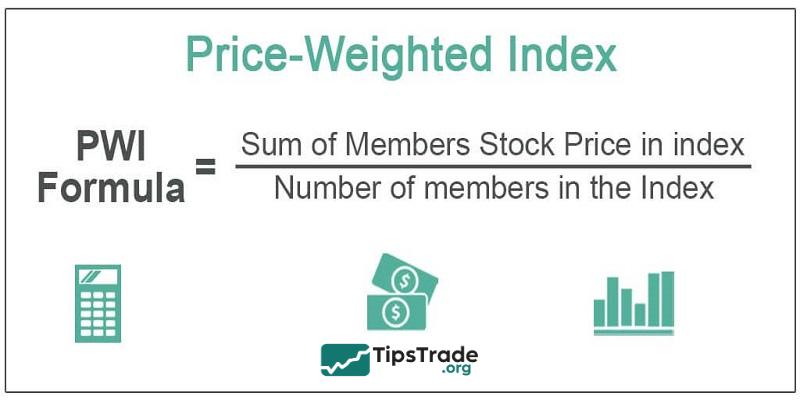

Price weighted method

In the price-weighted method, greater importance is given to the prices of the securities that make up the index rather than their market capitalization. Stocks with higher prices carry a larger weight in calculating the CFD index. The calculation begins by adding together the individual share prices of each company in the index and then dividing the total by the number of companies included.

Equal weighted method

With the equal-weighted method, every stock in the index is assigned the same weight, regardless of its share price or market capitalization. The returns of each stock are then added together and divided by the total number of stocks, resulting in the value of the CFD index.

Market capitalization method

The market capitalization method assigns higher weight to larger companies in the index compared to smaller ones. It is based on the assumption that larger companies tend to generate more revenue and potentially deliver higher returns for investors. Each stock in the CFD index is assigned a specific value on a 100-point scale based on its market capitalization, then multiplied by the index’s rate of return. These results are added together to reflect the overall value of the CFD index.

How to start CFD index investing: Step-by-step guide

Choose a Reliable CFD Broker

Many brokers offer CFD index investing services on online platforms or their own proprietary systems. Look for a broker that provides a full range of tools suitable for trading Index CFDs.

To choose a suitable CFD broker, below are several important factors you should carefully consider:

- Leverage rates: Check and compare various margin trading conditions. A lower margin typically means the index requires a lower initial investment to trade.

- Spreads: Brokers usually gain from the spreads they offer to traders. A lower spread means traders need to make potentially less profit to cover the overall trade cost.

- Reputation: When dealing with indices trading it is important to consider the reputation of your broker, given that CFD trading is not properly regulated in some countries. Check whether the broker and their platform are regulated.

- Customer support: The inability to access your funds or make decisions on your position owing to errors with the trading platform can be very frustrating, and not to mention painful if you incur losses. Therefore, traders should not overlook customer support – some CFD brokers even offer round-the-clock (24/7) support.

- Fees: CFD indices trading can have many associated fees, such as transaction fees and overnight holding charges. Be sure to compare all the costs of using different brokers and consider them against the trading strategy you want to use.

- Deposits: Consider how accounts are funded (currencies accepted) and how many days the deposit will take to appear in your account so you don’t miss a trade.

See more: Explore the Top 10 best CFD brokers for maximum profit

Open Your Position

Core principle: Never invest more money than you can afford to lose.

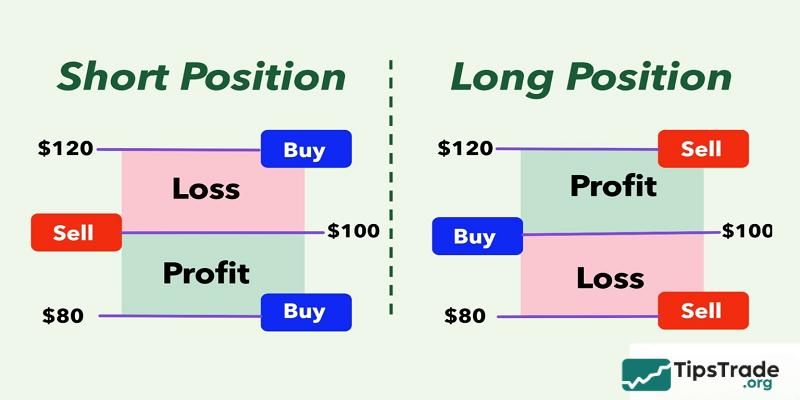

Most modern trading platforms are user-friendly, making it easy to open or close positions. Index CFD trading platforms usually present two options: Sell (Short) or Buy (Long) the selected index.

- Going short: This means traders take advantage of market opportunities when the index value is expected to decline.

- Going long: This applies when you expect the index value to increase. Most platforms provide detailed information about various financial instruments to help you make more informed decisions.

Monitor Your Position

Keep a close eye on all positions after opening them. You may consider setting up an automated exit strategy if possible. You should think about closing a position to avoid rapid losses if the price drops beyond your tolerance level. You can also place Stop orders, which are automatic limits that close your position immediately once the price reaches a specified threshold.

Popular indices used in CFD index investing

| Names of indices used in CFD index investing | Description |

| FTSE 100 | It is an index of the 100 biggest British companies listed on the London Stock Exchange (LSE). It is computed by weighting equities according to their market capitalization. It consists mostly of the top 100 stocks by market capitalization. |

| NASDAQ 100 | The top 100 non-financial firms listed on the NASDAQ stock exchange in the United States make up the NASDAQ 100 index. The weights of equities in this index are determined by their market capitalization, with certain limitations in place to limit the impact of bigger securities. |

| Dow Jones Industrial Average (DJIA) | The Dow Jones Industrial Average, often known as the Dow 30, is an indicator of the 30 top-performing businesses listed on the New York Stock Exchange (NYSE) (New York Stock Exchange). |

| S&P 500 | The S&P 500 is a market capitalization-weighted index of the 500 largest-capitalized firms. In contrast to the tech-heavy Nasdaq, the diversity of firms included in the index makes it one of the strongest indications of the overall success of the US stock market. Traders use this index because it measures a substantial portion of the US economy. |

Benefits & Risks of CFD index investing

Any form of investment in the financial market has certain advantages and disadvantages, and CFD index investing is no exception.

Benefits of CFD index investing

- High leverage enables trading with minimal capital

- Ability to profit from rising and falling markets

- Access to global market indices without direct asset ownership

- Lower transaction costs compared to traditional stock trading

- Flexible trading strategies with long and short positions

- No stamp duty or ownership complications

Risks of CFD index investing

- Significant financial risk due to leveraged trading

- Potential for losses exceeding initial investment

- Complex fee structure including spreads and overnight financing

- Requires advanced market knowledge and risk management

- Complex fee structure including spreads and overnight financing

- Psychological pressure from rapid market movements

Tips for effective CFD index investing

- Follow the latest news: It is paramount for traders to keep up to date on financial news and risk events taking place before deciding what stock indices they want to trade on. Changes in financial news can have a huge impact on indices based in the region and being able to identify possible price movement increases your chances to take advantage of market opportunities. Moreover, it reduces the risk of being caught off guard by the market.

- Hedging: CFD index investing is commonly used to hedge investments because it allows you to “short” (sell) the index. For example, if your investment portfolio contains various stocks and you’re expecting a sudden decline, you can use CFDs as a trading strategy to potentially reduce your downside exposure by offsetting losses.

Conclusion

CFD index investing is a powerful financial tool that offers rapid and efficient access to global stock markets. While it carries risks associated with leverage, mastering risk management and staying informed on market news can turn CFD index investing into a valuable asset for optimizing returns in both bull and bear markets. Start by choosing a reputable broker and practicing on a demo account today to master your trading skills!

See more: