LP vs GP in private equity is one of the most common and important questions for investors exploring private markets, fund structures, and alternative investments. Understanding capital commitments, fund governance, carried interest, management fees, risk exposure, and investment decision-making helps investors clearly see how private equity funds operate in practice. This article explains the differences between Limited Partners (LPs) and General Partners (GPs), why their roles matter, and how they interact throughout the private equity fund lifecycle. By reading this guide, investors can better evaluate private equity opportunities, understand incentives, and align their capital with the right role in private equity investing. Explore the detailed article at Tipstrade.org to be more confident when making important trading decisions.

What Is a Private Equity Fund Structure?

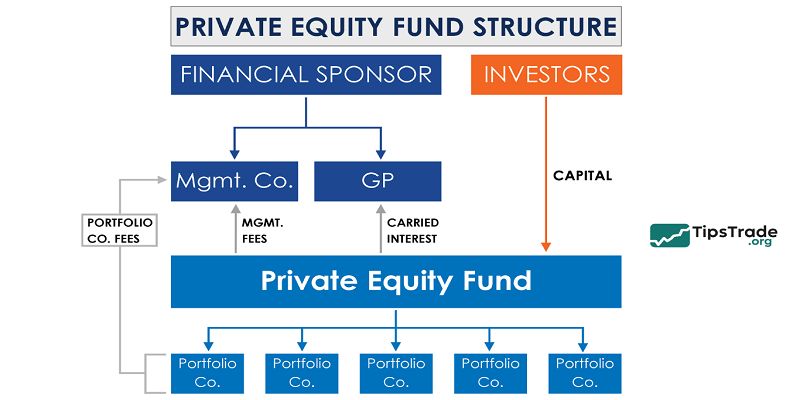

A private equity fund structure is a legal and economic framework that defines how capital is raised, managed, and distributed. Most private equity funds are structured as limited partnerships, where Limited Partners provide capital and General Partners manage investments. This structure aligns incentives while clearly separating ownership, control, and liability.

From an industry experience perspective, limited partnership structures have become the global standard because they offer flexibility and clarity. LPs commit capital upfront but contribute funds gradually through capital calls.

GPs, typically professional private equity firms, control investment decisions, portfolio management, and exit strategies. This division of roles allows institutional investors to access private markets without direct operational involvement, while GPs focus on generating returns through active ownership.

See more

- How Private Equity Funds Work: A Step-by-Step Guide for Investors

- Buyout Funds: A Comprehensive Guide to Private Equity Buyouts

- Fund of Funds (FoF): Definition, Structure, Benefits, Risks, and Investment Applications

-

Advantages of Private Equity Funds: Why Investors Continue to Favor PE Strategies

How Capital Flows Between LPs and GPs

Capital flow is central to understanding LP vs GP private equity dynamics. LPs make capital commitments at the fund’s inception, but capital is drawn over time as investments are identified. This staged funding approach improves capital efficiency and risk management.

In practice, GPs issue capital calls when deals close or operating expenses arise. LPs are contractually obligated to meet these calls.

Returns are distributed according to a predefined waterfall structure, which prioritizes returning capital to LPs before profit sharing. Industry reviews show that this model aligns long-term incentives while protecting LP interests during early fund stages.

Who Are Limited Partners (LPs) in Private Equity?

Limited Partners are investors who provide the majority of capital in private equity funds. Common LPs include pension funds, insurance companies, endowments, sovereign wealth funds, and family offices. Their primary role is to allocate capital rather than manage investments.

From a practical investment experience, LPs view private equity as a way to diversify portfolios, access illiquid assets, and enhance long-term returns.

LPs benefit from limited liability, meaning their financial risk is generally capped at their committed capital. This structure allows institutions to invest at scale without taking on operational or legal responsibility for portfolio companies.

Roles and Responsibilities of LPs

LP responsibilities are largely financial and oversight-oriented. LPs commit capital, meet capital calls, and review periodic fund reports. They do not participate in daily management or individual deal decisions.

In real-world practice, LPs influence funds indirectly through governance mechanisms such as Limited Partner Advisory Committees (LPACs).

These committees provide guidance on conflicts of interest, valuation policies, and fund extensions. Although LPs lack direct control, their collective influence shapes fund governance and accountability.

Benefits and Risks for LPs

LPs enjoy several advantages, including professional management, portfolio diversification, and access to private companies not available in public markets. Historical data from private markets research firms shows that private equity has delivered competitive long-term returns relative to public equities.

However, risks remain. LP capital is illiquid for extended periods, often 10 years or more. Performance depends heavily on GP skill and market conditions.

From a trust perspective, LPs must conduct thorough due diligence to ensure alignment with GP strategy, governance standards, and fee transparency.

Who Are General Partners (GPs) in Private Equity?

General Partners are responsible for managing private equity funds and executing investment strategies. GPs are typically private equity firms with specialized industry expertise and deal-making capabilities.

From an operational experience standpoint, GPs act as active owners. They source deals, negotiate acquisitions, oversee portfolio companies, and plan exits. GPs assume fiduciary responsibility for managing LP capital, making their role central to fund success.

Core Responsibilities of GPs

GP responsibilities span the entire investment lifecycle. They identify investment opportunities, conduct due diligence, structure transactions, and implement value-creation plans. Post-acquisition, GPs work closely with management teams to improve operations, governance, and strategic positioning.

Professional reviews emphasize that GP expertise is the primary driver of private equity performance. Strong GPs combine financial discipline with operational insight, enabling them to enhance portfolio company value over time.

Incentives and Compensation Structure

GP compensation typically includes management fees and carried interest. Management fees, often around 2% of committed capital, cover operating costs. Carried interest allows GPs to share in profits once LPs receive their preferred returns.

This incentive structure aligns GP interests with LP outcomes. Industry research suggests that carried interest motivates long-term value creation rather than short-term gains. However, fee structures vary, making transparency critical for LP trust.

LP vs GP in Private Equity

Understanding the key differences between LPs and GPs helps investors assess their role in private equity funds. While both parties aim for strong returns, their responsibilities and risk profiles differ significantly.

Control and Decision-Making Power

GPs hold decision-making authority over investments, exits, and portfolio management. LPs do not vote on individual deals but rely on GP expertise.

From an experiential perspective, this division allows efficient execution but requires trust. LPs evaluate GP track records and governance structures to mitigate agency risk.

Risk Exposure and Liability

LPs benefit from limited liability, protecting them from losses beyond their committed capital. GPs, by contrast, face greater legal and reputational risk.

This imbalance reflects the active role GPs play in managing investments. Industry practice views this risk allocation as essential for accountability and incentive alignment.

Fee Structure and Economic Interests

LPs pay management fees and share profits through carried interest. GPs earn fees and performance-based compensation.

Research shows that fee transparency is a major factor in LP satisfaction. Clear economic alignment strengthens long-term GP–LP relationships.

Governance and Reporting in Private Equity Funds

Governance structures ensure accountability between LPs and GPs. Limited partnership agreements define reporting standards, valuation policies, and conflict resolution mechanisms.

From an industry standpoint, strong governance improves transparency and trust. Regular reporting allows LPs to monitor performance and risk exposure.

Limited Partner Advisory Committees (LPACs)

LPACs serve as advisory bodies representing LP interests. They review conflicts of interest, approve valuation methodologies, and provide guidance on fund extensions.

Experience shows that active LPACs enhance communication and reduce governance disputes. While advisory in nature, LPACs play a critical role in fund oversight.

How LPs and GPs Work Together in Practice

The LP–GP relationship is long-term and relationship-driven. Successful funds often rely on repeat commitments from satisfied LPs.

From a practical perspective, alignment is built through transparency, consistent communication, and shared objectives. Conflicts may arise, but effective governance mechanisms help resolve them constructively.

Conclusion

LP vs GP private equity roles define how private equity funds operate and how value is created. Limited Partners supply capital and seek long-term returns with limited involvement, while General Partners actively manage investments and drive performance. Understanding these roles, incentives, and risks is essential for investors considering private equity exposure. By aligning expectations with fund structure and governance, investors can make more informed and confident decisions in private markets.

See more