Stock CFDs have become one of the most popular trading instruments for modern investors who want to profit from stock price movements without owning actual shares. But what exactly are Stock CFDs, how stock CFDs differ from regular stocks, the costs, and how you can trade stock CFDs. The answer will be detailed by Tipstrade.org in the article below!

What are Stock CFDs?

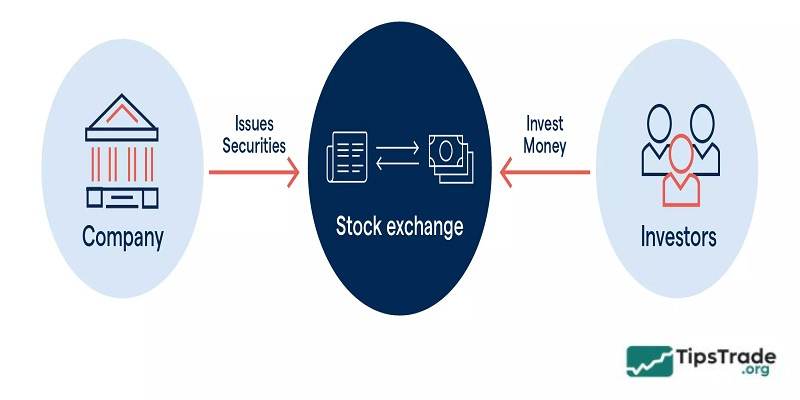

A Stock CFD is a type of financial derivative. Essentially, when you trade stock CFDs, you are entering into an agreement with a broker to exchange the difference in the price of a specific stock between the time the contract is opened and when it is closed.

The key takeaway is: You do not actually own the underlying stock. Instead of holding a share certificate or having voting rights in a company, you are speculating on the price movement of that stock in the market.

See more:

- What is CFD? Contracts for Difference Explained for Beginners

- Explore the Top 10 best CFD brokers for maximum profit

- CFD Forex: Why Do Investors Choose CFDs Instead of Direct Trading?

- Compare CFDs and Stocks: Differences, Similarities, and Which to Choose?

How do Stock CFDs work?

A Contract for Difference (CFD) is an agreement between a buyer and a seller in which the seller agrees to pay the buyer the difference between the current price of a stock and its price at the time the contract was established. Stock CFDs allow participants to speculate on whether the value of a stock will rise or fall without actually owning the underlying asset.

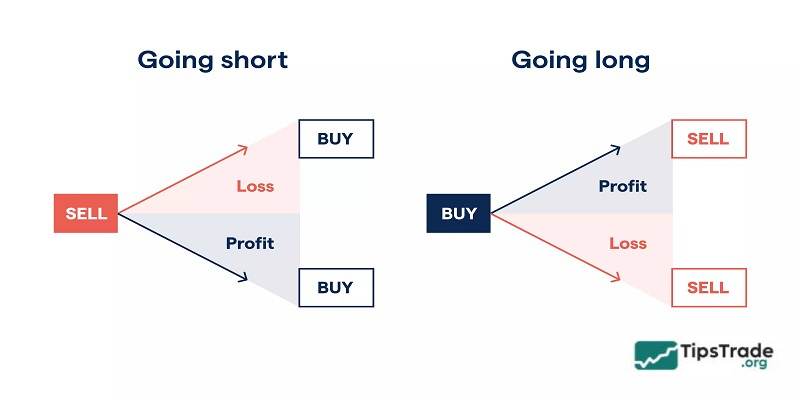

What makes Stock CFDs attractive is that it focuses on anticipated price movements, eliminating the need to purchase the shares outright. Traders can take short positions if they expect prices to decline, as well as long positions if they predict prices will rise. This flexibility means profits can be made even when stock prices are falling, not only when they are increasing.

Benefits of trading Stock CFDs

Stock CFDs offer several key advantages, making it an attractive option for investors:

- Leverage: One major benefit is the ability to use leverage, allowing you to control larger positions than your initial capital. This can amplify potential profits while requiring only a small portion of the total trade value.

- Short selling: CFDs enable short selling, allowing you to profit even when stock prices decline. This creates opportunities to take advantage of market movements regardless of whether prices rise or fall.

- Convenience: Since you are speculating on price movements rather than owning the underlying asset, you can avoid the complex procedures associated with buying, holding, or selling physical shares.

- Global access: CFDs provide access to a wide range of stocks from major exchanges around the world, enabling you to build broader trading strategies across multiple sectors.

- Flexible trading hours: Many CFD markets operate beyond standard trading hours, offering greater flexibility to place trades based on timely market events.

These advantages make Stock CFDs appealing to both beginner traders and experienced investors alike.

Fees to know when trading Stock CFDs

There are several types of costs associated with trading all kinds of CFDs; however, additional fees may apply specifically to stock CFDs. In most CFD trades, you may need to pay account management fees, holding fees, transaction costs, margin requirements, and spreads. For stock CFDs in particular, you may also be required to pay commissions and applicable taxes.

- Account charges: Depending on where you open your account, you may be required to pay a one-time activation fee or maintenance fees if your account remains inactive for an extended period.

- Holding fees: When opening a CFD position, you may hold it for a longer duration if you anticipate a medium-term trend. Most brokers charge holding fees, also known as overnight fees, for maintaining the contract each day. This fee may be positive or negative (meaning you may either pay or receive money).

- Transaction costs: Some brokers charge a certain percentage fee on each deposit or withdrawal.

- Margin rates: If you open a leveraged position, you will need to deposit a percentage (ranging from 1% to 50%) of the total position value as margin.

- Spreads: When an investor opens a CFD position, the instrument will have a Bid price (sell price – used when predicting a downward trend) and an Offer price (buy price – used when predicting an upward trend). The spread is the difference between these two prices.

- Commissions: When you open stock CFD positions, brokers typically charge a commission based on the amount of capital you stake.

- Taxes: You may be required to pay Capital Gains Tax if your profits exceed a certain threshold, or Corporation Tax if you trade stock CFDs as a registered corporate entity.

How to start trading Stock CFDs: A beginner’s guide

After gaining a clearer understanding of how stock CFDs work, the next step is learning how to trade them. There are three main components to trading CFDs, yet there are steps involved that pertain specifically to stock CFDs: opening a position, monitoring a position, and closing the position.

Opening a position

When you open a position, you are speculating on the price movement of a stock over a certain period of time.

- If you expect the market to move upward or remain positive, you take a long position.

- If you anticipate a downward trend, you take a short position.

These expectations may come from your knowledge of a specific company, insights into the stock market, or your outlook on the broader economy. For example, many investors take long-term positions because they are optimistic about the near-term future of the economy.

Another important factor at this stage is trade size. If you open a stock position, making a prediction on 200 shares could be referred to as a position with 200 contracts. The larger the number of stock CFDs, the greater your profit for each favorable price movement. However, it will also increase your losses for every price movement that goes against your prediction. In this case, the profit or loss would be 200 times the price difference generated.

Monitoring a position

As an investor, you have full control over the “lifecycle” of your position. Because stock markets can be highly volatile, regularly monitoring your profits and losses is extremely important. This helps you determine when to add new trades or close your current position.

Although you can close a position whenever you see fit, you may also choose to place a stop loss or a guaranteed stop on your position; this helps ensure that your losses do not exceed a predetermined limit.

Closing a position

When you close your position, your deal size and leveraged position will be taken into account when calculating your final profit or loss. This is also when the spread and other potential fees come into the equation.

Risks to consider when investing in Stock CFDs

Financial investment is never a “path strewn with roses”. Stock CFDs offer high returns but come with significant risks:

- Leverage risk: Leverage is a double-edged sword. While it magnifies profits, it also magnifies losses. If the market moves against your prediction by even a small margin, your account could face a Margin Call.

- Market volatility: Economic and political news can cause stock prices to skyrocket or plummet in seconds.

- Hidden costs: If you hold positions long-term, Overnight Fees (Swap) can eat into your profits. Stock CFDs are generally better suited for short-to-medium-term trading.

Popular Stock CFDs trading strategies

- Day Trading: Capitalizing on small price fluctuations within a single session and closing all positions before the market closes to avoid Swap fees.

- News Trading: Taking advantage of price breakouts during earnings reports or Federal Reserve interest rate decisions.

- Hedging: If you own physical stocks and fear a short-term market downturn, you can open a Short CFD position on the same stock to offset the losses in your long-term portfolio.

Stock CFDs vs. Regular Stocks: Key Differences

Many new investors confuse these two methods. Here is a comparison table to provide clarity:

| Feature | Physical Stocks | Stock CFDs |

| Ownership | Yes, you are a shareholder. | No, it is a price-based contract. |

| Leverage | Usually none or very low (Margin). | High (from 1:5 to 1:20 depending on the broker). |

| Two-way Trading | Difficult (requires borrowing stock to short). | Easy (Long/Short with one click). |

| Dividends | Received directly as a shareholder. | Cash adjustments equivalent to dividends. |

| Holding Fees | Generally no fees for holding. | Overnight fees (Swap) apply. |

Conclusion

Stock CFDs are a flexible, modern, and high-potential tool for anyone looking to conquer the international stock markets. However, the key to success lies not in luck, but in knowledge and disciplined risk management. Always remember: “Never invest money that you cannot afford to lose”.