How Private Equity Funds work is one of the most common questions among investors exploring alternative investments, long-term capital, portfolio diversification, private market exposure, and institutional-grade assets. Unlike public stocks or mutual funds, private equity operates behind the scenes, using active ownership, strategic control, and patient capital to create value over time. Explore the detailed article at Tipstrade.org to be more confident when making important trading decisions.

What Is a Private Equity Fund?

Basic Definition of a Private Equity Fund

A private equity fund is an investment vehicle that pools capital to acquire ownership stakes in private companies or take public companies private. These funds are typically structured as limited partnerships and managed by professional investment firms with deep operational and financial expertise.

In real-world practice, private equity funds focus on long-term value creation rather than short-term market movements. According to research from the CFA Institute, private equity funds play a critical role in financing business expansion, restructuring underperforming companies, and supporting innovation across sectors such as technology, healthcare, and industrials.

Unlike publicly traded funds, private equity investments are illiquid and require patience. This illiquidity, however, is often compensated by an illiquidity premium, which academic studies suggest can enhance long-term returns for disciplined investors.

Role of Private Equity in the Investment Landscape

Private equity occupies a central position within the alternative investment ecosystem. It complements traditional asset classes such as equities and bonds by providing exposure to private markets and operational value creation.

Institutional investors—including pension funds and endowments—allocate significant capital to private equity due to its diversification benefits. According to data from Preqin, private equity assets under management have grown steadily over the past two decades, reflecting investor confidence in the asset class.

From an experience-based perspective, portfolio managers often view private equity as a way to smooth volatility and enhance long-term returns, provided investors can tolerate limited liquidity and higher complexity.

Who Is Involved in a Private Equity Fund?

General Partners (GPs) Explained

General Partners (GPs) are responsible for managing and operating private equity funds. They source deals, conduct due diligence, execute acquisitions, and oversee portfolio companies.

In practice, GPs bring industry expertise, operational knowledge, and strategic networks. Reports from Bain & Company emphasize that the quality of the GP is one of the strongest predictors of private equity performance. Experienced GPs often have sector specialization, enabling them to identify operational inefficiencies and growth opportunities more effectively.

GPs are incentivized through management fees and performance-based compensation, aligning their interests with long-term fund success.

Limited Partners (LPs) Explained

Limited Partners (LPs) are the investors who provide capital to private equity funds. They include institutional investors, high-net-worth individuals, and family offices.

LPs typically have limited involvement in day-to-day operations but play a critical role in governance through advisory committees. According to ILPA guidelines, LPs focus heavily on transparency, reporting standards, and risk management when evaluating funds.

From a practical standpoint, LPs commit capital upfront but transfer funds gradually, allowing them to manage liquidity efficiently.

How GP–LP Alignment Works

Alignment between GPs and LPs is a cornerstone of private equity fund design. GPs usually invest their own capital into the fund, ensuring shared financial outcomes.

This alignment is reinforced through performance incentives such as carried interest. Academic research from Harvard Business School suggests that well-aligned GP–LP structures contribute to superior fund performance and investor trust.

How Private Equity Funds Raise Capital

Fundraising Process and Capital Commitments

Private equity fundraising involves securing capital commitments from investors before investments are made. During this phase, GPs present their strategy, track record, and target returns to potential LPs.

Capital commitments represent a promise to invest up to a specified amount. This model allows GPs to plan acquisitions strategically while giving LPs flexibility. According to Preqin data, fundraising cycles typically last 12–24 months, depending on market conditions and fund reputation.

Why Investors Commit Capital Instead of Paying Upfront

Committing capital rather than paying upfront allows investors to optimize cash management. LPs retain control of their capital until it is needed for investments.

This structure reduces opportunity costs and improves portfolio efficiency. However, it requires careful planning to ensure capital is available when calls are issued.

The Private Equity Investment Process

Deal Sourcing and Origination

- Deal sourcing is the foundation of successful private equity investing. GPs rely on proprietary networks, advisors, and industry relationships.

- Research from McKinsey shows that proprietary deals often outperform auction-based transactions due to reduced competition.

Due Diligence and Valuation

- Due diligence involves deep financial, operational, and legal analysis. This process reduces risk and informs valuation assumptions.

- Valuations rely on cash flow projections, comparable transactions, and scenario analysis, as recommended by the CFA Institute.

Investment Committee Decision-Making

- Final investment decisions are made by an investment committee. This ensures discipline, accountability, and risk control.

- Committees typically include senior partners with sector expertise and governance oversight.

How Private Equity Funds Create Value

Operational Improvements

Operational improvement is a primary value driver in private equity. GPs focus on governance, cost optimization, and management incentives.

Case studies from Bain & Company show that operational enhancements often account for the majority of value creation.

Financial Restructuring and Leverage

Leverage enhances returns but increases risk. Private equity firms carefully structure debt to balance growth and stability.

Academic studies in the Journal of Finance highlight prudent leverage as critical to sustainable performance.

Strategic Growth Initiatives

Growth strategies include market expansion, acquisitions, and innovation. These initiatives require active oversight and capital discipline.

Successful growth execution differentiates top-quartile funds from average performers.

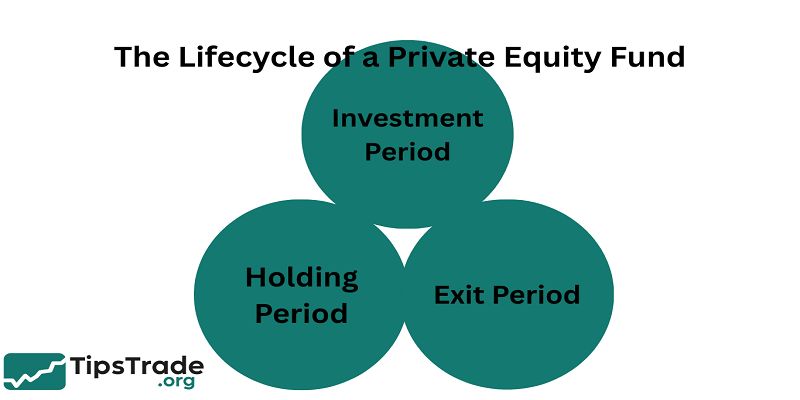

The Lifecycle of a Private Equity Fund

Investment Period

- The investment period typically lasts 3–5 years. During this time, new investments are made.

- After this phase, focus shifts to managing and exiting portfolio companies.

Holding Period

- The holding period emphasizes value creation and performance optimization.

- This phase may last several years, depending on strategy and market conditions.

Exit Period

- Exits realize returns for investors. Timing and execution quality significantly influence outcomes.

How Private Equity Funds Exit Investments

Initial Public Offerings (IPOs)

- IPOs provide liquidity and valuation transparency. However, they depend on favorable market conditions.

Strategic Sales

- Strategic buyers may pay premiums for synergies. This is a common exit route.

Secondary Buyouts

- Secondary buyouts involve selling to another private equity firm. These transactions are increasingly common in mature markets.

How Returns Are Distributed to Investors

Waterfall Structure Explained

- The distribution waterfall defines how profits are allocated. LPs typically receive capital and preferred returns first.

Preferred Return and Carried Interest

- Carried interest incentivizes performance. It is earned only after LPs meet minimum return thresholds.

Fees and Costs in Private Equity Funds

Management Fees

- Management fees cover operating expenses. They usually range around 2% annually.

Performance Fees (Carried Interest)

- Carried interest aligns GP incentives with investor returns.

Other Fund-Level Expenses

- Additional costs include transaction and monitoring fees. Transparency has improved through ILPA standards.

Risks Involved in How Private Equity Funds Work

Liquidity Risk

- Illiquidity limits flexibility. Investors must commit for long periods.

Leverage and Financial Risk

- Debt magnifies both gains and losses. Risk management is essential.

Valuation and Transparency Risk

- Private valuations rely on assumptions. Independent audits mitigate but do not eliminate risk.

Conclusion

Understanding how Private Equity Funds work is essential for investors considering private market exposure. From capital commitments and operational value creation to disciplined exits and return distribution, private equity follows a structured yet complex process. While private equity is not suitable for all investors, those with long-term horizons, adequate liquidity, and a tolerance for complexity may benefit from its diversification potential and return characteristics. Ultimately, informed decision-making—grounded in transparency, realistic expectations, and professional advice—is the foundation of successful private equity investing.