Among reversal candlestick patterns, the Abandoned baby candlestick is one of the most commonly seen and highly reliable formations. Therefore, investors who follow technical analysis need to understand it thoroughly and use it proficiently. Today, Tipstrade.org will share the key characteristics of this candlestick pattern with investors.

What is an abandoned baby candlestick?

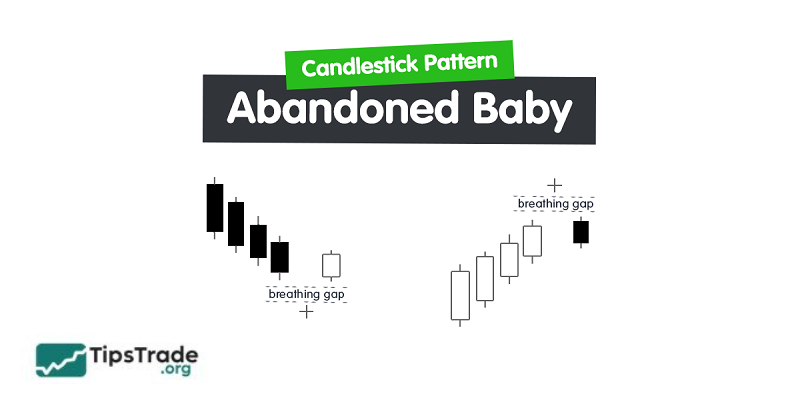

Abandoned baby candlestick is an extremely rare yet highly reliable Japanese candlestick reversal pattern. It consists of a cluster of three candlesticks and typically appears after a strong uptrend or downtrend, signaling exhaustion of the current market side and a powerful emergence of the opposing side.

The most distinctive feature that sets the Abandoned Baby apart from other patterns is the price gap between the first candlestick and the Doji, as well as the gap between the Doji and the third candlestick.

See more:

- How to Trade with the Piercing Candlestick Pattern Effectively

- Three Black Crows Candlestick – What It Is And How To Trade It

- Three White Soldiers Candlestick Pattern – Opening Profit Opportunities for Investors

- Dark Cloud Cover Candlestick and Profitable Trading Strategies Every Investor Should Know!

How to identify the abandoned baby candlestick?

To avoid confusion with the Morning Star or Evening Star patterns, a valid abandoned baby candlestick must meet the following conditions:

- Candle 1: A large candlestick moving in the direction of the prevailing trend (a strong decline or a strong rise).

- Candle 2 (Doji): A Doji candlestick indicating extreme indecision. Notably, the Doji’s shadows must not touch the shadows of Candle 1 or Candle 3.

- Candle 3: A large candlestick moving in the opposite direction to Candle 1.

- Gaps: There must be two clear price gaps, creating the impression that the Doji candlestick is completely “abandoned” on the chart.

Classification of the abandoned baby candlestick

This pattern is divided into two main types depending on where it appears:

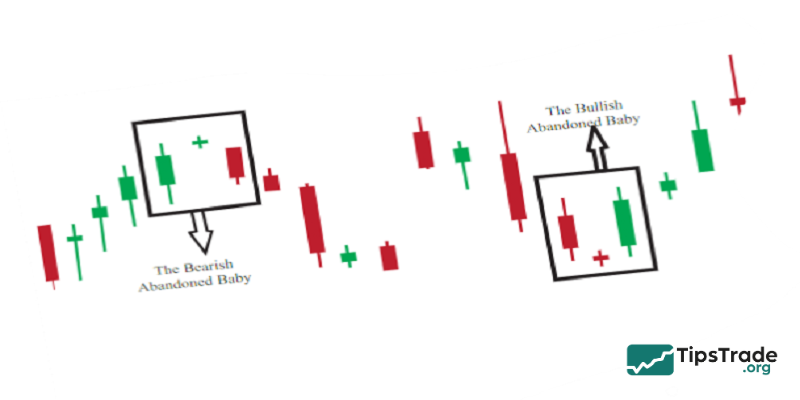

Bullish abandoned baby candlestick

- The bullish abandoned baby candlestick signals reversal to an uptrend and is used by the traders to enter a buy position.

- It is formed at the end of a downtrend and is composed of three candlesticks.

- The first candlestick is a large bearish candle that is followed by a Doji candle that gaps down.

- The third candlestick opens higher than the Doji and is usually a bullish candle.

- After the formation of this pattern, traders expect that the price will continue to move up and bulls are back into action.

Bearish abandoned baby candlestick

- The bearish abandoned baby candlestick signals reversal to the downtrend and is used by the traders to exit a buy position and enter a short position.

- It is formed at the end of an uptrend and is composed of three candlesticks.

- The first candlestick is a large bullish candle that is followed by a Doji candle that gaps up.

- The third candlestick opens lower than the Doji and is usually a bearish candle.

- After the formation of this pattern, traders expect that the price will continue to move down and bears are back into action.

Distinguishing between the Abandoned baby and Morning/Evening star candlesticks

Many traders confuse these patterns with one another. Below is a quick comparison table:

| Feature | Abandoned Baby | Morning / Evening Star |

|---|---|---|

| Rarity | Very rare | Common |

| Gap | A gap is mandatory on both sides of the Doji | May or may not have a gap |

| Reliability | Very high (Extremely strong) | Medium – High |

| Candle shadows | Do not overlap | Often overlap |

Practical trading strategy using the abandoned baby candlestick

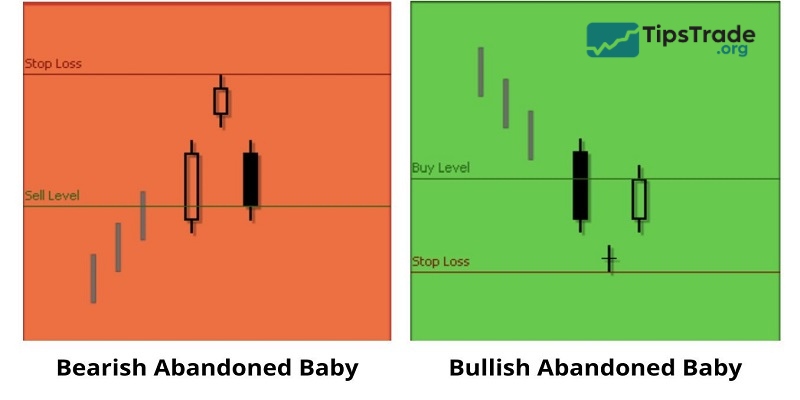

Based on the illustrated trade examples, below is a 3-step process for entering trades:

Step 1: Signal confirmation

Do not rush into a trade as soon as you spot the Doji. Wait for the third candlestick to close completely. If Candle 3 closes above 50% of Candle 1 (for a Bullish setup) or below 50% of Candle 1 (for a Bearish setup), the signal is considered confirmed.

Step 2: Entry point

- Open position: Enter the trade at the closing price of the third candlestick, or wait for a minor pullback (retest) into the gap area.

- Stop Loss: Place the stop loss below the low of the Doji (for Buy orders) or above the high of the Doji (for Sell orders) by approximately 2–5 pips.

Step 3: Take profit

Set take profit at the nearest support/resistance levels, or apply a minimum risk-to-reward ratio (R:R) of 1:2.

Some tips for trading with the abandoned baby candlestick to achieve maximum effectiveness

- Timeframes: This pattern is most reliable on the H4, Daily, or Weekly timeframes. On lower timeframes such as M5 or M15, it is more prone to noise caused by false price fluctuations.

- Volume: If the third candlestick is accompanied by a surge in trading volume, the probability of a reversal can exceed 80%.

- Indicator confluence: Combine the pattern with indicators such as RSI (to check overbought/oversold conditions) or MACD to further strengthen the trade setup.

Conclusion

The Abandoned baby candlestick pattern is a powerful “weapon” for any trader who is patient enough to wait for its appearance. However, no pattern is absolute, so always adhere to sound risk and money management principles. Wishing all traders great success!

See more: