Decentralized market represents a new paradigm in trading and financial systems where control is distributed across many participants rather than centralized entities. Decentralized market offers greater transparency, security, and resistance to censorship, enabling peer-to-peer transactions without relying on intermediaries. Through this article, let’s explore in detail with tipstrade.org the fundamental concepts, advantages, and real-world applications of decentralized markets, helping readers grasp their growing importance in the modern economy.

What is a Decentralized Market?

Definition and Core Principles

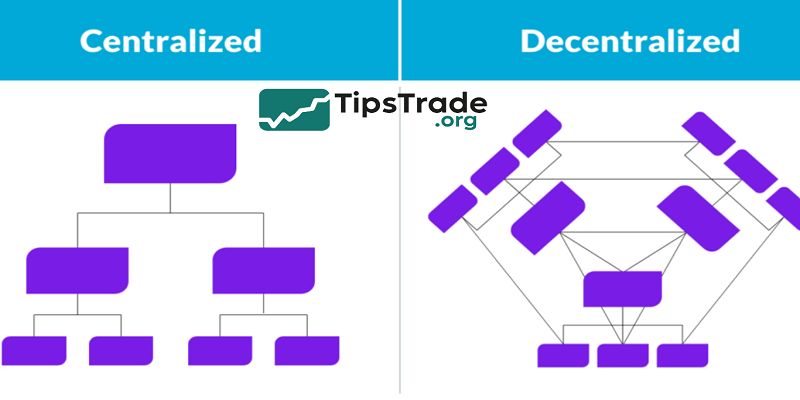

A decentralized market is a trading system where buyers and sellers interact directly through distributed networks instead of a centralized exchange.

In traditional markets, a bank, broker, or institution processes trades. In decentralized markets, transactions occur via blockchain technology and are often automated by smart contracts.

Core principles include:

- No central authority – control is spread across users.

- Peer-to-peer transactions – participants connect directly.

- Blockchain transparency – every trade is verifiable on-chain.

- User ownership – traders maintain control of their digital assets.

This structure creates markets that are often more transparent, global, and resistant to censorship.

As Investopedia explains, the foreign exchange (Forex) market is historically one of the largest decentralized markets, operating 24/7 globally.

Today, blockchain-powered markets are expanding this model into finance, art, and services.

>>See more:

- What is Forex? The Complete Guide for Beginners

- What are exchange rates? How to read and analyze rates in Forex

- Top 10 best forex currency pairs to trade in 2025

- Essential Forex Orders every trader must know

- What is forex trading? A detailed guide to forex trading from A – Z

How Decentralized Markets Work

Decentralized markets function through peer-to-peer networks and blockchain protocols. Instead of relying on a central entity to match orders, the system uses smart contracts—self-executing programs stored on the blockchain that automatically enforce trade rules.

Here’s how it works in practice:

- A user connects a digital wallet (e.g., MetaMask).

- They interact with a decentralized application (dApp) like Uniswap.

- The smart contract executes the trade between two users.

- The blockchain records the transaction, making it transparent and immutable.

This model is commonly seen in Decentralized Exchanges (DEXs), where liquidity pools replace traditional order books.

Instead of banks acting as custodians, users retain full control of their funds. This enhances security but also shifts responsibility to the individual.

For beginners, it’s helpful to think of decentralized markets as “financial apps without banks.” They combine open-source code, blockchain records, and user-driven governance.

Key Features of Decentralized Markets

Decentralized markets stand out from centralized systems due to unique features:

- No Central Authority – Decision-making and validation are distributed across networks.

- Transparency & Security – Every trade is permanently recorded on a blockchain, making manipulation difficult.

- Peer-to-Peer Transactions – No need for banks, brokers, or escrow services.

- Global Accessibility – Anyone with internet access can participate, regardless of geography.

- Lower Costs – Eliminating middlemen reduces transaction fees.

Example: Ethereum-based DEXs like Uniswap have higher fees due to gas costs, while PancakeSwap on Binance Smart Chain offers cheaper transactions.

These features align with the growing demand for financial inclusion and open global markets, giving users direct access to trading without institutional barriers.

Key Features of Decentralized Markets

Decentralized Finance (DeFi)

DeFi replicates traditional banking services in a decentralized way. Instead of banks, users interact directly with smart contracts. Key use cases include:

- Lending & Borrowing – Platforms like Aave and Compound allow users to earn interest or take crypto loans.

- Staking & Yield Farming – Locking tokens to secure networks while earning rewards.

- Derivatives & Insurance – Tools for hedging risks and protecting against smart contract failures.

DeFi has grown rapidly, surpassing $50 billion in Total Value Locked (TVL) in 2023 (DeFiLlama). This reflects its adoption as an alternative to traditional finance.

Decentralized Exchanges (DEXs)

DEXs are a key type of decentralized market. Unlike centralized exchanges (CEXs) like Binance or Coinbase, DEXs allow non-custodial trading—users keep control of their private keys.

Examples:

- Uniswap (Ethereum) – A pioneer in Automated Market Makers (AMMs).

- PancakeSwap (BSC) – Popular for lower fees and fast transactions.

- dYdX – Focused on derivatives trading.

Advantages:

- Censorship resistance.

- Thousands of tradable tokens.

- Transparent liquidity pools.

Challenges:

- High gas fees (Ethereum).

- Risk of low-liquidity tokens.

- User complexity for beginners.

Decentralized Marketplaces for Goods & Services

Beyond finance, decentralized markets extend to eCommerce and services. OpenBazaar, for example, experimented with peer-to-peer digital marketplaces. While adoption was limited, these platforms demonstrate potential for:

- Freelance services

- Digital goods

- Global trade without intermediaries

Payments are often made in cryptocurrencies, making transactions borderless but requiring users to understand crypto wallets.

NFT Marketplaces

NFT marketplaces are another form of decentralized markets. Platforms like OpenSea, Blur, and Rarible enable creators to sell directly to buyers, bypassing galleries or auction houses.

Key benefits:

- Artists keep more profits.

- Buyers gain verifiable ownership via blockchain.

- Secondary sales can pay royalties automatically through smart contracts.

NFT marketplaces illustrate how decentralization can reshape industries beyond finance, including art, music, and entertainment.

Advantages of Decentralized Markets

Decentralized markets provide significant benefits:

- Data Security – Users control their own assets, reducing custodial risk.

- Transparency – Blockchain ensures every transaction is visible and auditable.

- Elimination of Intermediaries – Cuts costs and delays.

- User Ownership – Participants have direct control of funds and assets.

- Global Reach – Markets operate 24/7, accessible worldwide.

Table: Benefits at a Glance

| Benefit | Centralized Markets | Decentralized Markets |

| Control | Held by exchanges/banks | Held by users |

| Transparency | Limited | Full (on-chain) |

| Costs | Higher fees | Lower fees |

| Accessibility | Region-specific | Global, 24/7 |

These advantages explain why decentralized markets are seen as the future of finance.

Challenges and Risks

Despite benefits, decentralized markets face challenges:

- Scalability Issues – Blockchains like Ethereum face congestion and high fees.

- User Experience – Complex interfaces and steep learning curves.

- Security Risks – Smart contracts may contain bugs or vulnerabilities exploited by hackers.

- Regulatory Uncertainty – Many governments are still defining legal frameworks.

- Liquidity Problems – Low user participation can cause slippage and volatility.

Real-world example: In 2022, hackers exploited vulnerabilities in DeFi protocols, causing billions in losses (Chainalysis report). This highlights the importance of careful security audits and user awareness

Decentralized Markets vs Centralized Markets

A direct comparison helps beginners understand differences:

| Aspect | Centralized Market | Decentralized Market |

| Authority | Controlled by an institution | Distributed across users |

| Security | Custodial, risk of hacks | Non-custodial, but user-responsible |

| Transparency | Limited | Full blockchain records |

| Costs | Fees, commissions | Lower, but network gas fees |

| Accessibility | Restricted by geography/regulation | Global, open access |

While centralized markets provide convenience and customer support, decentralized markets prioritize independence, transparency, and control.

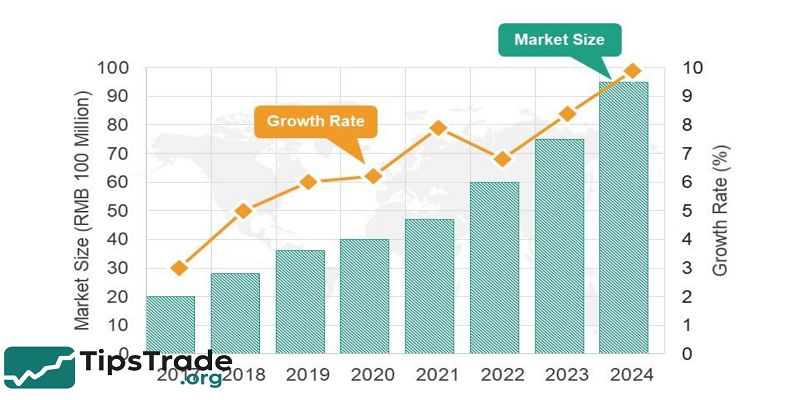

Market Size, Trends & Growth Forecast

- According to Grand View Research (2024), the global decentralized finance market is projected to expand at over 40% CAGR.

- Regions such as North America and Asia-Pacific are driving adoption.

- Emerging trends:

- Real-world asset tokenization (RWA)

- Decentralized Physical Infrastructure Networks (DePIN)

- Integration with traditional finance (TradFi)

- Real-world asset tokenization (RWA)

The future may see decentralized markets expand into real estate, supply chain management, and eCommerce.

How to Get Started with Decentralized Markets

Setting Up a Digital Wallet

A digital wallet is essential. Options include:

- Hot wallets (MetaMask, Trust Wallet) – convenient but online.

- Cold wallets (Ledger, Trezor) – hardware devices offering higher security.

Choosing a Reliable DEX or Marketplace

Key factors to consider:

- Reputation & audits

- Transaction fees

- Liquidity & trading volume

- Community support

Understanding Risks Before Trading

New users must understand:

- Volatility

- Smart contract risks

- Impermanent loss in liquidity pools

- Phishing scams

Security Best Practices

- Use hardware wallets for large amounts.

- Enable two-factor authentication.

- Verify URLs to avoid fake dApps.

- Never share private keys.

Conclude

Decentralized market is a system where buyers and sellers trade directly with each other without relying on a central authority or intermediary. Decentralized market operates through digital technology, such as blockchain, which ensures transparent, secure, and immutable transactions. This market structure eliminates middlemen, reduces transaction costs, and empowers users with greater control over their trades.