Forex capital management is one of the extremely important skills for traders to optimize profits and minimize the risk of losses. Ineffective forex capital management can lead to many troubles in investing. So how can you manage forex capital most effectively? Let’s explore this issue together with Tipstrade.org through the shared article below.

What is forex capital management?

Forex capital management, in essence, is the act of wisely controlling your working capital, combined with the application of strict risk management principles. However, the unfortunate reality is that many new traders often underestimate the importance of capital management. They get caught up in chasing technical indicators and complex price patterns, forgetting that the foundation of all success in trading is capital preservation.

Before thinking about profit, a professional trader always asks themselves: “What level of risk am I accepting for this trade?”. Instead of focusing on rosy scenarios about potential profits, they are always clearly aware of the possible losses. That is the secret to surviving and winning in this challenging Forex market.

Remember that forex capital management is not just a technique; it is also an art that requires continuous training and discipline. By managing capital effectively, you will be more confident in every trading decision, minimize risks, and gradually conquer new heights in the financial market.

>>See more:

- What is Forex? The Complete Guide for Beginners

- Forex Trading Hours – The Ultimate Beginner’s Guide

- Essential Forex Orders every trader must know

- Forex spread: How It Affects Your Trading Costs and Profitability

The importance of forex capital management

Forex is a highly volatile market, where risk always accompanies opportunity. Therefore, effective forex capital management will help you:

- Protect your account: Minimize the possibility of losing all your capital when facing a series of losing trades.

- Optimize profits: Help you maintain stable profits and take advantage of opportunities when the market is favorable.

- Reduce psychological pressure: When capital is well managed, you will be more confident and avoid impulsive trading decisions.

Key principles of effective forex capital management

Here are some principles in forex capital management that we need to implement:

Principle 1: Do not invest beyond your financial capacity

Investing beyond personal financial limits can lead to serious financial risks, especially in volatile markets like Forex. A smart investor will determine in advance a safe amount to invest, ensuring that this amount does not affect other basic financial needs of the family and individual. This helps them maintain stability even when the market moves unfavorably.

>>See more:

- What is forex trading? A detailed guide to forex trading from A – Z

- What is Forex Technical Analysis and How Important is it?

- Forex strategy: Top 10 most effective strategies for beginners

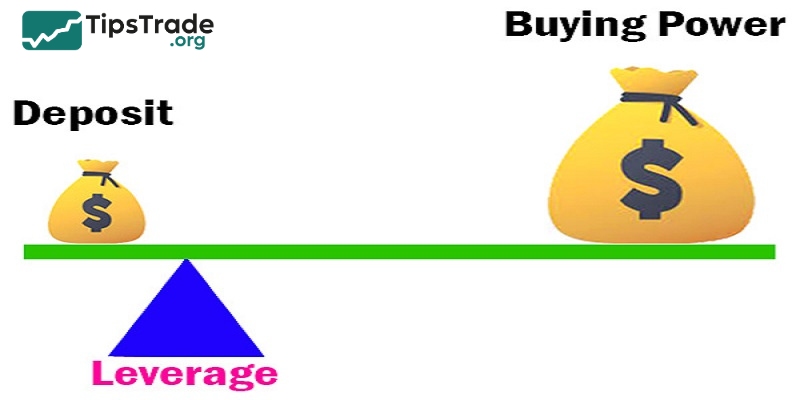

Principle 2: Use leverage cautiously

In Forex, leverage can significantly increase profit potential but also raises the level of risk. Using leverage cautiously means that investors should choose a level of leverage that is appropriate for their experience and risk tolerance. Thoroughly assessing the level of risk and not relying too much on borrowed capital will help minimize the risk of serious losses.

Principle 3: Diversifying the investment portfolio

Diversification is not limited to Forex but also includes other types of investments such as stocks, bonds, and commodities to minimize risk. Diversification helps spread risk and reduces dependence on any single asset or market. A wise investor will choose to invest in different types of assets based on thorough analysis and investment strategy.

Principle 4: Set stop-loss and take-profit levels

Setting stop-loss and take-profit orders are important tools to protect capital and profits. A stop-loss order helps limit losses to an acceptable level, while a take-profit order ensures that investors can realize profits when their target is achieved. The combination of these two orders helps manage risk and optimize profits.

These principles are essential for anyone who wants to manage capital effectively in the Forex market. By strictly adhering to the above principles, investors can protect and grow their capital in a high-risk investment environment.

Effective Forex capital management techniques

In Forex trading, applying effective capital management techniques is extremely important to maximize profits and minimize risks. Below are some specific methods and tools that traders can use in their capital management strategies:

Build a detailed trading plan

A detailed trading plan includes rules that determine when to buy, sell, the size of each trade, and withdrawal conditions. This plan should be established before executing any trades and must be based on thorough research, analysis, and a disciplined approach to maintain consistency and avoid investment decisions based on emotions.

Flexible capital management method

- The Martingale technique: This method involves doubling the size of the trade after each loss in order to recover what has been lost and earn a small profit when winning. However, this technique carries high risk as it can lead to depleting capital if a losing streak continues.

- Anti-Martingale Technique: Contrary to Martingale, this method encourages doubling the size of the trade after each win and reducing the size after each loss. This promotes taking advantage of favorable market trends and minimizes risk when the market is unfavorable.

Applying financial tools to protect capital

- Stop-loss and take-profit orders: These orders help automate the closing of trades, allowing traders to exit the market at their desired point. The stop-loss order prevents significant losses, while the take-profit order ensures that the desired profits are secured.

- Using options and futures to hedge risk: Options and futures contracts can be used as a means to insure against risk by locking in the future purchase or sale price of an asset. The use of these derivative instruments helps traders minimize the impact of unexpected price fluctuations.

By combining the techniques and tools mentioned above, traders can develop a comprehensive forex capital management strategy that effectively controls risk and enhances profit potential in the Forex market. Understanding and flexibly applying these techniques will be a key factor in helping traders achieve long-term success in this dynamic and challenging financial market.

Lessons on capital management in financial markets

Lessons on capital management in Forex, Crypto, and Stocks can provide insights into how investors have applied capital management principles to cope with market fluctuations. Below are three specific examples:

Forex capital management lesson: The event of Switzerland abandoning the fixed exchange rate of EUR/CHF (2015)

In January 2015, the Swiss National Bank (SNB) unexpectedly announced the abandonment of the fixed exchange rate between the Swiss franc (CHF) and the euro (EUR), a move that was not anticipated. The EUR/CHF exchange rate plummeted rapidly, from 1.20 to around 0.85 within minutes, causing significant volatility in the market.

Many investors have lost large sums of money due to not placing stop-loss orders, while those who apply strict risk management principles, especially those with automatic stop-loss orders, have been able to limit their losses. This event highlights the importance of having a proper risk plan and risk insurance.

The lesson of capital management in Crypto: The collapse of the Crypto market in early 2018

After a period of remarkable growth at the end of 2017, the price of Bitcoin and many other cryptocurrencies significantly declined at the beginning of 2018. Bitcoin, from a peak of nearly 20,000 USD, fell below 7,000 USD within a few months.

Investors with a clear plan and specific risk limits have been able to exit the market in a timely manner or at least minimize losses. Those who use methods such as portfolio diversification and have a capital management system have demonstrated resilience to volatility.

Lesson on Capital Management in the Stock Market: The Collapse of Lehman Brothers (2008)

The bankruptcy of Lehman Brothers in 2008 led to a global financial crisis. The stock prices of many companies plummeted, affecting millions of investors worldwide.

Investors who have applied the principle of broad portfolio diversification not only in stocks but also in other asset classes have been able to minimize losses compared to those who focused too much on the stocks of banks and financial companies. In particular, those with a systematic investment and capital management plan have effectively reduced risk.

The lessons above show that the systematic and proactive application of capital management can help investors withstand strong and unexpected market fluctuations, while also protecting capital and optimizing profit opportunities in different market conditions.

Tools and software to support forex capital management

In the modern investment world, using specialized tools and software to manage forex capital has become an indispensable part of every investor’s strategy. These tools not only help track and analyze investment capital effectively but also assist in decision-making, minimize risks, and optimize profits. Below are some popular tools and software widely used in the financial market:

Portfolio management software

- Morningstar Portfolio Manager: This software helps traders track and analyze the performance of their investment portfolios, providing detailed reports and risk assessments. Morningstar also offers evaluations of investments and recommendations on how to rebalance portfolios to optimize returns and manage risk.

- Personal Capital: This is a personal finance and investment portfolio management tool that integrates features for tracking assets, investments, and retirement planning, helping traders gain a comprehensive view of their finances.

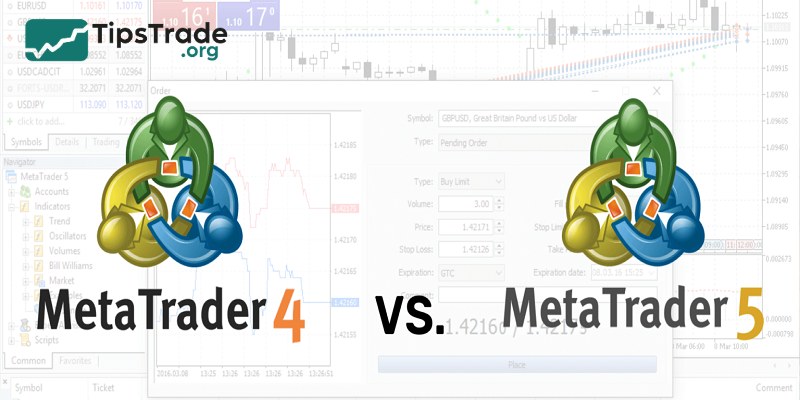

Technical analysis and risk management tools

- MetaTrader 4 and 5: These are the most popular trading platforms in the Forex and CFD community, providing powerful technical analysis tools, trading indicators, and the ability to automate trading through trading robots (Expert Advisors).

- TradingView: This platform provides interactive charts, technical analysis, and real-time market tracking. TradingView is a popular tool not only for individual traders but also for professional analysts.

Risk calculation and lot size tool

- Risk Management Calculator: Risk management calculators allow users to input total capital, desired risk percentage per trade, and expected stop loss to calculate the appropriate lot size for each trade, helping to ensure that traders do not risk too much capital on a specific trade.

- Myfxbook: An online tool that helps track, analyze, and share the performance of Forex trading accounts, as well as providing risk management tools.

Decision support and automation tools

- Interactive Brokers’ Trader Workstation (TWS): TWS offers a range of risk management and portfolio management tools, including features to control trading risk and automate order placement based on predefined criteria.

- Ally Invest: This platform provides trading automation tools and supports portfolio management, allowing traders to set stop-loss and take-profit orders, while automatically adjusting positions based on market changes.

These tools and software not only provide monitoring and analysis features but also help traders make more accurate decisions, enhancing capital management and risk control in an increasingly volatile investment environment.

Conclusion

Hopefully, through the article above, you have learned the most effective way to manage forex capital. Forex capital management is an essential skill that you need to master before starting to trade. To minimize risks and maximize profits, you should build a complete trading system and a reasonable capital management plan, as well as adhere to the principles you have set. Tipstrade.org wishes all traders success!