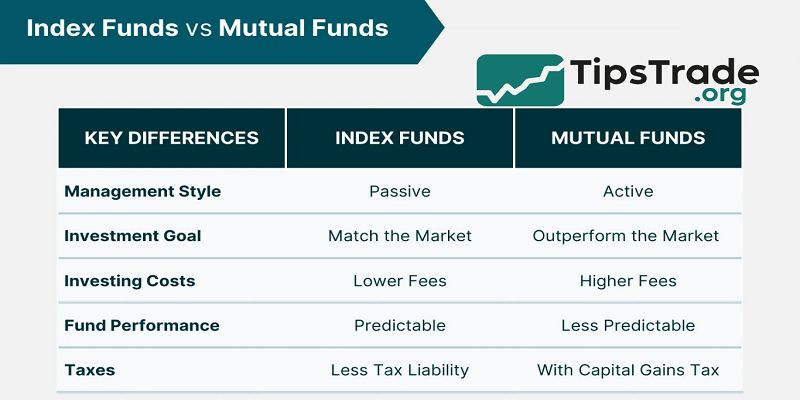

Index Funds vs Mutual Funds reveals key differences that can shape your investment strategy, with index funds offering passive, low-cost tracking of market benchmarks and mutual funds relying on active management by professionals. Index funds like Vanguard’s VTI shine with minimal fees and broad diversification, often outperforming mutual funds over time due to lower expenses. Mutual funds, however, aim to beat the market through stock picking but frequently underperform after fees. Explore the detailed article at Tipstrade.org to be more confident when making important trading decisions.

What Are Mutual Funds?

Mutual funds are pooled investment vehicles that collect money from many investors to buy a diversified portfolio of securities. Most traditional mutual funds are actively managed, meaning professional fund managers make decisions about which assets to buy, hold, or sell.

From a practical perspective, mutual funds appeal to investors who prefer professional oversight. In many retirement plans and bank-sponsored investment platforms, actively managed mutual funds remain the default option.

According to data from the Investment Company Institute (ICI), mutual funds have been a cornerstone of retail investing for decades, particularly in employer-sponsored retirement accounts. However, performance outcomes vary widely depending on management quality, fees, and market conditions.

See more

- Top Index Funds to Consider for Long-Term Investing

- Risks in Index Funds: What Every Investor Should Understand

- Active vs Passive Index Funds: Which Investment Strategy Makes More Sense?

- SEC Index Funds Regulations: A Complete Guide for Investors

How Mutual Funds Work

Mutual funds typically trade once per day at their net asset value (NAV), calculated after market close. Investors buy or sell shares directly through the fund company or a brokerage.

Key operational features include:

- Professional portfolio management

- Regular rebalancing and security selection

- Potential capital gains distributions

Because managers actively trade holdings, turnover can be high. In portfolio reviews, this often leads to unexpected tax consequences for taxable accounts. While active managers aim to outperform benchmarks, success depends on timing, research, and consistency.

Types of Mutual Funds

Not all mutual funds are the same. They are categorized by asset class, strategy, and risk profile.

Common types include:

- Equity mutual funds (large-cap, small-cap, growth, value)

- Bond mutual funds

- Balanced or allocation funds

- Sector-specific mutual funds

Some mutual funds follow a passive strategy, but the majority marketed to retail investors remain actively managed. Understanding the underlying strategy is more important than the fund label itself.

What Are Index Funds?

Index funds are investment funds designed to track a specific market index, such as the S&P 500 or a total bond market index. Instead of trying to beat the market, index funds aim to match market performance at the lowest possible cost.

In many long-term portfolio case studies, index funds are used as the core holding due to their simplicity and reliability. Investors are not betting on manager skill, but on the long-term growth of the overall market.

Research from Vanguard and Morningstar consistently shows that index funds have gained market share over the past two decades, largely due to cost efficiency and performance consistency.

How Index Funds Work

Index funds follow predefined rules set by the index provider. The fund automatically holds securities in proportions that closely mirror the index.

Key characteristics include:

- Rule-based investing

- Low turnover

- Minimal decision-making

Because trades occur mainly when the index changes, transaction costs remain low. From an investor behavior standpoint, this structure reduces emotional reactions during market volatility, which research shows improves long-term outcomes.

Index Funds as Mutual Funds or ETFs

Index funds can exist as:

-

- Index mutual funds

- Index ETFs (exchange-traded funds)

While both track the same index, ETFs trade intraday like stocks, whereas index mutual funds transact once per day. For long-term investors, the performance difference is usually minimal, but tax efficiency and flexibility may differ.

Index Funds vs Mutual Funds: Core Differences

Although index funds are technically a subset of mutual funds, investors often compare passive index funds vs actively managed mutual funds. The differences are most apparent in management style, cost, and predictability.

Passive vs Active

- Active mutual funds rely on manager expertise to select securities and time trades. Index funds use a passive approach, tracking an index regardless of market conditions.

- In real-world performance studies, active management introduces manager risk, meaning results depend heavily on individual decisions. Passive management removes this variable, offering consistent market exposure instead.

Performance Over Time

- Multiple long-term studies, including SPIVA scorecards, show that most actively managed mutual funds underperform their benchmarks over 10–20 years, especially after fees.

- Index funds, by design, deliver benchmark returns minus a small expense ratio. While they never “beat” the market, they also rarely lag significantly.

- For investors focused on long-term wealth accumulation, consistency often matters more than short-term outperformance.

Index Funds vs Mutual Funds

Costs are one of the most critical and controllable factors in investing.

Expense Ratios and Operating Costs

Actively managed mutual funds often charge expense ratios between 0.60% and 1.25% annually, while many index funds charge less than 0.10%.

Higher fees cover:

- Research teams

- Portfolio management

- Trading activity

According to Vanguard research, expense ratios are one of the strongest predictors of future performance. Lower costs increase the probability of matching or exceeding peer returns over time.

Impact of Fees on Long-Term Returns

- A frequently cited example shows that a 1% difference in annual fees can reduce a portfolio’s ending value by tens of thousands of dollars over 30 years.

- This compounding effect disproportionately favors index funds for long-term investors.

Tax Efficiency Considerations

Taxes are often overlooked when comparing funds.

Capital Gains Distributions

Actively managed mutual funds may distribute capital gains annually due to frequent trading. These distributions can create tax liabilities even if investors did not sell shares.

Index funds generally:

- Have lower turnover

- Generate fewer taxable events

This makes index funds more tax-efficient, especially in taxable brokerage accounts.

Risk and Volatility Differences

Both fund types are exposed to market risk, but the source of risk differs.

Market Risk vs Manager Risk

- Index funds expose investors to market-wide movements. Mutual funds add manager risk on top of market risk.

- In downturns, some active managers reduce losses, but others perform worse than the market.

- According to Morningstar risk-adjusted return studies, passive funds often perform favorably across full market cycles.

Investor Experience and Behavioral Factors

Behavior plays a critical role in real-life investment outcomes.

Simplicity and Discipline

- Index funds require minimal decision-making, helping investors stay invested during volatile periods.

- Behavioral finance research shows that investors who trade less often tend to achieve better results.

Overconfidence and Fund Selection

- Choosing winning active funds requires confidence in manager selection.

- Many investors chase past performance, which academic studies link to underperformance.

When Mutual Funds May Make Sense

Despite the data favoring index funds, mutual funds still have a role.

Specialized Strategies and Niche Markets

Active mutual funds may perform better in:

- Small-cap stocks

- Emerging markets

- Specialized bond strategies

These areas may be less efficient and harder to replicate with indexes.

Hands-On Portfolio Management

- Some investors value professional oversight and are willing to pay higher fees for guidance, downside protection strategies, or income-focused approaches.

When Index Funds Are the Better Choice

For most long-term investors, index funds are often the default recommendation.

Long-Term Growth and Retirement Planning

Index funds are commonly used in retirement portfolios due to:

- Low cost

- Broad diversification

- Predictable performance

Studies show that long-term market participation, rather than manager selection, drives most investment success.

Beginners and DIY Investors

- For new investors, index funds reduce complexity and decision fatigue.

- This simplicity supports better investing habits and long-term discipline.

Index Funds vs Mutual Funds

Index Funds

- Passive management

- Very low fees

- High tax efficiency

- Market-matching returns

Actively Managed Mutual Funds

- Active security selection

- Higher fees

- Variable tax impact

- Potential (but unlikely) outperformance

Conclusion

Index Funds vs Mutual Funds ultimately favors index funds for most investors seeking reliable, cost-effective growth without the risks of active management. While mutual funds provide expert oversight, their higher fees and inconsistent results make index options like Fidelity’s FZROX the smarter choice for passive wealth building. Choose based on your goals—index for efficiency, mutual for potential alpha—but data shows index funds win for steady, compounded returns.