The Bearish Engulfing candlestick is usually formed after a prolonged price increase. It is a sign of exhaustion in buying pressure, and a reversal signal is about to occur. In today’s article, let’s explore the Bearish Engulfing candlestick in detail with Tipstrade.org!

What is the Bearish Engulfing candlestick?

The Bearish Engulfing candlestick is a candlestick pattern consisting of two opposite candles, in which the second candle completely engulfs the first one. It typically appears at the end of an uptrend and signals a potential reversal into a downtrend.

Related posts:

- What is a Bullish Engulfing candlestick and how to trade it?

- How to Trade with the Piercing Candlestick Pattern Effectively

- Spinning Top Candlestick and How to Apply It in Technical Analysis

- Shooting Star Candlestick Pattern: How to Identify and Trade It Effectively

How to identify the Bearish Engulfing candlestick

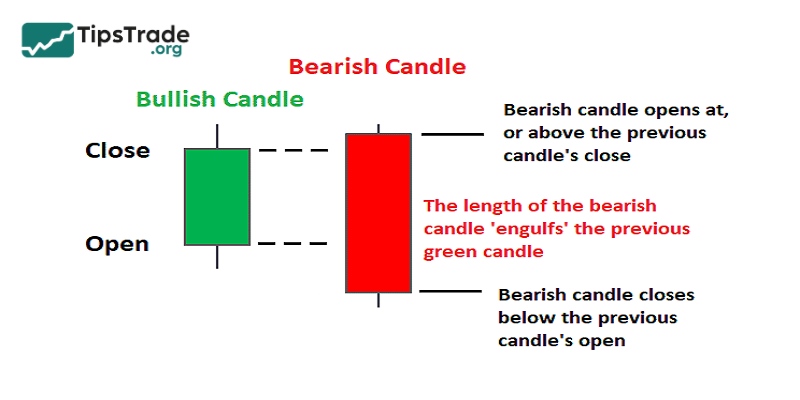

The Bearish Engulfing candlestick consists of two opposite candles and can be identified by the following characteristics:

- First candle: A bullish candle (green/yellow) with a small body, indicating a weakening of buying pressure.

- Second candle: A bearish candle (red/black) whose body completely engulfs the body of the first candle, showing a strong increase in selling pressure that overwhelms and negates the previous upward attempt.

Meaning of the Bearish Engulfing candlestick

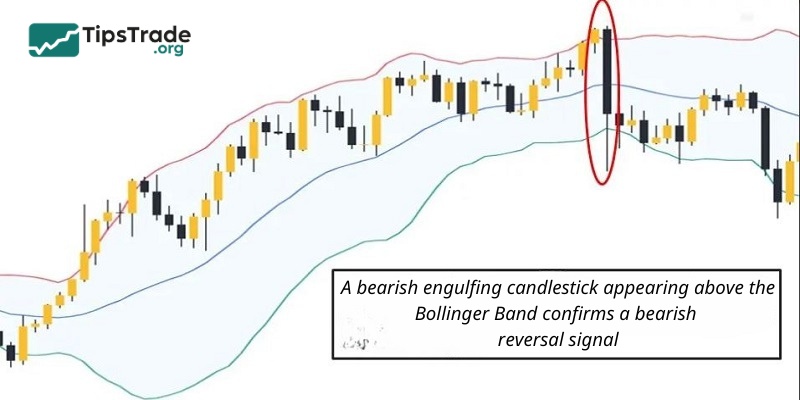

The Bearish Engulfing candlestick pattern signals a potential reversal from an uptrend to a downtrend. The strong bearish second candle reflects decisive dominance by sellers, indicating a shift in market sentiment from optimism to pessimism.

When the Bearish Engulfing pattern appears at a key resistance level and is accompanied by increased trading volume, the reliability of the reversal signal is further strengthened, creating favorable opportunities for traders to enter effective sell positions.

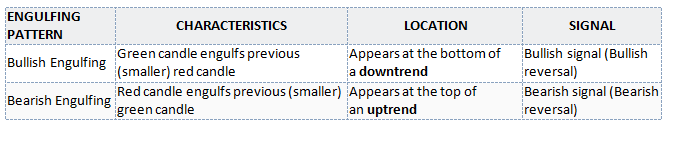

Difference between Bullish and Bearish Engulfing candlestick

Below is a summary of the main differences between the bullish and bearish engulfing candlestick:

How to trade with the Bearish Engulfing candlestick

Below are three ways to trade the Bearish Engulfing pattern without combining it with other technical indicators.

Method 1: Place a Sell Stop order immediately after the Bearish Engulfing pattern is completed

- Place the Sell Stop order slightly below the low of the bearish candle.

- Set the stop loss (SL) slightly above the high of the bearish candle to avoid being stopped out by false moves.

This is the safest approach, as it helps filter out false signals when the price has not yet moved decisively downward.

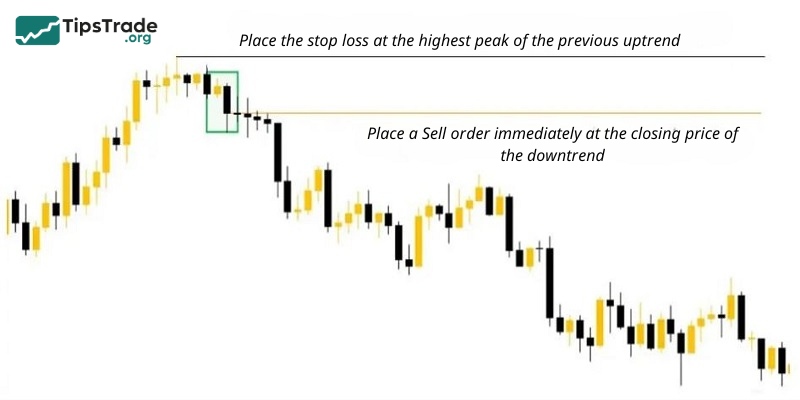

Method 2: Place a Sell order immediately after the Bearish Engulfing pattern is completed

- Enter a Sell order at the closing price of the bearish candle.

- Set the stop loss (SL) above the high of the bearish candle in the Bearish Engulfing pattern, or at the previous swing high, to protect the account if the market moves against the position.

This method allows traders to enter the market immediately after the pattern is confirmed, enabling them to quickly capitalize on the emerging downtrend.

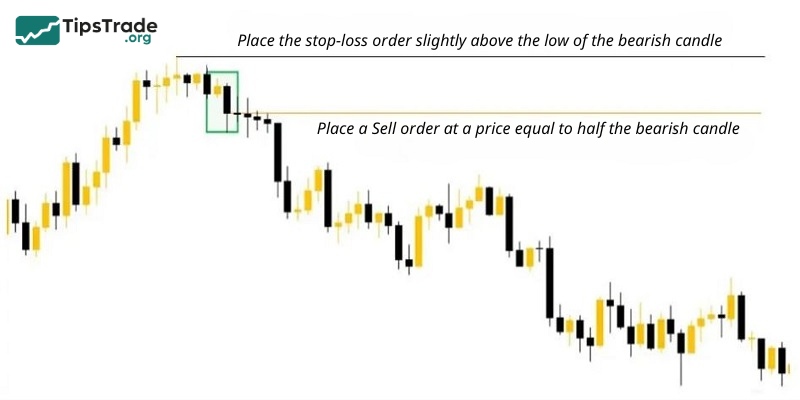

Method 3: Place a Sell Limit order

- Place a Sell Limit order at a level where you expect the price to reverse downward after a pullback. You can set the order around the midpoint of the bearish candle in the pattern.

- Set the stop loss (SL) at the highest point of the bearish candle’s wick or at the nearest resistance zone.

This approach allows traders to enter at a better price, increasing potential profit if the price retraces as expected before continuing downward.

Take-profit (TP) levels can be determined as follows:

- Taking profit at support levels: Traders often set take-profit targets at support zones, as prices tend to reverse or experience upward corrections at these levels.

- Taking profit based on the risk–reward ratio: First, define the stop-loss level, then set a take-profit target at a price that achieves a risk–reward ratio of 1:2 or 1:3.

Example of how to enter a trade with the Bearish Engulfing candlestick

Below is a specific example of how to place a BTC/USDT trade when the Bearish Engulfing candlestick pattern appears on the chart.

After the pattern is completed, you can apply the Sell Stop strategy to trade the Bearish Engulfing pattern.

- Place a Sell Stop order at 66,433 USDT, slightly below the low of the second candle, to ensure that the trade is only triggered once the downtrend is confirmed.

- Set the Stop Loss slightly above the second candle at 70,152 USDT to protect your capital.

- Set Take Profit targets at key support levels, around 60,260 USDT and 55,825 USDT.

Notes when trading the Bearish Engulfing candlestick

To trade effectively with the Bearish Engulfing candlestick pattern, traders should keep the following points in mind:

- Trading volume: The signal is stronger if the second bearish candle is accompanied by high trading volume. This indicates seller dominance and confirms the potential for further price decline.

- Trading position: The Bearish Engulfing pattern is most meaningful when it appears at resistance zones or after a strong upward move, where selling pressure is more likely to increase.

- Combining with other technical indicators: Traders should not rely solely on the Bearish Engulfing pattern to enter trades immediately. Confirming the signal with additional indicators such as RSI or MACD can help improve reliability.

- Risk management: Always set a clear stop-loss level, typically above the high of the Bearish Engulfing candle, to protect capital in case the market moves against the trade.

Final word

In this article, we have explored the bearish engulfing candlestick. Tipstrade.org has presented to you what the Bearish Engulfing candlestick is, how to identify it, and provided some examples of trading strategies. We hope that this article will help you build an effective trading strategy.

See more:

- How to Use the Hammer Candlestick for the Most Effective Trading

- What is the Tweezer candlestick pattern? Characteristics and how to identify it

- Marubozu Candlestick: A Detailed Guide to Identification and Effective Trading

- What is a Doji candlestick pattern? Common Doji candlestick patterns in investing