The Shooting Star candlestick is a popular reversal candlestick pattern in technical analysis when trading stocks, forex, and cryptocurrencies. This candlestick pattern helps investors identify potential reversal points to optimize profits and minimize risks. In this article, we invite you to explore with Tipstrade.org how to identify and trade the Shooting Star candlestick pattern in trading effectively.

What is a Shooting Star candlestick pattern?

The Shooting Star candlestick is a single-candle pattern that typically appears at the end of an uptrend. It is named “Shooting Star” because its shape resembles a star falling from the sky, signaling that the market may be preparing to cool down.

The appearance of a Shooting Star provides a strong signal that buying momentum is weakening while selling pressure is starting to dominate. During the trading session, prices are pushed higher by strong buying interest; however, subsequent selling pressure forces the price to close near the session’s low. This behavior reflects a rejection of higher prices and suggests a potential bearish reversal in the following sessions.

This candlestick pattern is considered one of the most useful tools for identifying the peak of an uptrend, especially when combined with other technical indicators such as support and resistance levels, RSI, and MACD.

See more:

- How to Use the Hammer Candlestick for the Most Effective Trading

- What is a Doji candlestick pattern? Common Doji candlestick patterns in investing

- What is price action? A complete guide to price action trading from basics to advanced

Characteristics of identifying a Shooting Star candlestick

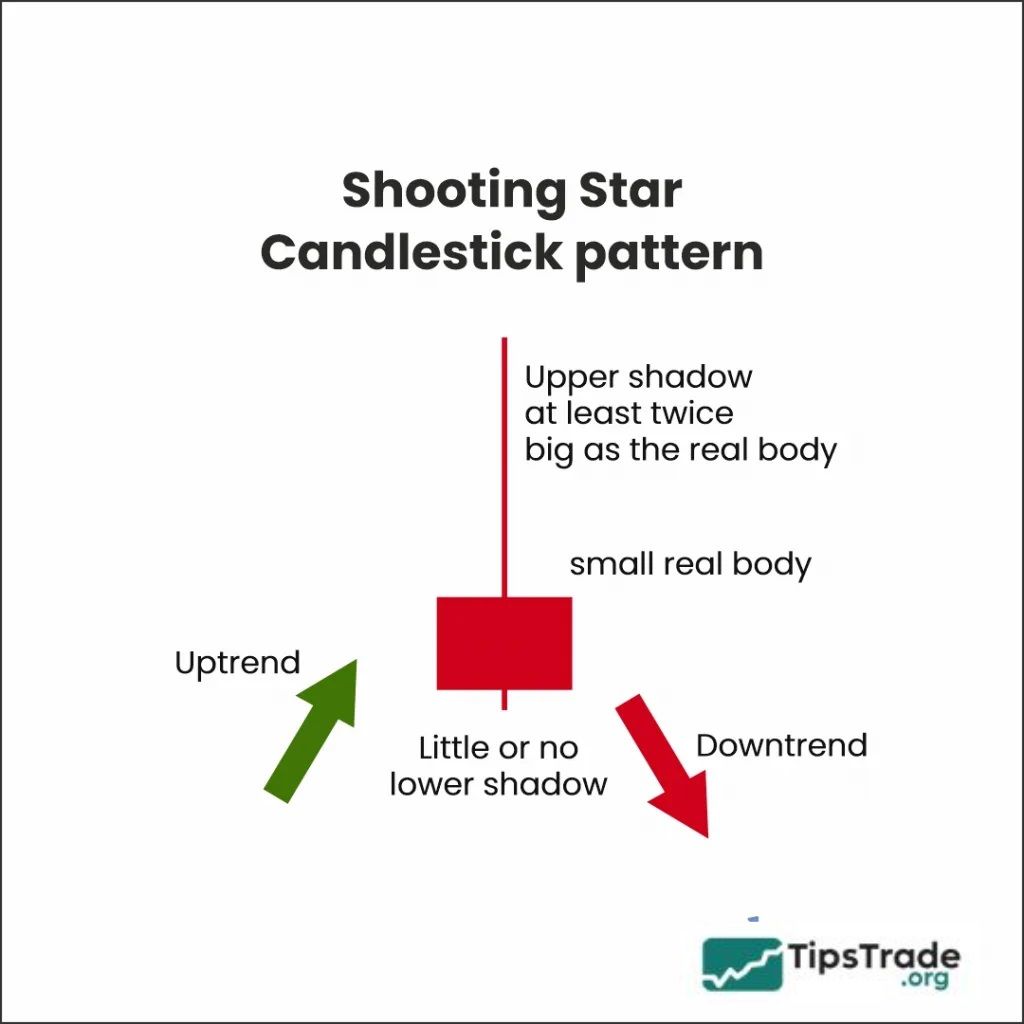

To identify a Shooting Star candlestick, you can rely on the following key features:

- Appears at the end of an uptrend: The Shooting Star is considered highly reliable only when it forms at the end of a clear uptrend. This indicates that buying momentum is weakening while selling pressure is starting to increase, potentially leading to a market reversal.

- Long upper shadow: The upper shadow of a Shooting Star is typically two to three times longer than the candlestick body, showing that buyers attempted to push prices higher but failed to sustain the upward momentum. Strong selling pressure emerged shortly afterward, driving the closing price down near the session’s low.

- Small real body: A small real body reflects initial indecision between buyers and sellers. However, as sellers gain dominance toward the end of the session, the price closes significantly lower than the peak, forming the characteristic shape of the pattern.

- Little or no lower shadow: A short or non-existent lower shadow indicates a lack of buying interest at lower price levels, suggesting that sellers were in full control by the end of the trading session.

Meaning of the Shooting Star candlestick in investing

When a Shooting Star candlestick appears, it may indicate the following signals:

- Signals increasing selling pressure: The long upper shadow clearly shows that the upward price momentum has stalled, even though buyers attempted to push prices to new highs. At the same time, strong selling pressure emerged and drove prices lower. This suggests that market sentiment is shifting against the buyers.

- Trend reversal signal: When formed at the peak of an uptrend, the Shooting Star serves as a warning sign that the bullish trend may be about to reverse. It can mark the beginning of a corrective phase or even signal the start of a prolonged downtrend.

- Supports trading decisions: Based on the signal provided by the Shooting Star candlestick, investors may choose to exit long positions or open short positions, helping to optimize profits when the market shows clear signs of a trend reversal.

How to trade with the Shooting Star candlestick effectively

The Shooting Star candlestick is a powerful indicator signaling that the market may be about to reverse from an uptrend to a downtrend. However, to trade this pattern more effectively, investors should combine it with other analytical tools and apply proper order management.

Combine the Shooting Star candlestick with other analytical tools

To make the signal from the Shooting Star candlestick more reliable, it should be combined with other indicators such as resistance levels, technical indicators, or trading volume:

- Resistance levels: A Shooting Star forming at strong resistance levels carries a higher probability of a trend reversal.

- Technical indicators: Indicators such as RSI, MACD, or Stochastic can help confirm overbought conditions or bearish divergence.

- Trading volume: If trading volume increases significantly during the formation of the candlestick, the reversal signal becomes more reliable.

Set trading orders properly

- Sell order (short): Place a sell order just below the low of the Shooting Star candlestick to take advantage of the bearish signal.

- Stop loss: Set the stop-loss level above the high of the upper shadow to limit risk in case the signal fails.

- Take profit: Place take-profit targets at support levels or use a reasonable risk/reward ratio, such as 1:2 or 1:3.

Additionally, after the order is triggered, traders need to closely monitor the market. If the price moves in the desired direction, the stop-loss level can be moved closer to the entry point to protect profits.

Things to note when using Shooting Star candlestick

When applying the Shooting Star candlestick in trading, traders should keep the following points in mind:

- Do not trade based on a single candlestick: Signals from the Shooting Star candlestick need to be confirmed by other factors such as resistance levels, technical indicators, or larger price patterns. Relying solely on a Shooting Star can lead to inaccurate trading decisions.

- Understand the market context: The Shooting Star candlestick is more reliable when it appears in a clearly defined uptrend or at key price levels such as the top of a long-term trend. Conversely, this signal is less effective if it forms in the middle of an unclear or sideways market.

- Capital and risk management: Placing stop-loss orders and defining an appropriate risk/reward ratio are essential, even when the signal appears reliable, to minimize losses if the indicator proves inaccurate.

- Choose the appropriate timeframe: Signals from the Shooting Star candlestick are more reliable on higher timeframes such as H4 or D1. On lower timeframes, the signal may be distorted by random market fluctuations.

Conclusion

The Shooting Star candlestick is a strong reversal signal in technical analysis. However, to maximize its value, investors need to combine this candle with other analytical tools, understand the market context, and adhere to risk management principles. When used correctly, the Shooting Star candlestick will help investors identify potential reversal points, optimize profits, and minimize risks in trading.