Equity ETFs, or stock-based exchange-traded funds, have gained massive popularity among investors seeking diversification, liquidity, and cost efficiency. Unlike individual stocks or mutual funds, Equity ETFs allow investors to hold a basket of equities in a single trade. Experience insight: Many investors, including long-term Vanguard ETF holders, report that having a diversified ETF reduces portfolio volatility during market fluctuations. Explore the detailed article at Tipstrade.org to be more confident when making important trading decisions.

What Are Equity ETFs?

Definition and Characteristics of Equity ETFs

Equity ETFs are funds that track a basket of stocks, offering investors exposure to broad market indices, sectors, or specific themes.

Experience example: BlackRock’s iShares Core S&P 500 ETF allows investors to replicate the performance of the S&P 500 index with low cost and daily liquidity.

Expertise: Key characteristics include diversification, transparent holdings, tradability on exchanges, and typically lower expense ratios compared to actively managed mutual funds.

Investors benefit from instant portfolio diversification, reducing the risk associated with holding single stocks.

How Equity ETFs Differ from Other ETFs (Bond, Commodity, Sector ETFs)

Equity ETFs differ primarily in asset composition. While bond ETFs invest in fixed income instruments and commodity ETFs track physical commodities, Equity ETFs invest in shares of companies.

Experience insight: A financial advisor noted that clients prefer Equity ETFs for long-term growth, while bond ETFs are better suited for income generation.

Expertise: Equity ETFs may track broad indices, sectors, or international markets, offering flexibility and market exposure that other ETF types cannot provide.

See more:

- Active vs Passive Mutual Funds — A Comprehensive Guide for Investors

- Mutual Funds Report — A Comprehensive Guide for Investors

- Mutual Funds Fees — A Complete Guide for Investors

- Mutual Funds Manager — A Complete Guide for Beginners

Role of Equity ETFs in Portfolio Diversification

Equity ETFs help investors spread risk across multiple companies and sectors. By holding a single ETF, investors gain exposure to dozens or hundreds of stocks.

Experience example: A small-cap equity ETF provided exposure to emerging tech companies, mitigating the risk of over-concentration in a single stock.

Expertise: According to Vanguard, including Equity ETFs in a portfolio can reduce volatility while maintaining potential for growth, making them a key tool in strategic asset allocation.

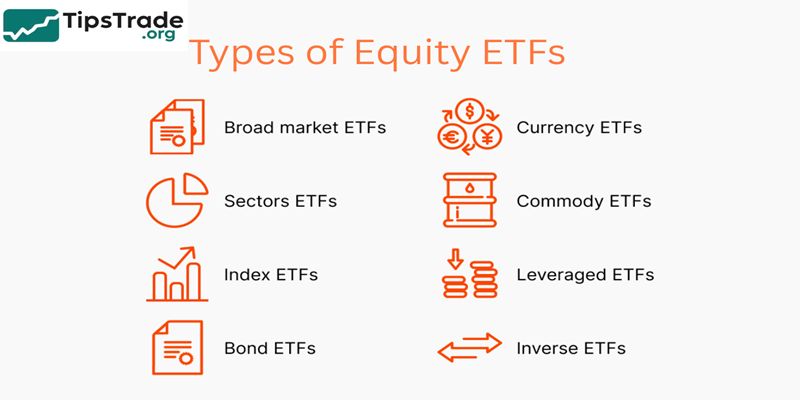

Types of Equity ETFs

Broad Market Equity ETFs

- Broad market ETFs track major stock indices, such as the S&P 500 or Russell 2000.

- Experience insight: Investors favor broad market ETFs for long-term growth because they reflect the overall market performance.

- Expertise: Morningstar reports that broad market ETFs typically have low expense ratios (0.03%–0.10%), making them cost-effective for investors seeking diversified exposure.

Sector-Specific Equity ETFs

- These ETFs focus on specific industries like technology, healthcare, or energy.

- Experience example: The Technology Select Sector SPDR Fund (XLK) allows investors to capitalize on trends in the tech industry.

- Expertise: Sector ETFs provide higher growth potential but come with increased volatility, as sector performance can be cyclical.

Dividend and Growth Equity ETFs

- Dividend ETFs focus on companies with stable, high-yield dividends, while growth ETFs target high potential capital appreciation.

- Experience insight: Schwab U.S. Dividend Equity ETF is popular among income-focused investors.

- Expertise: Dividend ETFs often reduce portfolio risk, while growth ETFs may generate higher returns but with more fluctuation.

International and Emerging Market Equity ETFs

- These ETFs invest in non-U.S. equities, including developed and emerging markets.

- Experience example: iShares MSCI Emerging Markets ETF (EEM) allows exposure to fast-growing economies like China, India, and Brazil.

- Expertise: International ETFs diversify country-specific risks, but investors must consider currency risk, geopolitical factors, and emerging market volatility.

Investment Strategies Using Equity ETFs

Passive Index Tracking Strategies

- Passive ETFs aim to replicate an index rather than beat it. Experience insight: A long-term investor using SPDR S&P 500 ETF (SPY) reported consistent growth aligned with the market.

- Expertise: Passive ETFs typically have lower expense ratios, minimal trading costs, and reliable performance tracking.

Active Management Strategies

- Actively managed Equity ETFs allow managers to select stocks to outperform benchmarks.

- Experience example: ARK Innovation ETF (ARKK) targets disruptive technologies and adjusts holdings frequently.

- Expertise: While potentially higher-performing, active ETFs usually incur higher fees and tracking error risks.

Thematic and Smart Beta Approaches

- Thematic ETFs focus on specific investment themes (e.g., AI, clean energy). Smart Beta ETFs use alternative weighting strategies beyond market capitalization.

- Experience insight: Investors in thematic ETFs like Global X Robotics & AI ETF (BOTZ) reported concentrated growth in tech sectors.

- Expertise: These strategies provide targeted exposure but may be more volatile and sensitive to market trends.

Key Metrics and Performance Indicators

Expense Ratios and Costs

- Expense ratios reflect annual management fees. Experience example: Vanguard Total Stock Market ETF (VTI) has an expense ratio of 0.03%, making it one of the lowest-cost options.

- Expertise: Lower costs improve net returns, particularly for long-term investors.

Tracking Error and Benchmark Comparison

- Tracking error measures how closely an ETF follows its benchmark. Experience insight: SPDR ETFs maintain low tracking error (~0.05%), ensuring that fund performance mirrors the index.

- Expertise: Tracking error affects returns and is critical for evaluating ETF efficiency.

Risk Metrics: Volatility, Beta, Sector Exposure

Investors should monitor:

- Volatility: daily or monthly price fluctuations

- Beta: sensitivity to market movements

- Sector exposure: concentration risk

Experience example: Technology ETFs exhibit higher beta, increasing potential gains and losses.

Expertise: Understanding these metrics helps manage portfolio risk and allocation decisions.

Benefits of Investing in Equity ETFs

Diversification and Market Exposure

- Investing in Equity ETFs allows instant diversification, reducing risk relative to individual stock ownership.

- Experience insight: Vanguard investors benefit from holding hundreds of equities through a single ETF, minimizing individual stock risk.

Liquidity and Transparency

- Equity ETFs trade like stocks, offering intraday liquidity. Holdings are disclosed daily or quarterly, providing transparency.

- Expertise: Transparent reporting enhances investor confidence and facilitates timely portfolio adjustments.

Lower Costs Compared to Mutual Funds

- Equity ETFs often have lower fees than mutual funds, particularly passive ETFs.

- Experience insight: Investors using iShares Core ETFs save thousands in fees annually, improving long-term returns.

Risks and Challenges of Equity ETFs

Market and Sector Risks

- Equity ETFs are subject to market fluctuations and sector-specific downturns.

- Experience example: Energy ETFs experienced losses during the 2020 oil price crash.

- Expertise: Diversification mitigates but does not eliminate risk.

Tracking Error and Performance Deviations

- Misalignment with benchmarks can affect returns.

- Experience insight: Actively managed ETFs may outperform or underperform due to stock selection and timing.

Regulatory and Tax Considerations

- Investors must consider capital gains taxes and compliance with local regulations.

- Experience insight: U.S. ETFs are tax-efficient, but international ETFs may have withholding taxes or currency risks.

How to Select the Right Equity ETF

Matching ETF to Investment Goals

- Long-term growth → broad market ETFs

- Income → dividend ETFs

- Thematic exposure → AI, clean energy, or sector ETFs

Experience insight: Tailoring ETFs to goals aligns risk tolerance and investment horizon.

Evaluating Performance History and Costs

- Compare 1-, 3-, 5-year returns

- Analyze expense ratios and trading costs

- Review tracking error and volatility metrics

Expertise: Morningstar ratings provide independent assessment for selection.

Considering Fund Size, Liquidity, and Issuer Reputation

- Large funds generally have better liquidity

- Well-known issuers (Vanguard, BlackRock) offer reliability and investor protection

- Avoid thinly traded ETFs to reduce bid-ask spread risk

Conclusion

Equity ETFs offer diversification, liquidity, and cost efficiency, making them ideal for investors seeking exposure to the stock market without holding individual equities. By understanding types, strategies, performance metrics, and risks, investors can make informed decisions and tailor ETFs to meet their financial goals.

See more:

- AI ETFs: Complete Guide to Investing in Artificial Intelligence Exchange-Traded Funds

- Commodity ETFs: A Complete Guide to Investing in Commodity Exchange-Traded Funds

- Equity Mutual Funds: A Complete Beginner-Friendly Guide to How They Work, Types, Returns, and Risks

- Mutual Fund Investment Strategies: A Complete 2025 Guide to Building Wealth