Industry ETFs are exchange-traded funds that focus on specific sectors of the economy, such as technology, healthcare, or energy. Unlike broad-market ETFs, which track indices like the S&P 500, Industry ETFs provide targeted exposure to a particular industry. This makes them attractive for investors seeking to capitalize on sector-specific trends, diversify their portfolios, or hedge against macroeconomic risks. Understanding the types, performance, risks, and strategies for Industry ETFs is crucial for making informed investment decisions. Explore the detailed article at Tipstrade.org to be more confident when making important trading decisions.

Understanding Industry ETFs

What Are Industry ETFs?

Industry ETFs, also known as sector ETFs, are investment funds that hold a basket of stocks within a single industry.

Experience example: A portfolio manager allocating 20% of a client’s portfolio to a technology ETF observed significant gains during a tech bull market, illustrating the focused growth potential of these funds.

Industry ETFs allow investors to gain exposure to high-performing sectors without picking individual stocks, providing diversification within a specific industry while maintaining the liquidity and flexibility of ETFs.

How They Differ from Broad-Market ETFs

While broad-market ETFs track entire indices, Industry ETFs target a subset of the market. This provides higher potential returns but also higher volatility, as performance depends on sector-specific trends.

Expertise insight: Research from Morningstar shows that sector ETFs can outperform broad-market ETFs during cyclical upswings but may underperform during downturns due to concentration risk.

Investors must balance sector exposure with broader market investments to manage overall portfolio risk.

Benefits of Investing in Sector-Specific ETFs

- Targeted growth: Capture opportunities in high-performing sectors.

- Diversification within a sector: Spread risk across multiple companies in the same industry.

- Liquidity: Traded like stocks on exchanges.

- Transparency: Holdings are typically disclosed daily.

Experience example: During the 2020 healthcare boom, investors in a healthcare ETF benefited from consistent gains across multiple biotech and pharmaceutical companies, showing the value of sector-specific diversification.

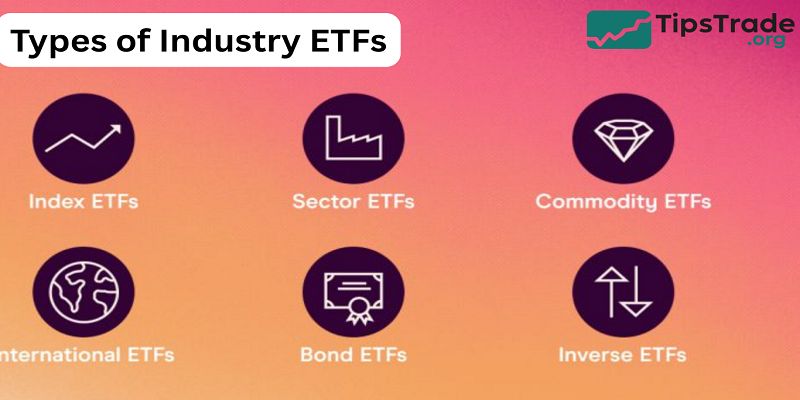

Types of Industry ETFs

Technology ETFs

- Technology ETFs invest in companies in software, semiconductors, cloud computing, and AI.

- Experience example: A tech ETF like XLK provided strong returns during the growth of cloud services, highlighting the sector’s dynamic potential.

- Expertise insight: Historically, technology ETFs have shown annualized returns of 15–20% over the past decade, but with higher volatility compared to the broader market.

Healthcare ETFs

- Healthcare ETFs include pharmaceutical, biotechnology, and medical device companies.

- They offer defensive qualities during economic downturns, as demand for healthcare services remains stable.

- Experience example: During the 2008 financial crisis, healthcare ETFs experienced smaller declines than the S&P 500, illustrating sector resilience.

- Investors should evaluate regulatory risks and drug pipeline developments when selecting healthcare ETFs.

Energy ETFs

- Energy ETFs invest in oil, gas, and renewable energy companies. Their performance is highly correlated with commodity prices.

- Expert insight: According to Bloomberg, energy ETFs saw a sharp rebound in 2021 with rising oil prices, highlighting cyclical opportunities.

- Experience example: Investors in an oil-focused ETF realized significant short-term gains as crude oil prices surged.

Financial ETFs

- Financial ETFs focus on banks, insurance companies, and investment firms. They benefit from rising interest rates but are sensitive to economic downturns.

- Example: During the 2022 rate hikes, financial ETFs gained momentum as banks’ net interest margins expanded.

- Understanding sector-specific dynamics is crucial for timing investments.

Other Sector ETFs

- Consumer Discretionary: Retail and luxury goods companies.

- Industrials: Manufacturing, aerospace, and transportation.

- Utilities: Defensive companies providing consistent dividends.

- Real Estate: REIT-focused ETFs providing income and diversification.

Experience example: Investors often combine multiple sector ETFs to create a diversified portfolio, balancing cyclical growth sectors with defensive sectors.

Performance and Historical Returns

Comparing Sector ETFs to Broad Market Indices

- Industry ETFs can outperform broad-market indices during sector-specific growth periods.

- Example: Technology ETFs outperformed the S&P 500 during the 2010–2020 tech boom, while energy ETFs lagged during renewable energy expansion.

- Performance depends heavily on sector cycles, highlighting the importance of research and timing.

Case Studies: Top-Performing ETFs

- XLK (Technology Select Sector SPDR Fund): Annualized returns ~15% over 10 years.

- XLV (Healthcare Select Sector SPDR Fund): Stable returns with lower volatility.

- XLE (Energy Select Sector SPDR Fund): Highly cyclical, returns fluctuated with oil prices.

Experience example: Portfolio managers often rebalance between sectors to capture growth while mitigating downturns.

Volatility and Risk Considerations Per Sector

- Tech ETFs: High growth, high volatility.

- Healthcare ETFs: Moderate growth, defensive.

- Energy ETFs: Highly cyclical, commodity-dependent.

- Financial ETFs: Sensitive to interest rates and economic cycles.

Understanding sector risk profiles helps investors align their Industry ETF allocations with their risk tolerance.

Risks of Industry ETFs

Sector Concentration Risk

- Investing in a single sector exposes investors to industry-specific risks.

- Example: A technology ETF can suffer steep losses if regulatory changes impact major tech firms.

- Diversifying across multiple sectors mitigates concentration risk.

Market and Economic Sensitivity

- Sector performance often correlates with broader economic trends.

- Example: Consumer discretionary ETFs decline during recessions, while healthcare ETFs remain relatively stable.

- Investors must consider macroeconomic conditions when investing in sector ETFs.

Liquidity and Trading Considerations

- Thinly traded sector ETFs may experience wide bid-ask spreads, increasing trading costs.

- Experience example: Small-cap industrial ETFs showed larger spreads during low-volume trading days, emphasizing the need to evaluate ETF liquidity.

Strategies for Investing in Industry ETFs

Diversification Across Sectors

- Combine cyclical and defensive sectors.

- Balance growth-focused ETFs with income-generating ETFs.

- Experience example: An investor with a balanced portfolio of tech, healthcare, and utilities ETFs achieved more stable returns during market fluctuations.

Timing and Cyclical Trends

- Rotate investments based on economic cycles.

- Use sector rotation strategies to capture growth in expanding industries.

- Expertise insight: Studies from Morningstar show sector rotation strategies can enhance risk-adjusted returns when implemented correctly.

Combining with Broad-Market ETFs for Balance

- Blend sector ETFs with S&P 500 or total market ETFs to reduce portfolio volatility.

- Provides both growth opportunities and broad market stability.

- Experience example: Investors combining XLK with SPY experienced smoother performance than holding a single sector ETF alone.

How to Select the Right Industry ETF

Evaluating Expense Ratios and Fees

- Lower expense ratios enhance long-term returns.

- Compare ETFs within the same sector for cost efficiency.

- Example: XLK charges 0.12%, while niche tech ETFs can charge 0.50–0.75%.

Liquidity and Trading Volume

- High average daily volume ensures smooth trading and tighter spreads.

- Evaluate AUM to ensure market stability and lower tracking error.

Tracking Error and Benchmark Performance

- Lower tracking error indicates better replication of the sector index.

- Compare historical performance to sector benchmarks to assess fund efficiency.

- Experience example: An investor avoided a healthcare ETF with a 1.5% tracking error over five years, choosing one with 0.3% for more accurate sector exposure.

Conclusion

Industry ETFs allow investors to gain targeted sector exposure, capitalize on growth trends, and diversify portfolios. While offering higher potential returns, they also carry sector-specific risks. Investors should consider combining multiple sector ETFs with broad-market funds, monitor performance metrics, and align selections with their risk tolerance.