Equity mutual funds are among the most popular investment vehicles for investors seeking long-term wealth creation. These funds pool money from many individuals and invest primarily in stocks, offering diversification, professional management, and access to the stock market without requiring deep trading knowledge. This guide provides a comprehensive breakdown of how equity mutual funds work, their benefits, risks, performance factors, fees, and practical strategies to choose the right fund. Whether you’re a new investor or someone comparing different investment products, this article covers everything you need to make confident decisions. Explore the detailed article at Tipstrade.org to be more confident when making important trading decisions.

What Are Equity Mutual Funds?

Equity mutual funds are investment funds that allocate the majority of their assets—typically more than 65%—into equities or stocks. These funds aim to generate capital appreciation over the long term by investing in publicly traded companies across sectors and market capitalizations.

They are managed by professional fund managers who make decisions based on market research, financial analysis, and economic trends.

Unlike direct stock investing, where individuals must pick and track specific companies, equity mutual funds offer structured diversification.

According to Morningstar, diversified funds reduce unsystematic risk by spreading investments across multiple sectors. For new investors, equity funds provide easier access to markets without the complexity of stock valuations or trading strategies.

They are widely recommended by experts for long-term goals such as retirement, home ownership, or education funding.

How Equity Mutual Funds Work

Equity mutual funds operate by pooling money from numerous investors, forming a collective investment corpus.

This pool is then invested in stocks based on the fund’s stated objective—whether growth, value, sector-specific, or diversified.

A fund manager, often supported by a research team, actively monitors market movements, earnings reports, and macroeconomic indicators to adjust portfolio holdings.

Investors purchase “units” of the mutual fund at the fund’s Net Asset Value (NAV), which is calculated daily based on the value of its underlying assets. As these assets appreciate or depreciate, NAV fluctuates. Returns are usually realized through capital gains, dividends, or NAV appreciation.

For example, a growth-oriented fund might invest heavily in technology companies anticipating rapid expansion, whereas a value-oriented fund may focus on undervalued blue-chip stocks with stable earnings. This structure allows investors to participate in the equity market without needing to buy individual shares.

Benefits of Investing in Equity Mutual Funds

Professional Portfolio Management

- One of the most significant advantages of equity mutual funds is expert management. Fund managers, supported by analysts and quantitative researchers, evaluate thousands of data points—earnings forecasts, technical indicators, macroeconomic signals, and sector trends—to decide what to buy or sell.

- For example, Fidelity reports that active fund managers use predictive models and deep research to identify outperforming sectors.

- This expertise benefits investors who lack the time or skill to track the market themselves.

Diversification and Reduced Risk

- Equity funds typically hold 50–100 stocks across industries, significantly reducing unsystematic risk.

- Diversification ensures that poor performance in one company or sector does not heavily impact overall returns.

- According to Vanguard, diversified equity portfolios can reduce volatility by up to 40% compared to holding individual stocks.

- Investors get immediate exposure to multiple sectors—technology, healthcare, finance, infrastructure—without needing to buy each stock individually.

Potential for High Long-Term Returns

- Historically, equity markets have delivered 8–12% average annual returns, outperforming bonds, gold, and cash equivalents.

- Equity mutual funds harness this long-term growth. For instance, data from S&P 500 Index shows that long-term equity investments outperform inflation and provide substantial capital appreciation.

- Investors aiming for goals that require growth—retirement, children’s education, wealth building—often choose equity funds as a cornerstone in their portfolios.

Liquidity and Flexibility

- Equity mutual funds offer high liquidity. Investors can redeem their units at NAV on any business day, making them flexible compared to long-lock-in products like fixed deposits or real-estate investments.

- Many funds also support systematic investment plans (SIPs), allowing investors to contribute small amounts regularly, which promotes disciplined investing and rupee-cost averaging.

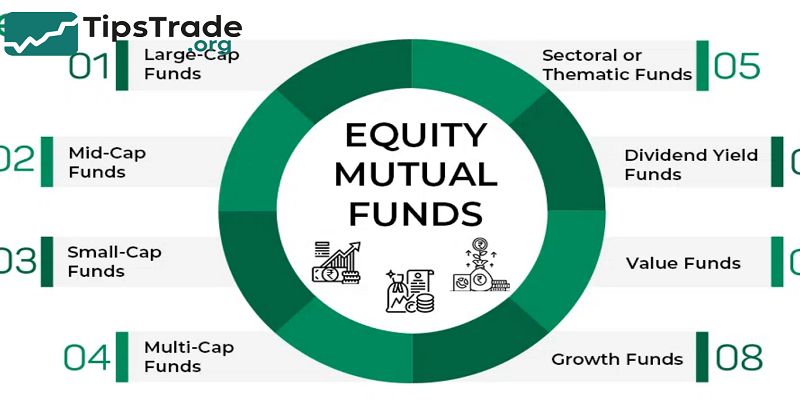

Types of Equity Mutual Funds

Large-Cap Funds

- Large-cap funds invest in well-established companies with strong financials and market capitalization within the top segment of the stock market.

- These companies are typically stable and resilient during economic fluctuations, making large-cap funds suitable for conservative equity investors.

- According to Morningstar research, large-cap funds often exhibit lower volatility and deliver steady long-term growth.

Mid-Cap Funds

- Mid-cap funds focus on medium-sized companies poised for expansion. These companies have higher return potential than large-caps but come with increased risk.

- Historically, mid-cap funds have outperformed other categories during bull markets but may decline sharply during downturns.

- Investors with moderate risk appetite often include mid-cap funds for portfolio growth.

Small-Cap Funds

- Small-cap funds invest in smaller emerging companies. These companies can deliver exponential gains but are highly volatile.

- A 2023 analysis by CRISIL shows small-cap funds generated over 15% CAGR over a decade, outperforming other segments, but with significant fluctuations.

- These funds suit aggressive investors with long-term horizons.

Sector and Thematic Funds

- Sector funds concentrate on a single industry such as technology, pharmaceuticals, or renewable energy.

- Thematic funds invest around broader themes such as ESG, consumption, or digital transformation. Because exposure is concentrated, these funds carry higher risk.

- However, when a sector outperforms—like technology in 2020—returns can be exceptional.

ELSS Tax-Saving Funds

- Equity Linked Savings Schemes (ELSS) combine tax benefits with market-linked growth.

- They offer deductions under tax laws and have a shorter lock-in period compared to other tax-saving instruments.

- ELSS funds typically invest across market caps, making them a popular choice among new salaried investors.

Key Risks of Equity Mutual Funds

Market Volatility

- Equity funds are influenced by stock market fluctuations caused by economic conditions, global events, corporate earnings, and investor sentiment.

- During bearish phases, NAV can drop sharply.

- For example, during the 2020 pandemic crash, many equity funds dropped 25–35% in value. Investors must be prepared for short-term volatility.

Fund Management Risk

- Active management involves decisions by fund managers. If the manager’s stock-picking strategy underperforms, the entire fund may suffer.

- According to SPIVA reports, nearly 60% of actively managed equity funds underperform their benchmarks over a 5-year period.

Concentration Risk

- Certain funds may invest heavily in specific sectors or themes. While this can increase returns, it also raises exposure to sector downturns.

- Investors should review portfolio concentration before investing.

Liquidity Risk

- Small-cap funds may face liquidity challenges during market stress when selling underlying stocks becomes difficult. This can temporarily impact NAV accuracy.

Factors That Influence Equity Mutual Fund Performance

Economic Conditions

- GDP growth, inflation, interest rates, and fiscal policy all shape market performance.

- For example, rising interest rates often depress equity markets because borrowing becomes expensive for companies.

- Conversely, stable inflation tends to support equity appreciation.

Corporate Earnings

- Stock prices ultimately follow earnings. When companies report strong revenue and profit growth, equity funds holding those stocks generally gain value.

- Fund managers continuously evaluate financial statements to select high-growth companies.

Fund Manager Strategy

- Management strategy—growth, value, contra, or blended—significantly impacts performance.

- Growth funds perform well in expansion cycles, while value funds may hold strong during downturns. The skill and approach of the manager influence consistency.

Expense Ratio

- Expense ratio refers to the annual fee charged by the fund to manage your investment.

- Higher fees may reduce net returns. According to Morningstar, actively managed funds with lower fees outperform costly funds more consistently.

How to Choose the Right Equity Mutual Fund

Analyze Past Performance

- While past performance does not guarantee future results, consistency across market cycles is essential.

- Compare 3-year, 5-year, and 10-year returns with benchmark indices. A good equity fund typically beats its benchmark in at least 60–70% of periods.

Check Fund Manager Track Record

- Experienced managers with a history of stable returns inspire confidence.

- Look for managers who have handled funds through different market cycles.

Review Portfolio Holdings

- Check sector allocation, top holdings, and market cap distribution.

- A diversified portfolio reduces risk, while concentrated positions indicate higher volatility.

Evaluate Risk Profile and Investment Horizon

- Growth-oriented aggressive funds suit long-term investors with high risk tolerance. Large-cap or ELSS funds suit moderate investors.

- Always match the time horizon with volatility—equity funds are ideal for 5+ years.

How to Invest in Equity Mutual Funds

Lump Sum vs. Systematic Investment Plan (SIP)

- Investors can choose between lump-sum investing or SIPs. SIPs are popular because they help average out market volatility.

- Lump-sum investing is effective during market corrections when valuations are low.

Online Investment Platforms

- Investors today use apps and online platforms like Vanguard, Fidelity, or local brokerage apps to buy equity funds.

- These platforms provide research tools, risk profiling, and performance insights.

Direct vs. Regular Plans

- Direct plans have lower fees because they don’t involve intermediaries. Over long periods, this fee difference can significantly boost returns.

- Regular plans suit investors who need advisory assistance.

Conclusion

Equity mutual funds are an excellent tool for long-term wealth building. They offer diversification, professional management, high return potential, and flexibility for investors at all experience levels. Whether you are planning retirement or building a long-term asset base, equity funds can play a central role in your financial strategy.