Mutual funds fees represent the costs investors pay for professional management and fund operations, significantly influencing net returns over time. These fees encompass various types, including management fees, shareholder fees like sales loads, and annual operating expenses such as 12b-1 distribution fees. Grasping these fee structures helps investors select cost-effective funds that align with their financial goals. Explore the detailed article at Tipstrade.org to be more confident when making important trading decisions.

What Are Mutual Funds Fees?

Definition and Core Concept

Mutual fund fees are charges levied by fund companies to cover the costs of managing investments, distributing shares, and maintaining operations.

These fees are typically expressed as a percentage of assets under management (AUM) or as flat charges.

While the specific fees vary depending on fund type and management style, all mutual funds incur costs that are ultimately borne by investors.

For example, expense ratios represent annual operating costs, including management salaries, administrative expenses, and marketing costs.

Even a 1% annual expense ratio can reduce net returns significantly over decades due to compounding.

Understanding fees is essential because high costs can erode the benefits of professional management, especially in actively managed funds.

Why Fees Matter

Fees matter because they directly affect investment returns. A fund charging 2% annually will require higher performance just to match a fund charging 0.5%.

Over long periods, this difference compounds. For instance, an investment of $10,000 growing at 7% for 20 years with a 0.5% expense ratio will grow to around $38,700, while the same fund with a 2% fee grows only to about $32,000.

Fees are not just numbers on paper—they influence strategy, portfolio construction, and fund performance.

Awareness of fees allows investors to compare funds effectively and select cost-efficient options aligned with their financial goals.

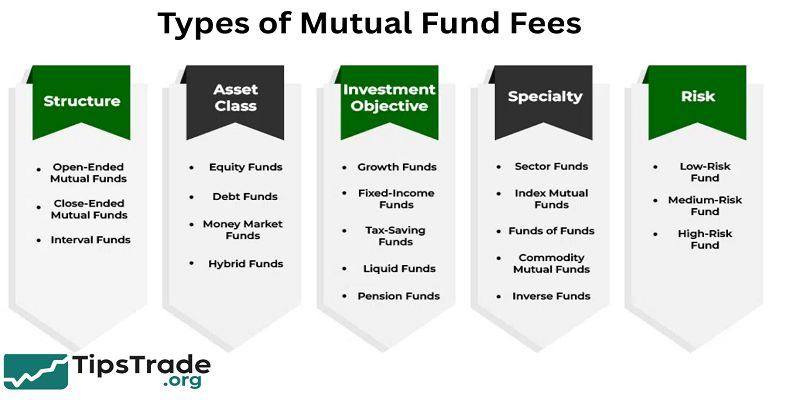

Types of Mutual Fund Fees

Management Fees / Expense Ratio

- Management fees are charged to pay fund managers for investment research, stock selection, and portfolio monitoring.

- These fees are included in the expense ratio, which encompasses all operating costs.

- Expense ratios vary widely: index funds often charge 0.05–0.25%, while actively managed funds may charge 0.75–1.5% or higher.

- Investors should note that high expense ratios do not guarantee better performance.

- According to Morningstar, many actively managed funds underperform their benchmarks after accounting for fees.

Example:

- A mutual fund with a 1.2% expense ratio and $50,000 invested will incur $600 in annual management fees, automatically deducted from the fund’s NAV.

Front-End Load / Back-End Load

- Front-end loads are fees paid when purchasing fund shares, usually ranging from 1% to 5%.

- For example, investing $10,000 in a 3% front-end load fund means $300 goes to fees, leaving $9,700 invested.

- Back-end loads or redemption fees are charged when selling shares, often declining over time. These fees discourage short-term trading and reward long-term investors.

Impact:

- Investors paying loads must consider timing and investment horizon. Short-term holdings in load funds may reduce returns significantly.

12b-1 Fees

- 12b-1 fees cover marketing and distribution expenses. They are included in the expense ratio and typically range from 0.25% to 1% annually.

- While designed to grow the fund’s investor base, these fees can reduce net returns over time.

- Vanguard and Fidelity recommend checking funds for 12b-1 fees when comparing costs, as eliminating these fees can save thousands over decades.

Other Operating Expenses / Hidden Costs

- Mutual funds incur transaction costs from buying and selling securities, legal expenses, auditing fees, and custodian charges.

- While less visible, these costs affect net returns.

- Active funds with high turnover generate more trading costs, reducing the investor’s effective return.

- Index funds usually have lower turnover and therefore lower hidden costs, making them more cost-efficient for long-term investors.

How Fees Impact Investor Returns

Fees reduce compounding over time. For example:

- Investing $10,000 in a fund growing 8% annually for 30 years:

- Expense ratio 0.5% → ~$100,600

- Expense ratio 1.5% → ~$78,000

- This demonstrates that even a 1% difference in fees can reduce wealth accumulation by more than 20%.

Bullet Points – Key Impacts:

- Higher fees require higher performance to break even.

- Compounding magnifies fee differences over decades.

- Active funds with high fees must outperform consistently to justify costs.

- Index and passive funds generally offer better net returns due to lower fees.

Active vs Passive Funds: Fee Differences

Active Funds

- Typically charge 0.75–2% expense ratios.

- Managers select securities to outperform benchmarks.

- Higher costs reflect active management, research, and operational effort.

Passive Funds / Index Funds

- Expense ratios 0.05–0.25%.

- Track market indices without active decision-making.

- Lower fees allow investors to keep more of the market return.

Table: Typical Fees Comparison

| Fund Type | Expense Ratio | Load Fees | 12b-1 Fees | Turnover |

| Active Equity | 0.75–1.5% | Possible | 0–1% | High |

| Passive Index | 0.05–0.25% | Rare | 0 | Low |

| Bond Fund | 0.25–1% | Possible | 0–0.5% | Medium |

How to Minimize Mutual Fund Fees

- Choose low-cost index funds for long-term investing.

- Avoid funds with high front-end or back-end loads unless necessary.

- Check 12b-1 fees and prefer funds without or with minimal marketing charges.

- Consider tax efficiency—funds with low turnover reduce capital gains taxes.

- Use no-load or fee-free platforms such as Vanguard, Fidelity, or Schwab.

Common Mistakes Investors Make Regarding Fees

- Ignoring the expense ratio when selecting funds.

- Confusing short-term returns with long-term net performance.

- Investing in high-load funds without considering investment horizon.

- Not comparing fees across similar fund types.

- Overlooking hidden operating expenses and turnover costs.

Conclusion

Mutual funds fees, though necessary for fund administration, can erode investment returns if not carefully evaluated. Actively managed funds typically carry higher fees than passive ones, underscoring the importance of comparing expense ratios and share classes before committing capital. Investors prioritizing long-term growth should focus on low-fee options to maximize compounding benefits.