Funds are pooled investment vehicles where multiple investors contribute capital, which is then professionally managed and allocated across different asset classes. They provide an accessible way for individuals and institutions to diversify their investments while benefiting from expert management. Investors choose funds to reduce risk, achieve consistent returns, and participate in markets they may not easily access independently. This guide explains different fund types, the investment process, regulatory considerations, and practical examples to help readers make informed investment decisions. Explore the detailed article at Tipstrade.org to be more confident when making important trading decisions.

What Are Funds?

Definition and Purpose of Funds

- A fund is a collective investment vehicle pooling capital from multiple investors to create a diversified portfolio of assets such as stocks, bonds, or alternative investments.

- The primary purpose is to provide investors with professional management, diversification, and economies of scale that are difficult to achieve individually.

- For example, a single mutual fund can hold hundreds of securities, offering risk reduction while allowing participation in global markets.

- Funds are governed by legal frameworks, ensuring transparency, reporting, and fiduciary responsibility. According to Investopedia, funds allow small investors to access strategies typically reserved for institutions, including large-cap equities, private debt, or real estate.

- Properly structured funds also define investment objectives, risk appetite, and expected return profiles, helping investors align their choices with financial goals.

- Real-world examples, such as the Vanguard Total Stock Market Fund, demonstrate how pooled investments can generate stable long-term growth for a wide range of investors.

Benefits of Investing in Funds

Investing in funds provides several advantages over direct stock or bond purchases:

- Diversification: Spreads risk across multiple assets, reducing the impact of individual security losses.

- Professional Management: Experienced fund managers conduct research, monitor markets, and make strategic investment decisions.

- Accessibility: Funds often require lower minimum investments than direct investments in large securities or private assets.

- Liquidity: Many funds, especially mutual funds and ETFs, allow investors to redeem shares daily or at regular intervals.

Studies by Morningstar and CFA Institute show that diversified funds often outperform individual investments over a decade due to disciplined asset allocation.

For instance, a balanced fund combining equities and bonds mitigates volatility while providing moderate growth. Funds also give access to complex strategies, such as international equities or private markets, which are difficult for individual investors to replicate.

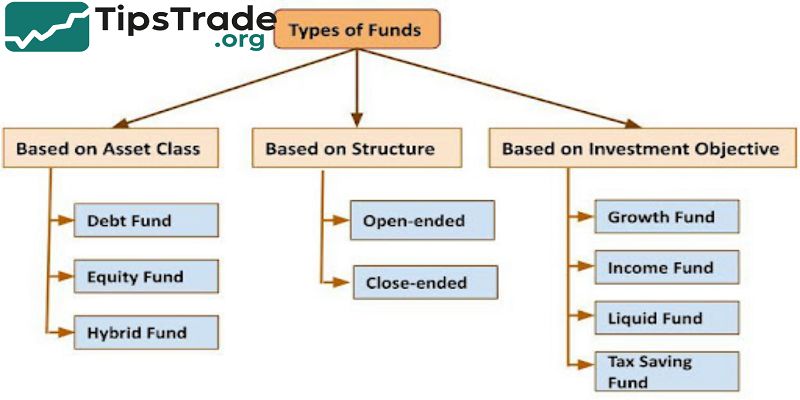

Types of Funds

Mutual Funds

- Mutual funds are investment vehicles that pool money from investors and invest in stocks, bonds, or a mix of assets. They can be actively managed, where fund managers select securities to outperform benchmarks, or passively managed, tracking an index.

- Mutual funds are suitable for retail investors seeking professional management and portfolio diversification. Fees vary depending on management style; actively managed funds typically charge higher expense ratios (around 0.75–2%), while index-tracking funds are more cost-efficient.

- For example, Fidelity Contrafund, an actively managed equity fund, has historically delivered long-term growth above benchmarks but charges higher fees than passive funds.

- Mutual funds provide regular reporting and liquidity, making them ideal for investors with medium- to long-term goals.

ETFs (Exchange-Traded Funds)

- ETFs combine features of mutual funds and individual stocks. They track specific indexes or sectors and trade on exchanges throughout the day, offering liquidity and flexibility.

- ETFs usually have lower expense ratios than actively managed mutual funds, often under 0.20%. Examples include SPDR S&P 500 ETF (SPY) and Vanguard Total Stock Market ETF (VTI).

- Investors can use ETFs for diversified exposure, tactical asset allocation, or sector-specific strategies. ETFs’ transparency, daily NAV reporting, and low fees make them a popular choice for both beginners and experienced investors.

- Research from Morningstar shows that ETFs often outperform comparable mutual funds over long-term horizons due to lower costs.

Hedge Funds

- Hedge funds are private investment funds employing complex strategies, including leverage, derivatives, and short-selling, to achieve high returns.

- They are accessible only to accredited investors due to high minimum investments and regulatory requirements. Hedge funds charge performance-based fees (commonly “2 and 20”: 2% management, 20% performance).

- For example, Bridgewater Associates’ Pure Alpha fund uses global macro strategies to deliver returns that are largely uncorrelated with market indices.

- While hedge funds offer potential high rewards, they carry high risk, limited transparency, and lower liquidity than public funds. Investors must assess strategy alignment and risk tolerance carefully.

Private Equity Funds

- Private equity (PE) funds invest in private companies through buyouts, venture capital, or growth-stage investments.

- PE funds generally have long-term horizons (7–12 years) and are illiquid until the exit stage, which may include IPOs or company sales.

- They are suitable for sophisticated investors seeking high returns and willing to commit capital over multiple years.

- Real-world examples include KKR and Sequoia Capital, which have generated substantial returns for investors through strategic acquisitions and venture investments.

- PE funds require extensive due diligence, legal structuring, and investor reporting.

Money Market Funds

- Money market funds invest in short-term, low-risk instruments such as treasury bills, commercial paper, and certificates of deposit.

- They are ideal for conservative investors seeking capital preservation and modest income.

- These funds typically offer lower returns than equities but higher stability. They are widely used for emergency funds, short-term savings, or as a temporary investment vehicle while awaiting other opportunities.

How Funds Work

Fund Lifecycle

The lifecycle of a fund typically includes:

- Fund formation and structuring

- Fundraising and capital commitment

- Portfolio construction and asset allocation

- Investment execution

- Management and reporting

- Exit or distribution

This structured approach ensures compliance, transparency, and effective capital deployment. According to the CFA Institute, funds following disciplined lifecycles achieve more consistent long-term performance.

Key Players in Fund Management

Several parties collaborate to ensure the smooth operation of a fund:

- Fund managers: Decide on investment strategy and allocation

- Investors: Provide capital and monitor performance

- Custodians: Safeguard assets

- Administrators: Manage reporting, NAV calculations, and compliance

- Regulators: Oversee legal adherence and investor protection

Coordination between these parties ensures transparency and risk management.

Regulation and Compliance

- Funds must comply with local and international regulations. In the US, funds are overseen by the SEC; in the EU, funds follow AIFMD; in Asia, jurisdictions like Singapore and Hong Kong have specific guidelines.

- Regulatory compliance ensures proper disclosure, reporting, and investor protection. Non-compliance can result in fines, legal action, or fund suspension.

- Well-structured compliance frameworks enhance investor trust and long-term fund credibility.

How to Choose the Right Fund

Assessing Risk Tolerance and Investment Goals

Investors should align fund selection with personal risk profiles:

- Conservative: Money market, bond, or balanced funds

- Moderate: Equity-heavy balanced funds or index funds

- Aggressive: Sector ETFs, hedge funds, or private equity

A clear understanding of goals, time horizon, and liquidity needs ensures appropriate fund choice.

Comparing Performance and Fees

Important metrics include NAV, CAGR, ROI, and expense ratios. Lower fees reduce drag on long-term returns, making index funds and ETFs attractive. According to Morningstar, funds with consistent benchmark-beating performance and reasonable fees provide better long-term value.

Diversification and Allocation Strategies

Diversification reduces risk by spreading investments across asset classes, sectors, and geographies. A typical moderate allocation might include:

- 60% equities

- 30% bonds

- 10% alternative funds

Asset allocation drives long-term risk-adjusted performance more than individual security selection.

Common Challenges in Funds

Market Volatility and Risk

- All funds face exposure to economic cycles, interest rate changes, and market fluctuations.

- Equity funds are particularly sensitive to downturns, while bond funds provide stability.

- Diversification and disciplined investing help mitigate risks.

High Fees and Underperformance

- Actively managed funds may charge high fees without consistently outperforming benchmarks.

- Investors must evaluate past performance relative to costs and benchmark indices.

Operational and Compliance Risks

- Errors in reporting, trading, or compliance can disrupt fund operations.

- Internal audits, governance frameworks, and robust systems reduce operational risk.

Best Practices for Investing in Funds

- Governance: Clear roles and accountability

- Transparency: Regular and accurate reporting

- Technology: Portfolio management tools

- Risk Monitoring: Track compliance, liquidity, and exposure

- Education: Keep investors informed of strategies and risks

Adhering to these practices improves trust, performance, and long-term fund success.

Comparison Table of Fund Types

| Fund Type | Risk | Liquidity | Fees | Typical Investors |

| Mutual Fund | Low–Medium | Daily | 0.5–2% | Retail & institutions |

| ETF | Low–Medium | Daily | 0.05–0.20% | All investors |

| Hedge Fund | High | Quarterly | 2/20 | Accredited investors |

| Private Equity | High | Illiquid | 1–2% + carry | Sophisticated investors |

| Money Market | Low | Daily | 0.1–0.5% | Conservative investors |

Conclusion

Funds offer structured, professional, and diversified investment solutions for a variety of investors. Choosing the right fund requires understanding risk tolerance, investment goals, fees, and performance metrics. From mutual funds and ETFs to hedge and private equity funds, every type has a role depending on strategy, horizon, and liquidity needs. Adhering to best practices in governance, reporting, and risk management ensures fund success and investor confidence.