IInvestment fund process encompasses a structured sequence of stages from inception to ongoing management, ensuring compliance, capital efficiency, and investor protection. It begins with defining objectives and legal structuring, followed by fundraising through commitments and capital calls, then proceeds to investment deployment, portfolio monitoring, and eventual wind-down or liquidation. This systematic approach enables fund managers to align strategies with market opportunities while mitigating risks for limited partners. Explore the detailed article at tipstrade.org to be more confident when making important trading decisions.

What Is the Investment Fund Process?

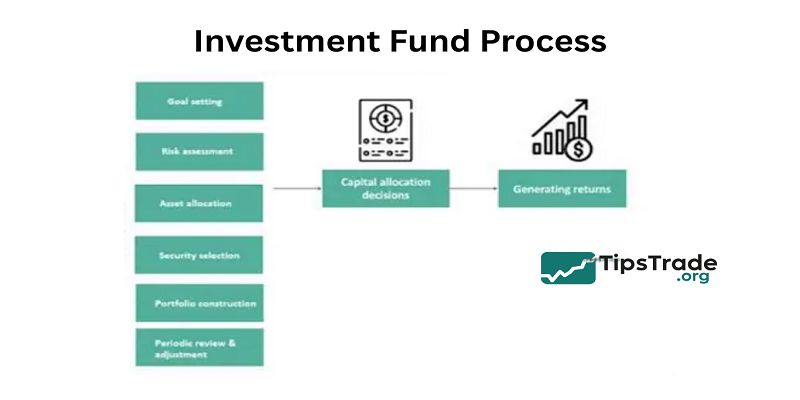

The investment fund process refers to the entire lifecycle of creating, operating, and eventually closing an investment fund. It encompasses legal structuring, fundraising, portfolio construction, investment execution, reporting, and distribution of returns.

Essentially, it’s a roadmap that ensures investors’ capital is managed professionally while complying with regulatory standards.

The process varies depending on the type of fund, such as mutual funds, hedge funds, private equity funds, or ETFs. A properly executed fund process reduces operational risk, increases transparency, and provides investors with confidence in the fund manager’s strategies.

According to CFA Institute reports, structured processes enhance long-term fund performance by maintaining discipline during market volatility.

Moreover, understanding the fund process helps investors compare offerings, evaluate risk, and align fund selection with personal financial goals.

How Investment Funds Work

Key Parties Involved

- Investment funds rely on multiple stakeholders to operate efficiently. Fund managers are responsible for portfolio decisions and strategic planning. Investors provide capital and monitor fund performance. Custodians safeguard assets and ensure operational compliance, while administrators handle day-to-day operations such as NAV calculations, reporting, and record-keeping.

- Finally, regulators oversee legal compliance, ensuring funds adhere to national and international standards.

- For example, US-based funds fall under the SEC, while EU funds comply with AIFMD regulations.

- Effective collaboration among these parties ensures transparency, minimizes risk, and maintains trust between investors and managers.

- Case studies from Vanguard and BlackRock demonstrate that funds with clear roles and accountability tend to deliver consistent, long-term performance.

Types of Investment Funds

Investment funds come in various structures, each with unique processes:

- Mutual Funds: Open-ended funds actively managed by professionals.

- Hedge Funds: Private funds employing diverse strategies including leverage and derivatives.

- Private Equity Funds: Invest in private companies, often for long-term capital gains.

- ETFs (Exchange-Traded Funds): Track indices with intraday liquidity and low fees.

- Venture Capital Funds: Focused on early-stage startups, high-risk/high-reward investments.

Each fund type follows a tailored process, but common stages include formation, fundraising, portfolio allocation, investment execution, reporting, and eventual exit. Understanding the distinctions helps investors choose the fund type that aligns with their risk appetite, liquidity needs, and long-term goals.

Step-by-Step Investment Fund Process

Step 1 – Fund Formation & Structuring

- The first stage in the investment fund process is fund formation. This includes selecting the legal structure (corporation, limited partnership, or trust) and jurisdiction, often influenced by regulatory and tax considerations.

- Drafting a prospectus or offering memorandum outlines the fund’s objectives, investment strategy, fees, and risk profile.

- Experienced fund managers often seek legal counsel to ensure compliance with securities laws and investor protection regulations.

- For example, Cayman Islands structures are popular for hedge funds due to favorable tax treatment and international recognition.

- Proper formation establishes a transparent governance framework, providing investors confidence and a foundation for regulatory compliance.

Step 2 – Fundraising & Capital Commitment

- After formation, the fund initiates capital raising from accredited investors, institutions, or retail participants, depending on fund type. Investors typically sign subscription agreements and undergo KYC/AML checks to verify identity and comply with regulations.

- Fundraising strategies may include roadshows, private meetings, or online platforms. Data from Preqin indicates that funds with clear governance and documented risk management policies attract more committed capital.

- Capital commitment is crucial because it defines the fund’s ability to execute its strategy, such as making acquisitions, investing in securities, or funding startups.

- Maintaining transparent communication during fundraising builds trust and ensures investors understand the expected return profile and potential risks.

Step 3 – Portfolio Construction & Asset Allocation

- Once capital is secured, managers construct a portfolio aligned with the fund’s investment objectives. Asset allocation decisions involve balancing equities, bonds, alternatives, or derivatives to optimize return for the fund’s target risk profile.

- Tools such as risk modeling, scenario analysis, and historical performance review help guide allocation.

- For instance, a balanced fund may allocate 60% to equities and 40% to bonds to achieve moderate growth with lower volatility. Diversification across sectors, geographies, and asset classes reduces risk.

- According to Morningstar research, funds employing disciplined portfolio construction outperform inconsistent strategies over 5–10 years.

- Clear documentation of allocation strategy also ensures transparency and investor confidence.

Step 4 – Executing Investments

- Investment execution is the stage where managers put capital to work according to the portfolio plan.

- This includes deal sourcing, due diligence, and transaction execution. For equity funds, managers analyze companies’ financials, industry trends, and market conditions before purchasing stocks.

- Private equity and venture capital funds conduct in-depth due diligence on startups or private companies, assessing growth potential and risk.

- Hedge funds may deploy advanced strategies such as short selling or derivatives trading.

- Effective execution requires coordination with brokers, custodians, and compliance officers to ensure transparency and regulatory adherence.

- Documenting transactions and maintaining a clear audit trail is essential for accountability and reporting purposes.

Step 5 – Fund Management & Reporting

- Once investments are active, ongoing fund management ensures that the portfolio aligns with objectives.

- This includes monitoring NAV (Net Asset Value), evaluating performance against benchmarks, and adjusting positions if necessary.

- Reporting obligations require quarterly or monthly updates to investors, detailing holdings, performance metrics, risk exposure, and fees.

- Compliance reviews ensure adherence to regulations such as the SEC in the US or AIFMD in the EU.

- Advanced analytics and portfolio management software are commonly used by top funds to track performance and risk indicators. Transparency at this stage fosters trust and allows investors to assess whether the fund is meeting expectations.

Step 6 – Exit Strategy & Distribution

- The exit phase involves realizing returns from investments, either through selling securities, distributing profits, or executing buybacks. In private equity, this might include mergers, acquisitions, or IPOs.

- Profit distribution follows agreed-upon terms in the fund’s documentation, including management fees and carried interest for managers.

- Timing and strategy are crucial to maximize investor returns while mitigating market risk.

- For instance, funds may stagger exits to avoid depressing asset prices. Proper execution during this stage ensures investor satisfaction and adherence to fiduciary responsibilities.

Step 7 – Fund Closure

- Finally, funds may reach a natural conclusion after their investment horizon. Fund closure involves auditing, final distribution of remaining assets, and regulatory filings.

- Investors receive detailed reports summarizing performance, fees, and lessons learned.

- Closure is an important stage to maintain credibility for fund managers, as proper completion demonstrates professionalism and governance standards.

- Post-closure evaluations also inform future fund launches, improving strategy and risk management practices.

Regulatory Requirements in the Investment Fund Process

International Standards

- Investment funds must comply with international regulations such as OECD guidelines for fund governance and transparency.

- These standards cover disclosure requirements, investor rights, and ethical fund management practices.

- Funds that operate cross-border must navigate varying compliance obligations, balancing legal requirements with operational efficiency.

- Following these standards enhances credibility and allows access to global capital markets.

US, EU, and Asia Regulations

- In the US, funds are regulated by the SEC under the Investment Company Act of 1940, requiring detailed reporting, periodic audits, and fiduciary responsibility.

- In the EU, the AIFMD (Alternative Investment Fund Managers Directive) governs hedge and private equity funds, emphasizing risk management, transparency, and investor protection.

- Asian markets have their own rules; for example, Singapore’s MAS and Hong Kong’s SFC enforce licensing, disclosure, and investor safeguards.

- Adhering to regulations is essential for trust and longevity in the investment fund process.

Common Challenges in the Investment Fund Process

Compliance Complexity

- Regulatory compliance is often complex, especially for cross-border funds. Failure to comply can result in fines, penalties, or fund closure.

- Managing compliance requires legal expertise, automated reporting systems, and internal audits.

Market Risks

- Funds are exposed to market volatility, interest rate fluctuations, and economic cycles.

- Even top-performing funds may experience temporary losses. Proper diversification and risk management strategies mitigate this risk.

Operational Risks

- Operational failures such as misreporting, technological errors, or human mistakes can disrupt fund operations.

- Effective governance, audits, and clear internal processes reduce operational risks and maintain investor confidence.

Best Practices for a Smooth Fund Process

- Governance: Clearly define roles and responsibilities.

- Transparency: Regular, accurate reporting builds investor trust.

- Technology Integration: Use portfolio management software to streamline operations.

- Risk Controls: Implement monitoring for compliance, liquidity, and market exposure.

Following these practices helps funds operate efficiently, comply with regulations, and deliver consistent performance.

Comparison Table: Investment Fund Types & Processes

| Fund Type | Lifecycle Length | Risk Level | Liquidity | Key Process Notes |

| Mutual Fund | Continuous | Low–Medium | Daily | Public offering, regulated reporting |

| Hedge Fund | 5–10 years | High | Quarterly | Private, complex strategies |

| Private Equity | 7–12 years | High | Illiquid | Long-term investment, exit-focused |

| ETF | Continuous | Low–Medium | Daily | Passive management, index tracking |

| Venture Capital | 8–15 years | High | Illiquid | Startup-focused, high-risk/high-reward |

Conclusion

Investment fund process is crucial for achieving sustainable returns and regulatory adherence throughout the fund’s lifecycle. Effective execution—from pre-closing preparations and initial closings to investment periods and reporting—builds investor confidence and operational resilience. Ultimately, funds that prioritize robust processes deliver diversified access to opportunities, supporting long-term wealth creation for participants