Advantages of financial ratios play a central role in modern financial analysis because they convert complex financial statements into simple, comparable, and actionable insights. Businesses, lenders, and investors use these ratios to evaluate performance, profitability, liquidity, efficiency, and long-term stability. By using structured ratio analysis, decision-makers reduce guesswork and rely on measurable indicators. Visit tipstrade.org and check out the article below for further information

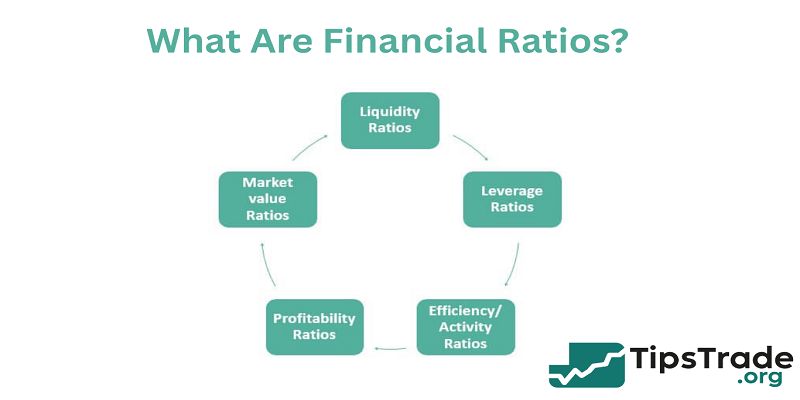

What Are Financial Ratios?

Definition and Purpose

Financial ratios are numerical indicators that compare two financial metrics to evaluate a company’s performance, efficiency, and overall financial health. Analysts typically derive these ratios from the balance sheet, income statement, and cash flow statement.

The purpose of financial ratios is to simplify financial data so stakeholders can quickly identify strengths, weaknesses, and trends.

For example, a company with rising revenue but declining margins may appear successful on the surface, but profitability ratios will reveal hidden inefficiencies. Ratios also help standardize comparisons between companies of different sizes, industries, or geographies.

According to the Corporate Finance Institute (CFI), ratio analysis is one of the most widely used financial evaluation techniques because it allows for fast benchmarking and educated decision-making.

Managers use ratios for budgeting and forecasting, lenders use them to assess credit risk, and investors rely on them to evaluate returns and volatility.

Ultimately, financial ratios transform raw data into meaningful insights that support smarter financial decisions.

How Financial Ratios Are Calculated

Calculating financial ratios typically involves dividing one key financial item by another to show relationships between profitability, liquidity, leverage, and operational performance.

The process begins with extracting accurate numbers from audited financial statements.

For example, the current ratio is calculated by dividing current assets by current liabilities, while return on equity (ROE) divides net income by shareholders’ equity. These formulas help analysts understand how efficiently a business operates and how well it manages resources.

Research from Harvard Business Review highlights that standardized ratio formulas allow consistent comparisons across periods, reducing the risk of misinterpretation. Most calculations are straightforward, but interpreting them requires context such as industry benchmarks, economic conditions, and company strategy.

For example, a debt-to-equity ratio of 2 may be normal in capital-intensive industries like telecom but considered risky in retail. By understanding how ratios are calculated and what they reflect, decision-makers can uncover trends that raw financial statements might hide.

Common Users: Managers, Investors, Lenders

Financial ratios are used by various stakeholders who depend on reliable financial information.

Managers review ratios to monitor internal performance, evaluate cost efficiency, and plan strategies.

For instance, declining inventory turnover may signal supply chain issues that require operational adjustments. Investors depend heavily on ratios like ROA, ROE, and P/E to assess profitability and long-term return potential. Investment analysts at Morningstar note that valuation ratios are among the strongest predictors of market performance.

Lenders—including banks and credit institutions—use leverage and liquidity ratios to evaluate risk before approving loans. A low interest coverage ratio, for example, suggests difficulty meeting debt obligations.

Regulators and auditors also examine ratios to identify red flags for fraud, insolvency, or financial manipulation.

Small business owners benefit as well; by monitoring profitability and liquidity ratios, they can make smarter decisions about pricing, expenses, and capital allocation.

Financial ratios serve as a universal language that connects decision-makers across different areas, ensuring consistency and transparency.

Key Advantages of Financial Ratios

Provide a Clear Snapshot of Financial Health

One of the biggest advantages of financial ratios is their ability to present a clear and concise picture of a company’s financial health. Instead of reading hundreds of line items in financial statements, users can quickly interpret the company’s liquidity, solvency, profitability, and operating efficiency through a handful of ratios.

Liquidity ratios, for example, help determine whether the company can meet short-term obligations, while profitability ratios show how well it converts revenue into profit.

According to Investopedia, financial ratios act as “health indicators,” similar to how blood pressure or heart rate provides insight into a person’s physical condition.

For managers, this snapshot helps detect issues early, such as declining margins or increasing debt levels.

For investors, it clarifies whether a company offers stable returns or faces financial risks. Because ratios summarize complex data in a simple format, they make financial evaluation faster, clearer, and more accessible even for non-experts.

Enable Easy Performance Comparison Over Time

Another advantage of financial ratios is their ability to show trends across multiple periods. By comparing ratios year-over-year (YoY) or quarter-over-quarter (QoQ), analysts can detect patterns that raw financial numbers may not reveal.

For example, a rising ROE over five years signals improving profitability, while a decreasing current ratio may indicate liquidity concerns. Trend analysis helps managers adjust strategies early, long before problems become severe.

Research published in the Journal of Financial Analysis emphasizes that companies that consistently monitor performance trends are more likely to maintain long-term financial stability.

For investors, historical comparison reveals whether a company’s performance is improving or deteriorating, enabling more informed investment decisions.

Comparing ratios over time also eliminates the impact of inflation, currency fluctuations, or one-time events. This makes ratio-based analysis a reliable tool for long-term planning and forecasting.

Help Compare a Company Against Competitors

Financial ratios make benchmarking easier by allowing comparisons between companies regardless of their size or business model.

For example, comparing the profit margin of two manufacturing firms reveals which one manages its production costs better. Industry benchmarking is widely used by CFOs and investment analysts to evaluate competitive positioning.

According to the Corporate Finance Institute, benchmarking through ratios is one of the most accurate ways to assess competitive advantage.

For instance, a company with a higher asset turnover ratio typically uses its resources more efficiently than competitors. Benchmarking also helps investors recognize undervalued or overvalued companies within the same sector.

Even small businesses can use benchmarking to compare their performance with industry averages published by financial advisory firms.

Ultimately, ratio-based comparison ensures objectivity and eliminates size bias, giving companies and investors a clearer understanding of where they stand in the market.

Support Better Decision-Making for Managers

Financial ratios help managers make better decisions by offering quantifiable insights into operational efficiency, financial stability, and profitability. Ratios simplify performance tracking and help managers identify areas that need improvement.

For example, if the inventory turnover ratio declines, managers may reevaluate purchasing strategies or sales processes. Profitability ratios help determine whether pricing strategies are working or whether cost structures need adjustment.

According to McKinsey & Company research, companies that incorporate ratio analysis into strategic planning achieve better financial outcomes and reduce internal inefficiencies. Ratios also support capital budgeting decisions, such as whether to expand operations, invest in new technology, or reduce debt.

When managers rely on data-driven insights rather than intuition, the company experiences more stable growth and improved financial resilience. Because ratios are based on factual financial data, they enhance accountability and transparency during decision-making.

Assist Investors in Evaluating Risk & Profitability

Investors rely heavily on financial ratios to evaluate the risk and return potential of companies before investing. Ratios like ROE, ROA, and profit margin show how effectively a company generates profit from its assets and equity.

Market ratios such as P/E and EPS reveal investor sentiment and expected growth. Morningstar notes that valuation ratios are among the most reliable indicators of long-term investment performance.

Leverage ratios help assess risk by showing how much debt a company carries compared to its equity. High leverage may provide higher returns during good times but increases vulnerability during economic downturns.

Liquidity ratios also help investors evaluate whether a company can survive short-term disruptions.

By analyzing a combination of ratios, investors can make balanced decisions that align with their risk tolerance and investment goals.

Identify Early Warning Signs

Financial ratios can reveal early warning signs of financial distress long before they appear in earnings reports.

For example, a sudden drop in the interest coverage ratio may indicate difficulty paying future debt obligations. A declining quick ratio can signal liquidity issues even if revenues appear stable.

Research published by the American Accounting Association shows that ratio-based models can predict bankruptcy with significant accuracy when combined with qualitative assessment.

Early detection allows managers to correct issues before they escalate, such as renegotiating debt terms, reducing expenses, or improving pricing strategies. Investors also benefit from early warning signs because they can adjust their portfolios to minimize risk.

Banks and lenders use early-warning ratios to prevent loan defaults. For small businesses, monitoring these ratios can prevent cash shortages and help maintain operational stability. Overall, ratios act as a financial alarm system that prevents large-scale failures.

Types of Financial Ratios Used in Analysis

Liquidity Ratios

Liquidity ratios measure a company’s ability to meet short-term obligations. The most common liquidity ratios are the current ratio, quick ratio, and cash ratio.

These indicators help determine whether a company has sufficient current assets to cover liabilities due within a year. For example, a current ratio below 1 may indicate liquidity pressure, while a quick ratio above 1 suggests strong short-term financial stability.

According to Investopedia, liquidity ratios are essential for assessing survival capability during economic uncertainty. Lenders use these ratios to determine whether a business can repay loans without relying on long-term financing.

For small businesses, strong liquidity ratios can attract partnerships and favorable credit terms.

Monitoring liquidity helps companies avoid cash flow shortages, maintain smooth operations, and reduce dependence on external financing.

Profitability Ratios

Profitability ratios evaluate a company’s ability to generate income relative to sales, assets, or shareholders’ equity.

Key profitability ratios include gross margin, net margin, ROA, and ROE. These ratios indicate whether a company effectively manages costs and utilizes assets to create value.

For example, a rising ROE reflects strong management efficiency in delivering shareholder returns. According to Harvard Business School research, profitability ratios are among the strongest indicators of long-term business success.

Investors closely track these ratios to determine whether a company is worth investing in. Managers also use profitability ratios to evaluate pricing strategies, cost control, and resource allocation.

High profitability ratios typically signal strong competitive positioning, while declining ratios may indicate operational weaknesses. Profitability analysis helps businesses identify improvement areas and optimize profit generation.

Leverage Ratios

Leverage ratios measure how much debt a company uses to finance its operations. Common leverage ratios include the debt-to-equity ratio, interest coverage ratio, and debt ratio.

These ratios help analysts assess financial risk, creditworthiness, and long-term stability. For example, a high debt-to-equity ratio may indicate aggressive financing strategies that increase risk during economic downturns.

Lenders use leverage ratios to determine whether a company can handle additional borrowed funds. According to the International Monetary Fund (IMF), companies with moderate leverage tend to exhibit more stable growth and resilience during economic shocks.

Managers rely on leverage ratios to plan capital structure, decide whether to raise funds through debt or equity, and manage interest costs. Investors use leverage insights to evaluate the company’s risk profile and long-term sustainability.

Balanced leverage indicates financial discipline, while excessive leverage raises concerns about solvency.

Efficiency Ratios

Efficiency ratios measure how effectively a company uses its assets and resources to generate revenue. Common efficiency ratios include inventory turnover, receivable turnover, and asset turnover.

These ratios help determine whether the company manages working capital efficiently and how quickly it converts assets into cash.

For example, slow inventory turnover may indicate over-stocking or weak sales, while high asset turnover suggests strong operational efficiency.

Research from McKinsey shows that companies with optimized efficiency ratios achieve higher profitability and stronger competitive advantage.

Managers use efficiency ratios to identify bottlenecks in operations, improve resource utilization, and enhance productivity.

Investors use them to assess whether a company is generating strong returns from its asset base. Overall, efficiency ratios provide valuable insights into the company’s internal processes and operational strengths.

Market Ratios

Market ratios evaluate how the stock market perceives a company’s value and growth potential. Common market ratios include the price-to-earnings (P/E) ratio, earnings per share (EPS), price-to-book (P/B), and dividend yield. Investors rely on market ratios to determine whether a stock is undervalued, overvalued, or fairly priced.

For example, a high P/E ratio may indicate strong growth expectations, while a low P/E ratio may signal undervaluation or weak market sentiment. According to Morningstar, valuation ratios strongly influence long-term stock performance and investor behavior.

Managers also track market ratios to understand investor expectations, guide communication strategies, and improve corporate governance. These ratios help align company performance with market realities and investor confidence.

How Financial Ratios Improve Business Performance

Clarify Strengths and Weaknesses

Financial ratios help companies identify strengths and weaknesses across different areas, such as liquidity, profitability, and operational efficiency.

For example, strong profitability ratios highlight effective cost management, while weak liquidity ratios may suggest cash flow challenges. According to the Harvard Business Review, companies that regularly analyze ratio-based performance are better equipped to handle market fluctuations and competitive pressure.

By pinpointing problem areas early, managers can take corrective action before issues escalate. Investors also rely on ratio insights to evaluate whether a business is fundamentally strong.

The clarity provided by ratios enhances strategic planning, budgeting, and risk management. Companies that consistently review their financial ratios tend to achieve more stable growth, higher profitability, and better resilience during economic downturns.

Improve Resource Allocation

Effective resource allocation is crucial for business success, and financial ratios play a vital role in guiding these decisions. Efficiency and profitability ratios help managers determine which products, services, or departments generate the highest returns.

Companies can shift resources toward high-performing areas and reduce investment in less profitable segments.

Research from McKinsey shows that firms that optimize resource allocation through quantitative metrics outperform competitors in long-term profitability. Ratios like inventory turnover help identify excess stock, while asset turnover guides investment in equipment and technology.

Managers use these insights to implement data-driven budgeting and strategic decision-making. Financial ratios ensure that resources are allocated effectively, minimizing waste and maximizing returns.

Increase Financial Transparency

Financial ratios improve transparency by converting complex financial data into clear, understandable metrics. This transparency is essential for stakeholders such as investors, employees, and lenders who need reliable information to make decisions.

Companies that maintain transparent reporting practices build stronger trust and credibility. According to a Deloitte study, businesses with high financial transparency experience better investor confidence and lower capital costs.

Ratios make it easier to communicate financial performance during presentations, board meetings, and investor reports. They also reduce the risk of misinterpretation because standardized ratios follow universal formulas.

Increasing transparency benefits both internal and external stakeholders by creating a clearer picture of financial performance.

Build Trust with Creditors & Investors (≈160 words)

Creditors and investors rely heavily on financial ratios to determine whether a company is trustworthy and financially stable. Strong liquidity and leverage ratios indicate that a business can manage debt responsibly and meet financial obligations.

According to the World Bank, transparent ratio reporting significantly increases the likelihood of securing financing and achieving favorable loan terms. Investors also use ratios to evaluate risk, growth potential, and return on investment.

When companies maintain healthy ratios and provide accurate reporting, they build long-term credibility. This fosters stronger investor relationships and increases market confidence.

Trust plays a major role in capital markets, and financial ratios are essential tools for demonstrating reliability and accountability.

Limitations of Financial Ratios

Ratios Do Not Show Qualitative Factors

One major limitation of financial ratios is that they do not capture qualitative factors such as brand value, customer satisfaction, employee morale, or management quality.

For example, a company may have strong financial ratios but suffer from poor leadership or weak customer loyalty. According to Harvard Business School, qualitative factors often play a significant role in long-term success but are difficult to measure using financial data alone.

Ratios focus solely on numerical relationships and may overlook important non-financial indicators. To address this limitation, analysts should combine ratio analysis with qualitative assessments such as market research, customer surveys, and leadership evaluations.

This holistic approach provides a more complete understanding of a company’s strengths and weaknesses.

Industry Differences Can Affect Comparison

Financial ratios vary significantly across industries, making it difficult to compare companies without considering industry context.

For example, capital-intensive industries like airlines or telecommunications naturally carry higher debt levels than technology firms. Profit margins and turnover ratios also differ widely between sectors.

According to Investopedia, comparing ratios without industry benchmarks can lead to inaccurate conclusions.

To mitigate this limitation, analysts should compare companies only within the same sector and use industry averages published by financial organizations. This ensures more accurate benchmarking and informed decision-making.

Historical Data May Not Predict Future Performance

Financial ratios are based on historical data, which may not accurately reflect future performance. Sudden market changes, economic downturns, or new competition can quickly alter a company’s financial outlook.

Studies from the American Accounting Association show that relying solely on historical ratios may lead to flawed predictions.

To address this issue, analysts should combine ratio analysis with forward-looking indicators such as economic forecasts, market trends, and strategic initiatives.

This balanced approach provides a clearer view of future opportunities and risks.

Practical Examples of Using Financial Ratios

Example for Small Businesses

A small retail store with declining profits may use financial ratios to identify the root cause. After calculating the gross margin ratio, the owner discovers that margins have fallen due to higher supplier costs.

The inventory turnover ratio also shows slow movement, indicating overstocking. Based on these insights, the owner negotiates with suppliers and adjusts purchasing volumes. As a result, profitability improves.

This example demonstrates how ratio analysis helps small business owners make informed decisions and optimize operations.

Example for Investors

An investor evaluating two technology companies may compare ROE, P/E ratio, and revenue growth.

The first company has a high P/E ratio but declining margins, while the second has stable ROE and consistent growth. Using ratio analysis, the investor determines that the second company offers stronger long-term potential.

This method reduces guesswork and ensures that investment decisions are supported by quantitative data.

Example for Bank Loan Assessment

A manufacturing company applying for a bank loan undergoes financial evaluation. The bank reviews its current ratio, interest coverage ratio, and debt-to-equity ratio.

The results show strong liquidity and healthy interest coverage, indicating that the company can repay the loan.

Based on this analysis, the bank approves the financing. This example illustrates how creditors use financial ratios to assess creditworthiness and minimize risk.

Conclusion

Financial ratios remain essential tools for evaluating a company’s financial performance, risk level, and long-term stability. They provide quick, clear, and comparable insights that help stakeholders make informed decisions. Whether used by managers, investors, or lenders, ratios offer a structured approach to understanding complex financial data. Despite their limitations, financial ratios become more powerful when combined with qualitative assessment and industry knowledge. In a fast-moving business environment, ratio analysis allows companies to detect early warning signs, identify strategic opportunities, and improve resource allocation. For investors, ratios offer a reliable foundation for evaluating profitability and growth potential