Debt To Equity Ratio is one of the most essential financial metrics investors and analysts use to evaluate a company’s financial leverage. Understanding this ratio helps businesses maintain a healthy balance between debt and equity, ensuring long-term stability and sustainable growth. Whether you are a business owner, investor, or financial analyst, knowing how to interpret the D/E ratio can significantly influence your decisions. Visit tipstrade.org and check out the article below for further information

What Is Debt to Equity Ratio?

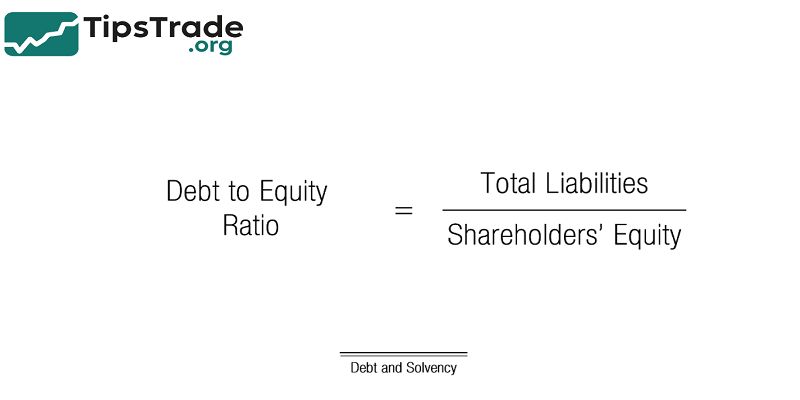

The Debt-to-Equity Ratio measures the relationship between a company’s total liabilities and its shareholders’ equity. It represents how much debt a company is using to fund its assets relative to the value of shareholders’ investments.

Formula:

- Debt−to−EquityRatio=TotalLiabilitiesShareholders’EquityDebt-to-Equity Ratio = \frac{Total Liabilities}{Shareholders’ Equity}Debt−to−EquityRatio=Shareholders’EquityTotalLiabilities

- For example, if a company has $500,000 in total liabilities and $250,000 in shareholders’ equity, the D/E ratio is 2.0. This means the company uses $2 of debt for every $1 of equity.

A higher D/E ratio indicates greater financial risk because the company relies more heavily on borrowed funds, while a lower ratio suggests financial stability and conservative financing.

Components of Debt and Equity

To calculate the ratio accurately, it’s essential to understand what “debt” and “equity” include:

| Component | Description |

| Total Debt (Liabilities) | Includes both short-term and long-term obligations such as loans, bonds, leases, and accounts payable. |

| Shareholders’ Equity | The net value owned by shareholders, including common stock, retained earnings, and additional paid-in capital. |

It’s important to use consistent accounting standards.

For example, financial institutions often carry more debt as part of their business model, so a “normal” D/E ratio for them may look high compared to manufacturing firms.

How to Calculate Debt-to-Equity Ratio

Here’s a simple 3-step approach:

- Find total liabilities on the company’s balance sheet.

- Identify shareholders’ equity, including retained earnings and common stock.

- Divide total liabilities by equity to get the ratio.

Example:

| Item | Amount |

| Total Liabilities | $600,000 |

| Shareholders’ Equity | $400,000 |

| Debt-to-Equity Ratio | 1.5 |

This result means that for every $1 of equity, the company uses $1.5 in debt.

Ideal Debt-to-Equity Ratio: What Is Considered Good?

There’s no universal “perfect” ratio. The acceptable range depends on the industry, business model, and risk appetite:

| Industry | Typical D/E Range |

| Technology / Software | 0.3 – 0.6 |

| Manufacturing | 1.0 – 2.0 |

| Banking / Financial | 2.0 – 5.0 |

| Retail | 0.5 – 1.5 |

In general:

- Low D/E ratio → conservative structure, less risk, but limited growth potential.

- High D/E ratio → aggressive strategy, higher risk, potential for faster expansion.

As Investopedia notes, a ratio below 1.0 is often viewed as financially sound, but this can vary depending on capital intensity.

Why the Debt-to-Equity Ratio Matters

The D/E ratio provides critical insights into a company’s financial health and risk management. Here’s why it matters:

- For Investors: Indicates how much risk is tied to the company’s capital structure.

- For Lenders: Determines creditworthiness and repayment ability.

- For Management: Helps decide how to finance new projects or expansions.

- For Analysts: Allows comparison across firms and industries to assess efficiency.

Companies with extremely high D/E ratios may struggle during downturns, while those with balanced ratios can weather financial challenges more easily.

Advantages of Using Debt-to-Equity Ratio

- Clear leverage indicator: Simplifies complex financial data into one meaningful figure.

- Helps manage risk: Shows if the company is over-leveraged or underutilizing debt.

- Supports decision-making: Guides strategies for borrowing, investment, or dividend policies.

- Benchmarking tool: Useful for comparing companies within the same sector.

By consistently tracking D/E ratios, companies can make informed choices about financing mix and avoid liquidity issues.

Limitations of Debt-to-Equity Ratio

While useful, the ratio has limitations:

- Industry differences: A “high” ratio may be normal in some sectors.

- Accounting variations: Different accounting standards affect how debt and equity are measured.

- Doesn’t reflect cash flow: A firm might have high D/E but strong cash reserves.

- Ignores asset quality: Doesn’t consider how efficiently assets are used to generate returns.

Thus, the D/E ratio should always be analyzed alongside other financial ratios such as interest coverage, current ratio, or return on equity (ROE).

Debt-to-Equity Ratio vs. Other Financial Ratios

Here’s how D/E compares to other key leverage metrics:

| Ratio | Measures | Formula | Focus |

| Debt-to-Equity | Leverage between debt and equity | Liabilities ÷ Equity | Long-term solvency |

| Debt Ratio | Debt as part of total assets | Liabilities ÷ Assets | Overall leverage |

| Equity Ratio | Shareholders’ equity as part of assets | Equity ÷ Assets | Financial independence |

| Interest Coverage Ratio | Ability to pay interest | EBIT ÷ Interest Expense | Short-term debt servicing |

A well-rounded financial analysis should use multiple ratios for accuracy.

How to Improve Debt-to-Equity Ratio

If a company has an unhealthy D/E ratio, it can take the following steps:

- Increase equity through new share issuance or retained earnings.

- Reduce liabilities by repaying high-interest debt.

- Boost profits to strengthen the equity base.

- Convert debt to equity through restructuring or investor agreements.

- Optimize cash flow management to reduce dependency on borrowing.

Practical Tips for Investors

When analyzing a company’s D/E ratio:

- Compare with industry averages, not absolute numbers.

- Check trends over time to see if leverage is increasing or decreasing.

- Review notes in financial statements for hidden liabilities.

- Combine with metrics like ROE, ROA, and EBITDA margin for full context.

An informed investor looks beyond numbers and examines the company’s strategic context.

Conclusion

Debt to Equity Ratio is a crucial indicator of a company’s financial leverage and risk level. It shows the proportion of debt financing relative to shareholders’ equity, helping investors understand how much risk a company is taking to fund its operations. Monitoring the Debt to Equity ratio allows for better assessment of a company’s stability and long-term solvency.