Liquidity ratios are among the important financial metrics that economists need to consider when assessing a company’s financial capacity. In this article, we will examine the most common liquidity ratios and explain how they apply in real-world situations.

What are liquidity ratios?

Liquidity ratios are financial metrics that indicate a company’s ability to repay short-term debts and maintain a balance between current assets and current liabilities. These ratios typically involve comparing assets that can be easily converted into cash. In addition, they provide important information for investors, banks, and company management to assess the business’s financial health, ensuring that the company can meet its financial obligations.

Importance of liquidity ratios

This ratio plays a crucial role in evaluating a company’s short-term financial health. It helps make informed business decisions, minimize risks, and optimize financial management.

- Measuring the ability to pay short-term debts

Liquidity ratios help assess whether a company has sufficient capacity to pay off short-term debts and obligations within a year. This is vital for ensuring financial stability and avoiding the risk of failing to meet financial commitments on time.

- Evaluating the balance between assets and short-term liabilities

These ratios also allow the assessment of the balance between current assets and short-term financial obligations. A balanced financial situation enables a company to sustain its debt repayment capability while optimizing the use of current assets to achieve the best business performance.

- Forecasting and managing financial risks

Liquidity ratios support the forecasting and management of a company’s financial risks. By analyzing these ratios, businesses can identify potential financial issues in the future and implement preventive measures or adjust financial plans accordingly.

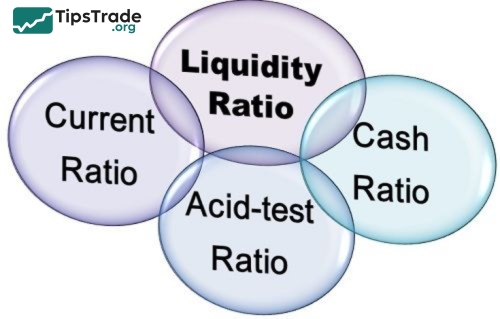

Common types of liquidity ratios

By analyzing various types of ratios, we can gain a better understanding of the company’s short-term financial situation. This is very important for both businesses and other stakeholders such as investors, banks, and business partners. Currently, there are three commonly used types of liquidity ratios:

Current ratio

Current ratio is a useful tool for evaluating a company’s short-term financial situation. It also supports decision-making related to finance, investment, and business operations.

Formula for calculating current ratio

Current Ratio = Current Assets / Current Liabilities

- Current ratio > 1: This indicates that total current assets exceed total current liabilities, showing that the company is capable of meeting its short-term debts and financial obligations. This scenario often reflects a stable financial condition and effective debt repayment capability.

- Current ratio < 1: This indicates that total current liabilities exceed total current assets, meaning the company may face difficulties in paying its debts and financial obligations. This situation poses financial risks and requires careful review and adjustment of financial management to ensure stability.

Advantages and limitations of the current ratio

Every financial ratio has its own strengths and weaknesses. Understanding this information helps investors make informed decisions and develop effective trading strategies.

Advantages of the current ratio:

- Easy to understand and calculate

- Helps forecast financial risks

- Measures the ability to pay short-term obligations

Limitations of the current ratio:

- Lacks detailed insight: A company may have a high current ratio but still face difficulty paying debts if its current assets are not easily convertible to cash.

- Does not consider profitability: This can reduce the ratio’s usefulness in assessing long-term sustainability.

- Impact of depreciation: Depreciation can reduce asset values, which may artificially inflate the current ratio.

- Ignore uncombined current assets: The current ratio does not differentiate between combined current assets (e.g., inventory) and other current assets, which can reduce its accuracy in evaluating payment capacity.

Quick ratio

Quick ratio provides a more accurate view of a company’s ability to meet obligations in emergency situations. However, to gain a complete understanding of the financial condition, it should be used in combination with other financial ratios and information.

Formula for calculating quick ratio

Quick Ratio = (Cash + Accounts Receivables + Marketable Securities) / Current Liabilities

Advantages and limitations compared to current ratio

Advantages over current ratio:

- Focuses on quickly convertible current assets: The quick ratio excludes assets that are not easily convertible to cash (such as inventory) from the calculation. This allows a more precise assessment of the company’s immediate payment capability in urgent situations.

- Measures higher liquidity: By excluding non-liquid assets, the quick ratio provides a faster and more accurate measure of the company’s ability to pay short-term obligations.

Limitations compared to quick ratio:

- Can be affected by a shortage of liquid assets: Unlike the current ratio, the quick ratio only considers assets that can be quickly converted into cash. If a company has few liquid assets, this ratio may not fully reflect its ability to meet obligations.

- Lacks a comprehensive view of financial health: This ratio focuses on immediate short-term payment capacity while overlooking long-term liquidity, which may limit a full understanding of the company’s overall financial condition.

Cash ratio

Cash ratio is a financial metric used to measure a company’s ability to pay its obligations immediately. It focuses solely on cash and cash equivalents, ignoring other current assets.

Formula for calculating cash ratio

Cash Ratio = (Cash + Marketable Securities) / Current Liabilities

Advantages and limitations of the cash ratio

Advantages of cash ratio:

- Measures immediate liquidity: The cash ratio focuses on cash and cash equivalents, allowing a company to assess its ability to pay obligations instantly when necessary. This is particularly useful in emergency situations or during financial difficulties.

- Simple and easy to understand

Limitations of cash ratio:

- Ignores other assets that can be converted into cash

- Does not reflect the company’s profitability

Example liquidity ratios calculations in real life

Below is annual 10-K filing for 2022 of Tesla, Inc:

Based on this information, we can calculate our three most common liquidity ratios as follows:

- Current Ratio = Current Assets / Current Liabilities

= $40.9 billion / $26.7 billion

= 1.53

- Quick Ratio = (Current Assets – Inventory) / Current Liabilities

= ($40.9 billion – $12.8 billion) / $26.7 billion

= $28.1 billion / $26.7 billion

= 1.05

- Cash Ratio = Cash and Cash Equivalents / Current Liabilities

= $16.3 billion / $26.7 billion

= 0.61

As you can see, the general trend is that the current ratio returns the highest number at 1.53, while the cash ratio returns the lowest number at 0.61. This is because the cash ratio is more conservative as it only accounts for cash and cash equivalents and omits other current assets such as inventory or accounts receivable.

What is a good liquidity ratio?

The “ideal” liquidity ratio is highly dependent on the industry and type of business.

Generally, a good liquidity ratio should be above 1.0. This indicates the company has enough current assets to cover its short-term liabilities.

A higher liquidity ratio (above 2.0) shows the company is in a stronger financial position and may have spare cash available for investments or other opportunities.

Advantages and disadvantages when using liquidity ratios

Using liquidity ratios such as the current ratio, quick ratio and cash ratio can present both advantages and disadvantages for businesses. Below are the advantages and disadvantages when using these liquidity ratios:

Advantages when using liquidity ratios

- Guiding financial strategy adjustments: Liquidity ratios provide a clear view of a company’s payment capacity and financial condition. Using these ratios can help businesses adjust their financial strategies and manage resources more effectively to achieve their business objectives.

- Assessing financial health in emergency situations: These ratios also allow companies and investors to evaluate their ability to respond to emergencies. Having a clear understanding of short-term liquidity helps prepare for unexpected financial changes.

- Supporting investment and lending decisions: Liquidity ratios provide important information for investors when assessing risk, as well as the potential profitability of investing in or lending to a company.

Disadvantages when using liquidity ratios

- Does not fully reflect the financial situation: These ratios focus on specific aspects of a company’s finances. They may not provide a complete picture of the overall financial health. Relying too heavily on a single ratio can lead to losing sight of the broader financial situation and the actual risks facing the company.

- Cannot predict the future: Liquidity ratios use historical data and cannot forecast future events. They also cannot anticipate unexpected financial changes. Relying on these ratios without considering variable factors and the current business situation may result in poor decision-making.

- Ratios are not independent: Ratios are often interrelated and can influence each other. A strong result in one ratio may mask underlying issues in other ratios. Relying solely on a single ratio can reduce the ability to see the overall picture and increase decision-making risk.

Conclusion

Tipstrade.org has helped you gain a more comprehensive overview of liquidity ratios in financial analysis of businesses. Beside the advantages, these indicators also face challenges. However, if used correctly, they offer opportunities to support effective financial management. Good luck!