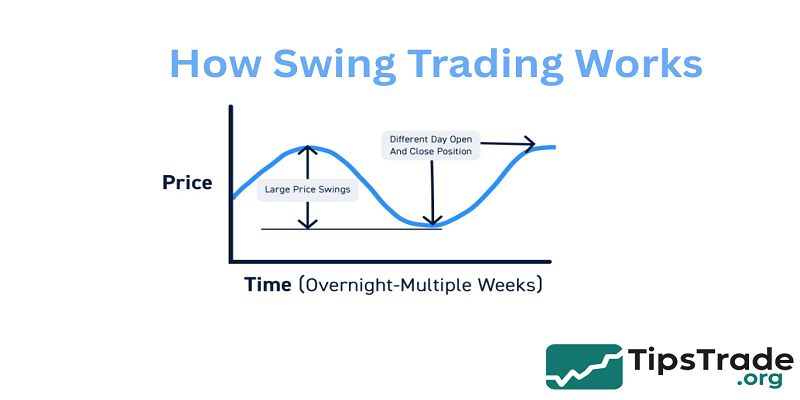

Swing Trading is a short- to medium-term trading strategy that aims to capture gains from “swings” in price movements within an overall trend. Unlike day trading, which requires constant monitoring, swing trading allows traders to hold positions for days or even weeks, capitalizing on market fluctuations without the stress of intraday volatility. Visit tipstrade.org and check out the article below for further information

What is Swing Trading?

Swing trading focuses on capturing short-term price movements in a stock, currency pair, or commodity. Traders typically hold positions from 2 days to 3 weeks to ride the natural swings of the market.

Key characteristics:

- Timeframe: 2 days–3 weeks

- Primary tools: Technical analysis, chart patterns, indicators (RSI, MACD, EMA)

- Market approach: Trend-following or counter-trend trades

For example, a stock trending upward might pull back 5–10% temporarily. A swing trader would enter a buy position during this retracement and hold until the next resistance level is reached.

Swing trading differs from:

- Day trading: Trades opened and closed within the same day

- Position trading: Trades held for months to years

It combines flexibility with the potential for higher profits than long-term investing when executed with discipline.

>>See more:

- Uptrend: Meaning, Signals, and How Traders Use It In Real Market Conditions

-

What are market trends? 3 ways to accurately identify market trends

-

Downtrend provides opportunities for traders to profit through short selling strategies

-

What Is a Sideways Trend? Definition, Causes, and How Traders Profit from It

Swing Trading vs Other Trading Styles

| Trading Style | Timeframe | Objective | Pros | Cons |

| Swing Trading | Days–weeks | Capture short-term swings | Less time-intensive, good risk/reward | Exposure to overnight risk |

| Day Trading | Minutes–hours | Profit intraday volatility | High profit potential, no overnight risk | Stressful, requires constant attention |

| Position Trading | Weeks–months | Capture long-term trend | Less monitoring, more stable | Slower capital turnover, less responsive to news |

Understanding your trading personality and time commitment is essential when choosing the right style. Swing trading provides a middle ground: more flexible than day trading but faster than long-term investing.

How Swing Trading Works

Swing trading relies heavily on technical analysis and chart patterns. The typical workflow includes:

- Identifying the trend: Use EMA, trendlines, or support/resistance levels.

- Finding a retracement: Wait for a pullback or consolidation before entering a trade.

- Confirming entry signals: Indicators like RSI, MACD, or candlestick patterns can validate the trade.

- Setting stop-loss and take-profit: Risk management ensures that losses are controlled, ideally with a risk-to-reward ratio of 1:2 or higher.

Example:

A stock in an uptrend pulls back to the 50-day EMA. RSI indicates oversold conditions. The trader enters a buy trade, sets a stop-loss below the EMA, and takes profit at the next resistance level.

Common Swing Trading Strategies

Swing traders use various strategies depending on their market knowledge, risk tolerance, and time availability.

Moving Average (EMA) Strategy

- Use short-term and long-term EMAs to spot trends

- Buy when the price crosses above EMA, sell when it crosses below

- Works well for trending markets

RSI Strategy

- RSI indicates overbought/oversold conditions

- Buy at RSI < 30 (oversold), sell at RSI > 70 (overbought)

- Helps identify reversal points

MACD Crossover

- MACD line crossing the signal line indicates trend momentum shifts

- Combine with price action for higher accuracy

Fibonacci Retracement

- Identify potential support/resistance during pullbacks

- Useful for setting entry, stop-loss, and take-profit levels

Risk Management in Swing Trading

Risk management is crucial to prevent catastrophic losses. Key principles include:

- Position sizing: Never risk more than 1–2% of your account per trade

- Stop-loss placement: Below support for buys, above resistance for sells

- Diversification: Don’t concentrate all trades on one asset

- Avoid overleveraging: Margin can amplify both gains and losses

- Monitor news: Unexpected events can create gaps overnight

Checklist for risk control:

- Calculate risk/reward ratio before trade

- Set stop-loss automatically

- Keep trade journal for review

- Avoid emotional decision-making

Psychology and Discipline

A successful swing trader must manage emotions:

- Fear: Avoid exiting trades too early

- Greed: Stick to your take-profit targets

- Patience: Wait for confirmation signals

- Consistency: Follow your trading plan strictly

Maintaining a trading journal can help identify mistakes, track performance, and reinforce discipline.

Pros and Cons of Swing Trading

Pros:

- Flexible time commitment

- Medium-term profit potential

- Less stressful than day trading

- Can trade multiple markets (stocks, forex, crypto)

Cons:

- Exposure to overnight and weekend risks

- Requires technical knowledge

- Missed opportunities if trends change rapidly

- Emotional discipline is critical

Common Mistakes New Swing Traders Make

- Overtrading: Entering too many trades without proper analysis

- Ignoring risk management: Not setting stop-loss

- Chasing the market: Buying at tops or selling at bottoms

- Skipping trade review: Failing to learn from past trades

- Neglecting market news: Sudden news can invalidate your technical analysis

Swing Trading in Different Markets

- Stocks: Most popular; large volume and clear trends

- Forex: 24-hour market; volatility provides swing opportunities

- Cryptocurrencies: Highly volatile; requires strict risk control

- Commodities: Gold, oil, and other commodities offer swing trades based on seasonal trends and news

Tip: Always analyze liquidity, volatility, and market hours before choosing an asset for swing trading.

Conclusion

Swing Trading is an effective strategy that aims to capture short- to medium-term price movements within larger market trends. Swing trading allows traders to capitalize on both upward and downward swings by carefully analyzing technical indicators and market patterns to time their entries and exits. Although it requires discipline, patience, and risk management, swing trading offers flexibility and the opportunity to profit from market volatility without the need for constant monitoring like day trading. Mastering swing trading can significantly enhance a trader’s ability to navigate market fluctuations and achieve consistent gains over time. This approach is well-suited for those who prefer a structured yet adaptable trading style that seeks to maximize momentum within established trends.

>>See more: