In Forex, Pip is a fundamental concept that any trader needs to grasp in order to succeed. Understanding the definition of “What is Pip” and how to calculate Pip in Forex not only helps you measure the price changes of currency pairs but also assists in calculating profits, losses, and effectively managing risks. This article will explain in detail about Pip, its role in trading, how to accurately calculate Pip, along with practical examples and useful tips to apply in trading strategies.

What is Pip in Forex?

In the world of Forex trading, understanding the definition of “what is pip” is very important. Accordingly, Pip is an abbreviation for the phrase “percentage in point” and is considered the smallest price movement of a currency pair. This unit of measurement is fundamentally important in the Forex market, as it helps traders perceive changes in value between two currencies.

A Pip is usually a movement of 1 digit at the 4th decimal place of most currency pairs.

Example of “what is pip” in forex:

For the EUR/USD pair, if the price fluctuates from 1.1050 to 1.1051, then the change of 0.0001 USD is called 1 Pip. However, the Japanese Yen has an exception; for pairs that include JPY, a Pip is calculated as a fluctuation at the second decimal place. If the USD/JPY pair fluctuates from 110.40 to 110.41, it is referred to as a fluctuation of 1 Pip.

>>See more:

- What is Forex? The Complete Guide for Beginners

- What are exchange rates? How to read and analyze rates in Forex

What is a Pipette/Point?

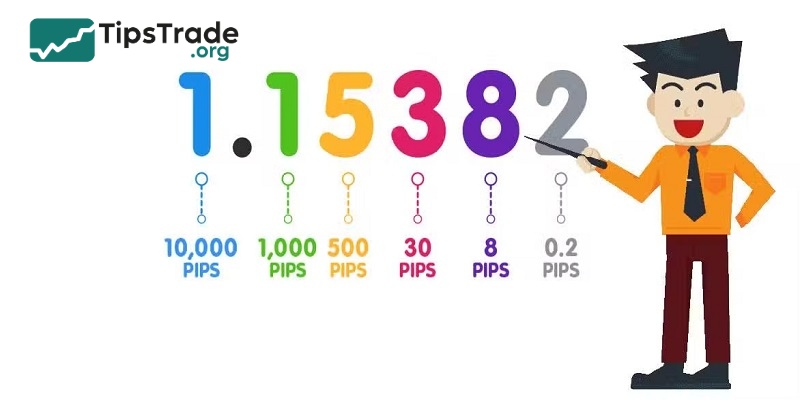

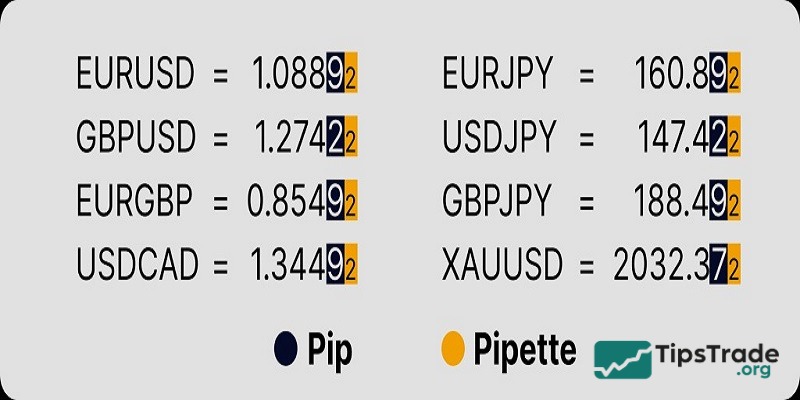

Some forex trading platforms provide more accurate quotes, often up to five decimal places instead of four. In this case, the fifth decimal place is called a Point or Pipette or Fractional Pip, equivalent to 1/10 of a Pip.

For example: If EUR/USD changes from 1.10500 to 1.10505, that is 5 Pipette or 5 Point or 0.5 Pip.

How to calculate Pip in Forex Trading

Now that you understand the definition of ‘what is pip”, how do you calculate pip? To calculate Pip, you need to understand the value of Pip and how it is applied in trading. Below is a step-by-step guide:

Step 1: Determine the value of 1 Pip

The value of 1 Pip depends on:

- The currency pair you are trading.

- The Lot Size of the trade.

- The currency of your account.

The basic formula to calculate the Pip value is:

Pip value = (1 Pip / Exchange rate) x Lot size

For example:

- You trade 1 standard lot (100,000 units) of the EUR/USD pair, the current exchange rate is 1.1050, and your account is in USD.

- 1 Pip of EUR/USD = 0.0001.

- Pip value = (0.0001 / 1.1050) x 100,000 = 9.05 USD.

This means that each Pip movement will result in a profit or loss of approximately 9.05 USD when trading 1 standard lot.

Step 2: Calculate profit or loss

After knowing the Pip value, you can calculate profit or loss using the formula:

Profit/Loss = Number of Pips x Pip Value

For example:

- You buy 1 lot of EUR/USD at 1.1050 and sell at 1.1080.

- Number of Pips earned = 1.1080 – 1.1050 = 0.0030 = 30 Pips.

- Profit = 30 Pips x 9.05 USD = 271.5 USD.

Step 3: Adjust according to lot size

In Forex, you can trade with different lot sizes:

- Standard Lot: 100,000 units.

- Mini Lot: 10,000 units.

- Micro Lot: 1,000 units.

The value of a Pip will change according to the lot size. For example, with 1 mini lot or 0.1 lot EUR/USD, the value of a Pip will be 0.905 USD instead of 9.05 USD.

Note on currency pairs related to JPY

For currency pairs like USD/JPY, a Pip is the second decimal place (0.01). The formula for calculating Pip value will be slightly different:

Pip Value = (0.01 / Exchange Rate) x Lot Size

For example:

- If you trade 1 lot of USD/JPY, and the exchange rate is 109.50.

- Pip Value = (0.01 / 109.50) x 100,000 = 9.13 USD.

Factors influencing Pip values

Leverage

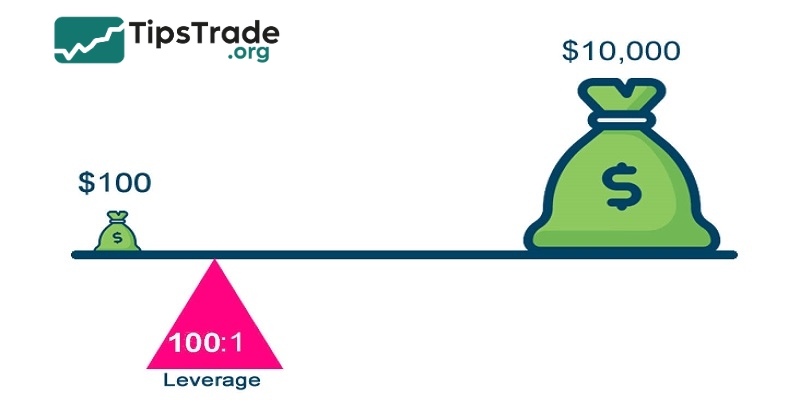

Leverage is when you borrow funds from a broker to increase your trading exposure and the size of your position beyond the available cash balance. The higher the leverage used on a position, the greater the risk.

Combining a high-leverage position with Pip can lead to a significant decrease in the value of the investment, even if Pip only drops a few points. This is because as the trading value increases, the value of Pip also rises, which can quickly wipe out the investment sooner than expected.

Volume

Trading volume refers to the amount of currency pairs traded in the forex market within a specific time period. It directly affects the Pip value in forex, meaning the larger the trading volume, the more profit earned from Pips.

For example: If the market moves 50 Pips in your favor with a lot size of 100,000 units, the Pip value per unit will be 100,000 * 0.0001 = 10 USD. Thus, 50 Pips will yield a profit of 50 * 10 USD = 500 USD.

Conversely, if the trading volume is smaller, say only 10,000 units, the Pip value per unit will also be much lower = 10,000 * 0.0001 = 1 USD.

Type of currency pair

Since all fluctuations of currency pairs are measured in Pips, the value of a single Pip will vary for each currency pair. This is because the exchange rate of each currency pair is also different.

Importance of Pip in Forex

What is pip? Understanding the importance of pips in Forex trading is essential for every trader, as it is the foundation for making informed trading decisions:

Understanding market movements

Pip helps traders grasp the volatility of the market.

For example: A currency pair with large and frequent Pip fluctuations can be an indicator of high volatility. Traders will use this information to adjust their strategies accordingly, either to take advantage of the opportunities from that volatility or to avoid potential risks.

Profit and Loss calculation

Pip is directly related to estimating the potential profit or loss of a trade.

For example: A person buys EUR/USD at 1.1200 and sells at 1.1250, so they have made 50 Pips. The financial benefit will depend on the value of the Pip, which is determined by the lot size of that trade.

Risk management

Pips play a crucial role in risk management. Traders determine their risk tolerance based on pips and set their stop-loss orders accordingly.

For example: Suppose a person buys EUR/USD at 1.1200 and sets a stop-loss order at 1.1180, with a potential risk of losing 20 pips. If each pip is worth 10 USD, then the trader is at risk of losing 200 USD on that trade. This calculation is essential in shaping and managing the trader’s risk tolerance.

Top Forex Pip trading strategies

50 Pips a day

In the forex trading strategy of 50 Pips per day, traders will open and close multiple positions within the same day instead of investing long-term. This strategy is suitable for day traders, who seek frequent short-term profits. It helps capture at least 50% of the price range that currency pairs move within a trading day.

You need to observe the chart closely as soon as a candle closes in a specific timeframe during the day. After the candle closes, you can place a buy pending order and a sell pending order. Specifically, set the buy stop order 2 Pips above the highest price point and the sell stop order 2 Pips below the lowest price point, to ensure you can profit regardless of whether the market goes up or down.

One of the two pending orders will be activated when the currency pair’s price fluctuates, and at that point, you can cancel the opposite order to take advantage of the price movement.

- The take profit order can be set at a target of 50 PIPs.

- The stop-loss order for risk management can be set at about 10 PIPs above the highest price point or below the lowest price point.

If the profit target is reached, your trade for the day is considered complete. However, if the currency pair’s price does not hit the profit target, you should exit the order before the trading day ends by moving the order to the stop-loss point or breakeven point. Each successful trade with this strategy will yield a profit of at least 50 PIPs, equivalent to $0.005 per PIP, meaning that with a standard lot of 100,000 units, you will earn $500.

30 Pips a day

In the 30 PIPs per day forex trading strategy, you can profit from highly volatile currency pairs in the market such as GBP/JPY, AUD/JPY, GBP/AUD, GBP/NZD, and many others. The 5-minute time frame is the most suitable for this strategy as it provides clear reversal points when necessary.

The 30 PIPs per day strategy is based on the 10-period Exponential Moving Average (EMA) and the 26-period EMA.

When the 10-period EMA crosses above the 26-period EMA, it is a signal to enter a trade, indicating the market’s direction. The price of the currency pair will begin to move in the direction indicated by the EMA lines to confirm market sentiment.

You can open a position at the high or low price point as soon as the market makes a short-term correction, aiming to capture a price range that can yield profit after the correction.

This strategy only applies at retracement levels, as the market trend often reaffirms itself at these points, creating the highest success rate.

- A sell position can be opened in a downtrend when the 10-period EMA crosses below the 26-period EMA and continues to decline.

- A buy position can be opened in an uptrend when the 10-period EMA crosses above the 26-period EMA and continues to rise.

- The stop-loss order can be set about 20 PIPs above the sell level.

- The take profit order can be set about 40 PIPs above the sell level.

Conclusion

Hopefully, this article has provided you with a comprehensive and detailed overview of the topic “What is Pip” in Forex. If you’re a new trader, start by practicing on a Demo account and familiarize yourself with the calculation tools. And if you’re an experienced trader, use Pip to optimize your trades and manage your capital more effectively. Wishing all traders successful trading!