Fundamental Analysis books provide essential knowledge for investors to evaluate the intrinsic value of stocks and make informed investment decisions. Fundamental analysis focuses on examining a company’s financial statements, business model, management quality, and market position to assess its true worth beyond market price fluctuations. These books often cover key techniques such as income statement and balance sheet analysis, valuation frameworks, and risk assessment, which are crucial for long-term investing success. Visit tipstrade.org and check out the article below for further information

What Is Fundamental Analysis?

Fundamental analysis is the process of evaluating a company’s real financial health to determine whether its stock price is undervalued or overvalued. Instead of following market noise, investors study revenue, profit, debt, industry trends, and competitive advantages.

The goal is to find companies with strong fundamentals and a long-term growth potential. This approach is used by long-term investors, mutual funds, financial analysts, and hedge funds. In contrast, day traders often rely on technical charts, short-term news, or price momentum.

Fundamental analysis helps investors avoid emotional decisions and create a long-term strategy based on data. Many investors consider it the foundation of value investing, popularized by Benjamin Graham and Warren Buffett.

By understanding a company’s intrinsic value, investors can buy great companies at fair or discounted prices, increasing the chance of long-term profits and reducing risk.

Definition and Why It Matters

Fundamental analysis studies the “business behind the stock.” A stock is not a lottery ticket—it represents ownership in a company. When the business performs well, shareholders benefit.

This method matters because markets are not always logical in the short term. Prices fluctuate due to sentiment, panic, or speculation. However, in the long term, companies with strong earnings, cash flow, and sustainable competitive advantages usually see their share prices rise.

For example, Apple, Coca-Cola, or Microsoft built lasting value through products, profits, and brand power—not sudden hype. This is why books on fundamental analysis help investors build financial literacy instead of gambling.

Many financial educators, including CFA Institute and Investopedia, recommend beginners start with fundamental concepts to make smarter decisions.

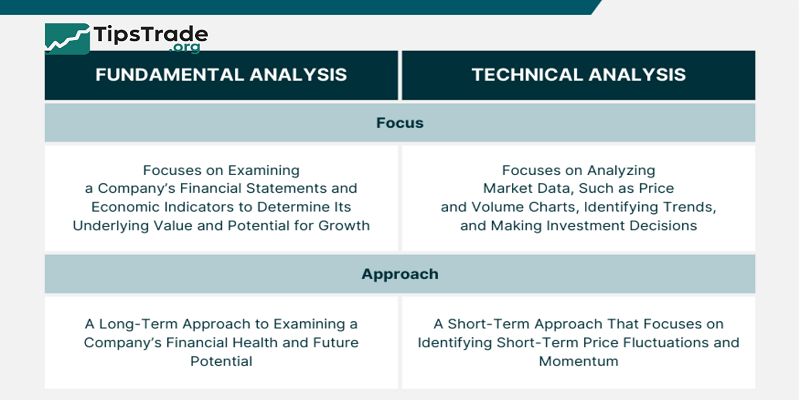

Fundamental vs. Technical Analysis

| Factor | Fundamental Analysis | Technical Analysis |

| Focus | Business performance, earnings, valuation | Price charts, patterns, momentum |

| Time Horizon | Long-term | Short-term |

| Used by | Investors, analysts, fund managers | Day traders, swing traders |

| Goal | Find intrinsic value | Predict price movement |

Fundamental analysis answers: “Is this business worth investing in?” Technical analysis answers: “When should I buy or sell?”

Who Should Read Fundamental Analysis Books?

Fundamental analysis books are suitable for many types of learners. Beginners use them to understand how the financial world works and why some companies succeed while others fail.

University students in finance, accounting, or business use these books to learn how to evaluate real companies and prepare for careers in investment banking or equity research. Long-term investors use them to build disciplined strategies instead of chasing meme stocks or social media trends.

Even experienced traders benefit from understanding financial quality and valuation. Many retail investors who learned from these books improved their portfolios by avoiding companies with weak balance sheets or unrealistic growth expectations.

These books are also valuable for anyone interested in Warren Buffett’s approach, because most value investing strategies come directly from Graham, Fisher, or Dorsey—authors featured below.

Do Beginners Need a Financial Background?

A financial background is helpful, but not required. Many books on this list are written in simple language so ordinary investors can understand financial statements, valuation, and competitive advantage.

For example, “One Up on Wall Street” explains how Peter Lynch, a legendary fund manager, used common-sense observations to find great companies. “The Little Book That Still Beats the Market” teaches valuation through an easy formula even teenagers can understand.

Beginners can start with simple books, then move to advanced ones like McKinsey’s “Valuation” or CFA Institute’s textbooks.

Common Mistakes When Self-Learning

New investors often read theory but never apply it. They may understand concepts like PE ratio or cash flow but fail to analyze real companies.

Another mistake is focusing only on stock price, ignoring debt, management quality, competition, or long-term growth. Some beginners jump straight into advanced valuation and get overwhelmed.

The best approach is to learn fundamentals step by step and practice analyzing companies you know—consumer brands, tech firms, or banks in your local market.

Top 12 Best Fundamental Analysis Books for Beginners

The Intelligent Investor — Benjamin Graham

Often called “the bible of value investing,” this book teaches the foundations of safe, long-term investing.

Graham explains concepts like intrinsic value, margin of safety, and investor psychology. Instead of chasing quick returns, the book encourages patience and discipline.

Warren Buffett has repeatedly stated that this is the best book ever written on investing.

What you learn:

- How to evaluate a company’s real worth

- Why emotional decisions cause losses

- How to avoid speculation and financial bubbles

Strengths: Timeless principles, clear mindset training

Weakness: Long and academic, not ideal for impatient readers

Security Analysis — Benjamin Graham & David Dodd

- This advanced book is often used in finance programs and by professional analysts. It goes deeper into valuation, financial statements, and risk.

- Although the writing style is old-fashioned, the lessons are still relevant. Investors who read this book learn to separate good businesses from dangerous ones by studying assets, cash flow, and earnings quality.

Common Stocks and Uncommon Profits — Philip Fisher

- Philip Fisher focuses on growth companies. Instead of looking only at numbers, he analyzes management quality, innovation, and competitive strategy.

- This book teaches the “scuttlebutt” method—gathering information from suppliers, customers, and employees.

- Many modern growth investors, including Warren Buffett, applied Fisher’s ideas when choosing companies like Apple and Coca-Cola.

One Up on Wall Street — Peter Lynch

- Peter Lynch managed the Magellan Fund and achieved legendary returns.

- This book teaches beginners to observe real life—products you use, stores that are always crowded, brands young people love.

- If the business performs well in real life, it might be a good stock. Lynch shows how ordinary people can spot great opportunities before Wall Street notices them.

Strengths: Easy to read, full of real examples.

Weakness: Some examples are dated but the principles remain valid.

The Little Book That Still Beats the Market — Joel Greenblatt

- A short, fun, and practical book that explains valuation through a simple “magic formula.” Many young investors begin here because the writing style is friendly and humorous.

- It shows how to rank companies based on earnings yield and return on capital.

- Even though the formula is simple, many hedge funds apply similar concepts in real life.

Financial Statements

- This book teaches beginners how to read income statements, balance sheets, and cash-flow statements.

- Understanding financial statements is the heart of fundamental analysis.

- Investors who learn this skill can avoid companies with fake profits, high debt, or weak cash flow. The book uses simple examples and avoids complex theory.

Best Advanced & Professional-Level Fundamental Analysis Books

Valuation — McKinsey & Company

- Considered a global standard for professional valuation, this book is used in investment banks, consulting firms, and MBA programs.

- It explains discounted cash flow (DCF), risk analysis, and capital structure.

- Although the content is technical, investors who understand valuation can identify whether a stock is truly cheap or just appears cheap.

Equity Asset Valuation — CFA Institute

- This textbook is part of the CFA curriculum, trusted by analysts around the world.

- It covers valuation models, industry analysis, and macroeconomic factors.

- Many professional analysts use this as a reference for research reports.

- The explanations are practical and backed by real data.

Investment Valuation — Aswath Damodaran

- Damodaran is one of the world’s leading valuation professors, teaching at NYU. His book provides case studies of companies like Amazon, Tesla, and Disney.

- The book is technical but very useful for serious investors.

- His valuation methods are respected globally and often used by equity research teams.

The Interpretation of Financial Statements — Benjamin Graham

- A shorter alternative to Security Analysis, this book focuses on understanding real numbers.

- It teaches how to spot accounting tricks, weak earnings, or debt problems.

- Many investors use this book to avoid dangerous stocks that look good on the surface but are financially unhealthy.

The Five Rules for Successful Stock Investing — Pat Dorsey

- Written by Morningstar’s former equity research director, this book explains how to evaluate competitive advantages (economic moats).

- It shows why companies with strong brands, patents, cost advantages, or network effects outperform the market.

- Many case studies are included, helping readers apply theory in real-life markets.

Best Books Used by Warren Buffett & Famous Investors

Many successful investors were shaped by the books above. Warren Buffett has publicly recommended The Intelligent Investor, Security Analysis, and Common Stocks and Uncommon Profits.

Charlie Munger prefers business-focused books like “Business Adventures.” Peter Lynch’s books inspired generations of retail investors to find opportunities in daily life.

What makes these books special is their long-term wisdom. Markets change, technology evolves, but human behavior—fear, greed, overconfidence—remains the same. Value investing works because it relies on real business results, not speculation.

Reading the same books as legendary investors gives learners a rare chance to understand how professionals think.

Comparison Table: Which Book Fits Your Level?

| Book | Level | Best For | Difficulty | Focus |

| The Intelligent Investor | Beginner | Long-term investing mindset | Medium | Value investing, psychology |

| One Up on Wall Street | Beginner | Retail learning | Easy | Real-life opportunities |

| Valuation (McKinsey) | Advanced | Professionals, analysts | Hard | DCF, corporate finance |

| Investment Valuation | Advanced | Serious learners | Hard | Case studies, financial modeling |

How to Choose the Right Fundamental Analysis Book

Choosing the right book depends on your learning style and experience. If you prefer simple explanations and real examples, start with Peter Lynch or Joel Greenblatt.

If you want deep theory or plan to become a financial analyst, McKinsey or CFA textbooks are better. Growth-focused investors can learn from Philip Fisher, while value investors should read Benjamin Graham.

Some people start with simple books to build confidence, then move to advanced valuation.

Beginner vs Intermediate vs Advanced

- Beginner: simple language, real examples, short chapters

- Intermediate: more accounting concepts, valuation basics

- Advanced: modeling, DCF, competitive strategy, market economics

Value vs Growth Books

- Value investing books: Graham, Dorsey, Buffett style

- Growth investing books: Fisher, Lynch

What You Will Learn From These Books

After reading these books, investors can:

- Read financial statements correctly

- Understand revenue, margin, and EPS growth

- Evaluate management quality

- Identify durable competitive advantages

- Avoid overpriced or risky companies

- Estimate intrinsic value

Real investors who apply these skills often make better decisions than those who rely on rumors. The ability to analyze numbers and business strategy improves long-term success

Conclusion

Fundamental Analysis books serve as invaluable guides for both beginners and experienced investors to deepen their understanding of stock valuation and investment strategy. By studying these books, investors can develop the skills needed to identify undervalued stocks, understand market behaviors, and apply concepts like margin of safety and value investing. Ultimately, mastering the principles taught in these books helps investors build a disciplined approach to investing, minimizing speculation and maximizing potential returns over time.