Stock brokers play a crucial role in the financial market as intermediaries between investors and stock exchanges. They not only facilitate the buying and selling of shares but also provide valuable services such as market analysis, investment advice, and portfolio management support. Understanding the function and importance of stock brokers helps investors make more informed and effective decisions in the stock market. Visit tipstrade.org and check out the article below for further information

What Is a Stock Broker?

A stock broker (or registered representative) is an intermediary who helps clients buy and sell securities such as stocks, bonds, mutual funds, ETFs, and derivatives.

Brokers must be registered with a regulatory body—like the Financial Industry Regulatory Authority (FINRA) in the U.S.—and work under a licensed broker-dealer.

Brokers act on clients’ instructions, earning compensation through:

- Commissions (per trade or per transaction)

- Spreads or markups on trades

- Advisory or management fees (for managed portfolios)

Traditionally, stock brokers operated on trading floors or via phone calls. However, since the late 1990s, digital platforms have revolutionized access—enabling anyone with a smartphone to trade within seconds.

This democratization of investing has made brokers not only execution agents but also financial educators and strategic partners.

See more:

- Impact of Macroeconomic Factors on Stocks

- What is bid ask spread? Factors that influence bid ask spread

- Fundamental Analysis Stocks: Everything Investors Need to Know

- Technical Analysis for Stocks: The Complete Guide for Modern Investors

How Stock Brokers Work

Every broker operates through a brokerage account—an investment account that holds cash and securities for a client. When you place a trade (for example, to buy 10 shares of Apple), your broker:

- Routes your order to the exchange or market maker.

- Executes the order at the best available price.

- Hold your purchased securities in your account.

Behind the scenes, brokers manage complex systems that ensure trade accuracy, compliance, and liquidity access. Depending on the brokerage model, they may also offer:

- Margin accounts (borrowed money to trade)

- Research reports and analyst recommendations

- Educational content and trading simulators

In the U.S., brokers must comply with regulations set by the Securities and Exchange Commission (SEC) and FINRA, ensuring investor protection and transparency.

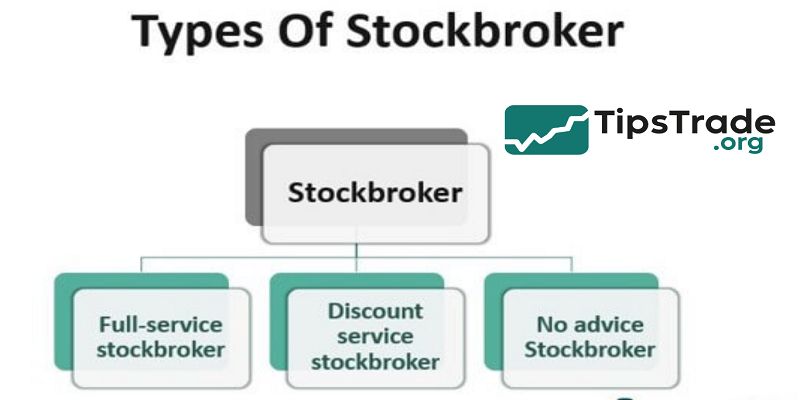

Types of Stock Brokers

Not all brokers are the same. The brokerage landscape can be broadly divided into three main categories—each serving a distinct investor profile.

Full-Service Brokers

Full-service brokers, such as Morgan Stanley, Merrill Lynch, or Charles Schwab (advisory division), provide a comprehensive suite of financial services. These typically include:

- Personalized financial advice

- Retirement and estate planning

- Access to IPOs and alternative investments

- Dedicated human advisors

They are ideal for high-net-worth individuals (HNWIs) or investors seeking hands-on portfolio management.

However, their fees are often significantly higher—ranging from 1% to 2% of assets under management (AUM) annually, or higher transaction commissions.

Discount Brokers

Discount brokers emerged during the 1990s with the rise of the internet. Firms like E*TRADE, TD Ameritrade, and Fidelity popularized self-directed investing by lowering commission costs.

They focus on trade execution rather than financial advice, offering:

- Online platforms for DIY trading

- Lower or zero commissions

- Access to research tools

These brokers appeal to active traders and cost-conscious investors who prefer independence.

The average account fees are minimal, and most trades today are commission-free, thanks to competitive market forces.

Online and App-Based Brokers

The newest generation—such as Robinhood, We bull, or Sofi Invest—operates primarily via mobile apps, targeting younger, tech-savvy investors. Features often include:

- Fractional shares

- Zero-commission trading

- Real-time notifications

- Integration with banking services

While these platforms have democratized investing, critics warn of over-trading risks and lack of personalized guidance. Regulatory scrutiny around gamification and risk disclosure has also intensified since 2020.

Key Functions of a Stock Broker

Beyond executing trades, brokers provide a wide range of essential market functions:

| Function | Description | Example |

| Order Execution | Places clients trade accurately and quickly on exchanges. | Buying 50 shares of Tesla at market price. |

| Research & Analysis | Offers insights, reports, and recommendations. | Morningstar, Schwab Equity Ratings. |

| Portfolio Management | Helps clients rebalance holdings and manage risk. | Personalized ETF portfolios. |

| Advisory Services | Gives tailored financial advice or planning. | Retirement or tax-efficient strategies. |

| Margin & Leverage | Provides credit for margin trading. | 2:1 leverage accounts. |

A reliable broker thus acts as both execution partner and financial guide—helping investors make informed decisions with data-driven insights.

Stock Brokers vs. Investment Advisors

Although the terms are sometimes used interchangeably, stock brokers and investment advisors serve distinct purposes.

| Criteria | Stock Broker | Investment Advisor |

| Role | Executes trades for clients | Provides advice and manages portfolios |

| Regulation | FINRA | SEC / State regulators |

| Compensation | Commission-based | Fee-based (AUM or flat fees) |

| Fiduciary Duty | Suitability standard | Fiduciary standard |

The main distinction lies in the fiduciary obligation. Advisors must always act in the client’s best interest, while brokers are only required to recommend “suitable” products. Many modern firms, however, combine both under hybrid models (e.g., Charles Schwab, Fidelity, Vanguard).

How to Choose the Right Stock Broker

Selecting a broker is a critical decision that shapes your investment experience. Here’s a practical checklist based on investor needs:

Determine Your Investment Style

- Passive investor → Prefer brokers offering ETFs, robo -advisors, and automatic rebalancing.

- Active trader → Look for platforms with advanced charting, low spreads, and instant execution.

- Long-term investor → Choose firms offering research tools, financial planning, and tax optimization.

Compare Fees and Commissions

Check for:

- Account maintenance fees

- Trading commissions (if any)

- Margin interest rates

- Transfer or inactivity fees

Even small differences can erode returns over time. For example, a 1% annual fee can reduce long-term returns by over 25% in 30 years.

Evaluate Tools and Research Access

Modern brokers provide:

- AI-driven portfolio analysis

- Analyst ratings

- Real-time market data

- Third-party integrations (like Morningstar or Bloomberg)

Assess Customer Support and Education

New investors benefit from brokers offering:

- 24/7 support

- Demo or paper trading accounts

- Educational webinars and tutorials

Check Regulation and Security

Ensure your broker is registered with:

- FINRA / SEC (U.S.)

- FCA (U.K.)

- ASIC (Australia)

- MAS (Singapore)

Also confirm that assets are insured (e.g., SIPC coverage up to $500,000 in the U.S.).

Online vs Traditional Brokers

| Feature | Online Broker | Traditional Broker |

| Platform | Web & Mobile Apps | Office or phone-based |

| Commissions | Usually $0 | Higher, often per trade |

| Advice | Self-directed | Personalized advisory |

| Speed | Instant execution | Manual processing |

| Ideal For | DIY investors | High-net-worth clients |

The rise of commission-free trading has blurred the lines between online and traditional brokers.

Today, many full-service firms offer hybrid solutions, combining automated tools with access to human advisors.

Regulation and Licensing

Brokerage firms must meet strict compliance and licensing requirements before serving clients.

Key U.S. authorities include:

- SEC (Securities and Exchange Commission) – Oversees securities markets.

- FINRA (Financial Industry Regulatory Authority) – Regulates broker-dealers.

- SIPC (Securities Investor Protection Corporation) – Provides insurance protection for client assets.

Investors can verify a broker’s record through FINRA’s Broker Check database to review disciplinary history or licensing status.

Regulatory oversight ensures fair dealing, transparency, and investor safety.

How Brokers Earn Money

Modern brokers generate revenue through various channels beyond traditional commissions:

- Payment for Order Flow (PFOF): Market makers pay brokers to route trades through them—a practice that reduces costs for investors but raises transparency concerns.

- Margin Interest: Brokers lend funds to traders using leverage, earning interest.

- Asset Management Fees: For advisory accounts, typically 0.25%–1% annually.

- Securities Lending: Lending out client-held shares to short sellers.

- Premium Features: Subscriptions for research or advanced analytics.

While most brokers now advertise “commission-free trading,” these other revenue models sustain their operations.

The Role of Technology in Brokerage Evolution

Technology has redefined brokerage operations:

- AI-powered insights personalize portfolios.

- Algorithmic trading enables faster and more efficient execution.

- Blockchain promises transparent settlement and ownership tracking.

- APIs allow fintech apps to integrate with brokers directly.

According to a 2024 Statista report, over 80% of retail trades in the U.S. are executed online, reflecting how mobile-first investing has become mainstream.

Common Mistakes Investors Make When Choosing a Broker

- Ignoring fees and spreads → Small costs compound significantly.

- Overtrading due to app notifications → Behavioral bias leads to poor timing.

- Choosing based on brand only → Always verify service quality and platform tools.

- Neglecting regulation → Unregulated brokers can risk your funds.

- Skipping demo testing → Always test the interface before depositing money.

Best Practices for Working with a Broker

To maximize returns and maintain control:

- Review statements regularly for accuracy.

- Set clear risk parameters with your advisor.

- Use limit orders to control trade prices.

- Diversify across asset classes.

- Communicate regularly with your broker about financial goals.

A disciplined approach, combined with a transparent broker relationship, enhances long-term success.

Future of Stock Brokers

The brokerage industry continues to evolve rapidly. Key trends shaping the future include:

- AI-driven personalization: Predictive analytics tailor investment recommendations.

- Fractional investing: Enables micro-investments starting from $1.

- Sustainable finance: Growing investor demand for ESG portfolios.

- Zero-commission and decentralized trading: Increasing accessibility and competition.

However, as automation expands, the human element of trust and fiduciary care remains irreplaceable. Investors still seek brokers who can interpret market complexity through experience and integrity.

Conclusion

Stock brokers are indispensable in the process of stock investing. They create opportunities for smooth transactions and assist investors in optimizing profits while managing risks. Choosing a reliable and suitable stock broker is essential for achieving success in the stock market.

>>See more: