Stock market definition refers to the organized system where buyers and sellers trade shares of publicly listed companies. It plays a crucial role in the global economy by providing a platform for companies to raise capital and for investors to potentially earn returns. Understanding the stock market definition helps individuals grasp how financial markets operate and influence economic growth. Visit tipstrade.org and check out the article below for further information

What Is the Stock Market?

- The stock market is a network of exchanges where investors buy and sell shares of publicly traded companies.

- In essence, it is the marketplace for ownership stakes in businesses.

- Each share represents a fraction of a company’s equity, and the market provides a mechanism for investors to trade those ownership units.

- When someone refers to “the stock market,” they may mean the overall system of markets (like the U.S. stock market) or a specific exchange (like the New York Stock Exchange (NYSE) or NASDAQ).

- According to the CFA Institute, the stock market acts as a bridge between companies seeking capital and investors seeking returns through ownership.

- Unlike informal transactions, stock markets are regulated, transparent, and centralized, ensuring that all participants have access to similar information.

- They are driven by supply and demand: when more people want to buy a stock, its price rises; when more want to sell, it falls.

>>See more:

- What is Industry Comparison and How to do it?

- What are Profitability Ratios? Types & Its Significance

- Key Stock Valuation Ratios and When to Use Which One

- How to Read Financial Statements Like a Pro in Stock Investment

Stock Market vs. Stock Exchange

While the terms “stock market” and “stock exchange” are often used interchangeably, they aren’t identical.

- Stock Market refers to the overall system of buying and selling shares across all exchanges.

- Stock Exchange is a specific venue where the trading takes place (e.g., NYSE, NASDAQ, London Stock Exchange).

For instance, Apple Inc. trades on NASDAQ, while companies like Coca-Cola list on the NYSE. Together, these exchanges make up the broader U.S. stock market.

Think of it like this: the “stock market” is the global financial ecosystem; the “stock exchanges” are the individual marketplaces within it. Both are crucial in facilitating investment flows and liquidity.

A Brief History of the Stock Market

- The origins of the stock market date back to the 1600s with the establishment of the Amsterdam Stock Exchange, often regarded as the world’s first official exchange. The concept spread rapidly as trade and capitalism expanded.

- The New York Stock Exchange, founded in 1792 under the Buttonwood Agreement, became the cornerstone of American capitalism.

- Over centuries, technology transformed trading—from open outcry floors to high-speed electronic systems.

- Today, global exchanges like NASDAQ, the London Stock Exchange, and Tokyo Stock Exchange handle billions of dollars in daily volume.

- Despite evolution in technology, the core purpose remains unchanged: connecting capital seekers with investors.

How the Stock Market Definition Works

At its core, the stock market enables companies to raise capital and investors to gain ownership in those companies. The market operates through two main segments: the primary market and the secondary market.

Primary Market vs. Secondary Market

- Primary Market: This is where new shares are created through Initial Public Offerings (IPOs).

- Companies issue stock to raise funds for growth, expansion, or debt repayment. Investors buy shares directly from the issuing company.

- Secondary Market: Once issued, those shares are traded among investors on exchanges.

- Companies do not receive money from these transactions; instead, ownership simply changes hands.

For example, when Tesla first sold shares in its IPO in 2010, it was a primary market transaction. Today, when investors trade Tesla shares on NASDAQ, those trades occur in the secondary market.

This two-tiered structure ensures liquidity—allowing investors to buy or sell ownership without dealing directly with the issuing company.

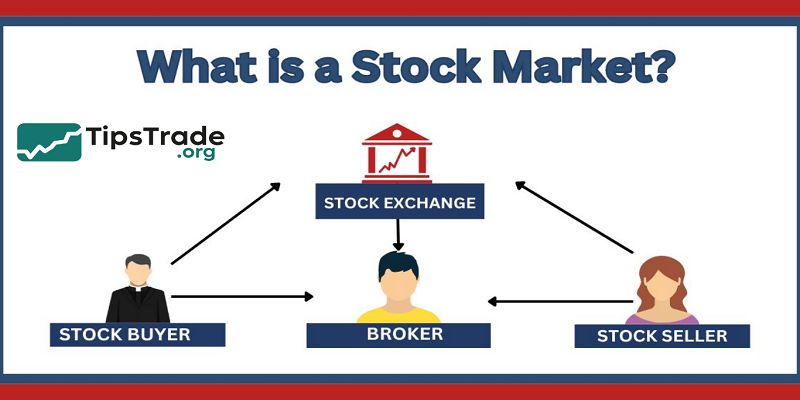

The Role of Brokers, Exchanges, and Regulators

Three main entities facilitate stock market operations:

- Brokers: Licensed intermediaries who execute trades on behalf of investors. In modern markets, online platforms like Charles Schwab, Fidelity, or Robinhood act as brokers.

- Stock Exchanges: Organized venues (like NYSE, NASDAQ, or LSE) that list companies and maintain fair trading environments.

- Regulators: Institutions such as the Securities and Exchange Commission (SEC) in the U.S. ensure transparency, prevent fraud, and protect investors.

These players form the backbone of trust in financial markets. According to a 2023 SEC report, over 65% of U.S. adults hold some form of stock market investment—either directly or through retirement accounts.

Price Discovery and Market Forces

Stock prices fluctuate constantly, driven by supply and demand, company performance, macroeconomic conditions, and investor sentiment. Analysts often refer to this process as price discovery—the mechanism through which the market determines fair value.

Factors that influence stock prices include:

- Company earnings reports and guidance.

- Interest rates and inflation data.

- Global events and geopolitical risk.

- Market psychology (fear vs. greed cycles).

Sophisticated investors use tools like fundamental analysis (examining financial statements) and technical analysis (chart patterns and momentum indicators) to evaluate stocks.

Why the Stock Market Matters

The stock market is not merely a place for speculation—it plays a vital role in economic development, wealth creation, and capital formation.

For Companies: Access to Capital

Public companies use stock issuance to raise money for:

- Expanding operations or entering new markets.

- Investing in research and innovation.

- Paying down debt or funding acquisitions.

For example, when Amazon went public in 1997, it raised around $54 million—capital that fueled its growth into one of the largest corporations in the world.

Wealth Creation and Ownership

Investors buy stocks to grow wealth over time through:

- Capital appreciation: Stock price increases.

- Dividends: Regular income paid from profits.

Historically, the U.S. stock market has delivered an average annualized return of about 10%, according to long-term S&P 500 data from Morningstar. However, returns vary widely year to year—underscoring the importance of risk management and diversification.

A Barometer of Health

- The stock market often reflects the overall health of an economy. Rising markets signal optimism and growth, while falling markets often precede or accompany recessions.

- Economists track stock indexes (like the S&P 500, Dow Jones, or NASDAQ Composite) as leading indicators of future activity.

The IMF and World Bank consider well-functioning stock markets crucial to financial stability and innovation funding.

Benefits and Risks of Stock Market Investing

Benefits

- Liquidity: Stocks can be bought or sold quickly.

- Diversification: Exposure to many sectors and companies.

- Ownership: Shareholders may receive voting rights and dividends.

- Inflation hedge: Over time, equities tend to outperform inflation.

Risks

- Volatility: Prices can swing sharply.

- Market downturns: Economic shocks can wipe out short-term gains.

- Behavioral risks: Emotional decision-making (fear, greed) often leads to losses.

- Company risk: Poor management or scandals can destroy value.

Tip: Diversify across sectors, regions, and asset classes to manage exposure.

Managing Risk Effectively

Professional investors rely on portfolio diversification and long-term strategies.

Key approaches include:

- Holding a mix of stocks, bonds, and cash equivalents.

- Investing through index funds or ETFs for broad exposure.

- Avoiding short-term speculation.

- Rebalancing portfolios periodically.

According to Vanguard’s research, maintaining a diversified portfolio and staying invested long-term has historically produced better outcomes than market timing.

Common Terms and Concepts in the Stock Market

| Term | Definition | Example |

| Stock/Share | A unit of ownership in a company. | 1 Apple share = tiny ownership stake. |

| IPO (Initial Public Offering) | The first time a company sells shares to the public. | Facebook IPO in 2012. |

| Dividend | Portion of company profits paid to shareholders. | Coca-Cola pays quarterly dividends. |

| Index | Group of stocks representing a market segment. | S&P 500 tracks top 500 U.S. companies. |

| Bull Market | Period of rising prices. | 2009–2021 expansion cycle. |

| Bear Market | Period of declining prices (≥ 20% drop). | 2022 market correction. |

Learning these core concepts builds confidence for anyone entering the investing world.

Conclusion

Stock market definition is fundamental to comprehending how investment opportunities and company valuations are created and maintained. Recognizing its importance allows investors to make informed decisions and participate effectively in the financial ecosystem.

See more: