Raising capital is a crucial process for businesses seeking to fund their operations, expand, or invest in new opportunities. It involves obtaining financial resources from various sources, such as equity investors, debt financing, or other instruments. Effective capital raising strategies enable companies to support growth while managing risks and maintaining control. For a detailed understanding of these risks, you may also explore resources at Tipstrade.org which provide expert insights and comprehensive analysis on IPOs.

What Is Raising Capital?

- Raising capital refers to the process of securing money to fund business operations, growth, or new projects.

- Companies may seek funds to expand into new markets, invest in technology, or cover operational expenses.

- Capital can come from external investors, financial institutions, or public offerings.

- In practice, raising capital is not just about “getting money.” It’s about structuring a financial partnership that aligns the company’s growth ambitions with investor expectations.

- A small business might raise $100,000 through angel investors, while a large firm could issue billions in bonds or stock.

- This process lies at the heart of capitalism — without capital formation, innovation and expansion would stagnate.

- According to the World Bank, efficient capital markets are key drivers of GDP growth and job creation worldwide.

Why Companies Raise Capital

Businesses raise capital for multiple reasons:

- Growth and expansion: entering new markets, opening branches, or launching new products.

- Working capital: funding daily operations, payroll, or inventory.

- Debt repayment: refinancing existing obligations under better terms.

- Acquisitions: buying competitors or merging to strengthen market position.

For instance, Tesla raised billions through stock offerings between 2020–2021 to accelerate its production capacity.

The capital allowed it to expand Gigafactories and strengthen its competitive edge.

Raising capital, when used strategically, becomes a catalyst for long-term growth rather than a temporary fix.

Capital Raising vs. Other Funding Methods

Capital raising is distinct from grants or revenues.

- Grants (e.g., government funding) are non-repayable but often limited and competitive.

- Revenue reinvestment uses profits to self-fund, but may not be enough for rapid growth.

- Capital raising (equity or debt) injects external funds, allowing immediate scaling — though it introduces new obligations or shared ownership.

For early-stage startups, combining multiple methods — e.g., bootstrapping, then venture capital, then IPO — is a common funding trajectory.

Major Methods of Raising Capital

Equity Financing – Selling Ownership Stakes

Equity financing means selling ownership in exchange for money. Investors receive shares and a portion of future profits. This is common among startups and high-growth companies with uncertain cash flow.

Common forms include:

- Venture capital (VC): professional investors funding early-stage startups.

- Angel investors: wealthy individuals providing early capital.

- Private equity: funding for mature businesses seeking expansion or restructuring.

- Public offering (IPO): selling shares on stock exchanges.

Example: In 2021, Stripe raised $600 million at a $95 billion valuation — all through equity financing. This allowed the company to expand globally without taking on debt.

Pros: No repayment obligation, access to expert investors.

Cons: Ownership dilution, loss of partial control, investor pressure.

Debt Financing – Borrowing Money

Debt financing involves borrowing money that must be repaid with interest. Unlike equity, it does not dilute ownership. Businesses opt for loans or bonds when they have predictable cash flow to service debt.

Types of debt financing:

- Bank loans: short- or long-term.

- Corporate bonds: raising capital from the public or institutions.

- Convertible notes: hybrid instruments that can turn into equity.

- Credit lines: flexible borrowing for working capital.

For example, Apple Inc. issued $14 billion in bonds in 2021 despite having significant cash reserves — a move to leverage low interest rates and maintain liquidity.

Advantages: Maintain full control, tax-deductible interest.

Risks: Repayment pressure, credit-rating impact.

Hybrid or Alternative Methods

Beyond traditional equity or debt, innovative methods have emerged:

- Crowdfunding: platforms like Kickstarter or SeedInvest allow retail investors to fund startups.

- SAFE (Simple Agreement for Future Equity): popular in early-stage financing.

- Mezzanine financing: a blend of debt and equity with higher risk and reward.

- Peer-to-peer lending (P2P): individuals lend money through digital platforms.

These methods democratize access to capital. In 2024, global equity-crowdfunding volume exceeded $1.3 billion, highlighting investors’ growing appetite for early-stage opportunities (Source: Statista 2024).

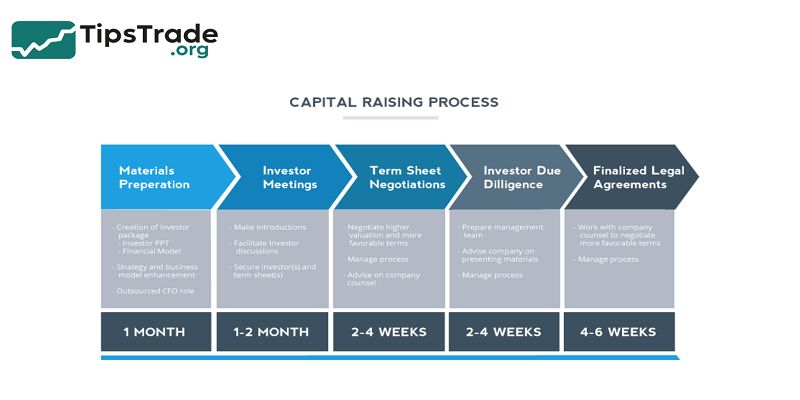

The Capital Raising Process – Step by Step

Preparation Stage

Before raising funds, a company must evaluate its financial health and define how much capital is needed. This stage includes:

- Preparing a business plan and financial projections.

- Assessing valuation and ownership structure.

- Identifying potential funding sources (banks, VCs, angel networks).

Professional preparation increases credibility. Research by Harvard Business School shows that startups with detailed financial plans are 2.5× more likely to secure funding.

Finding Investors or Lenders

Next comes the search for suitable capital partners. Networking plays a huge role.

- Equity route: connect with angel groups, VC firms, or accelerators.

- Debt route: approach banks or corporate-bond underwriters.

- Online platforms: use digital funding portals for wider visibility.

Building trust is crucial. Investors invest in people as much as in ideas. Having transparent communication and a clear pitch deck often determines success.

Structuring the Deal

At this point, valuation and terms are negotiated. Founders must balance capital needs with ownership and control.

Key elements to consider:

- Valuation method (DCF, multiples, comparables).

- Investor rights & preferences.

- Exit strategies (IPOs, acquisitions).

- Debt terms (interest, maturity, covenants).

A common mistake is accepting unfavorable terms for quick funding. Experienced advisors or legal counsel help prevent costly errors.

Closing and Compliance

After due diligence and agreements, funds are transferred. However, compliance doesn’t stop there.

- Companies must adhere to securities laws (e.g., SEC filings in the US).

- Continuous reporting and transparency build investor trust.

- Proper use of funds must align with declared purposes.

According to PwC data, 70 % of failed fundraising campaigns stem from poor communication or regulatory non-compliance.

Advantages and Risks of Raising Capital

Benefits

- Accelerated growth: Access to large capital enables scaling.

- Networking & expertise: Strategic investors bring mentorship.

- Liquidity: Enhances financial stability and market confidence.

Example: Netflix raised over $5 billion through debt financing to fund its content expansion — a strategic move that paid off in global market share.

Risks and Trade-offs

- Dilution of ownership (in equity financing).

- Debt burden and interest payments.

- Market pressure from investors expecting rapid returns.

- Regulatory complexity.

Companies must strike a balance between growth and sustainability. Over-leveraging or misusing funds can lead to bankruptcy or loss of control.

Conclusion

Raising capital is both an art and a science. It requires a solid understanding of financial instruments, market dynamics, and investor psychology. Whether you’re an entrepreneur seeking funds or an individual investor studying how companies grow, knowing the mechanics of capital raising is crucial.