When investing in the stock market, one of the important factors investors need to consider is the bid ask spread, in order to maximize their profits. So, what is bid ask spread? What are the factors influencing bid ask spread? This article by Tipstrade.org will help you answer those questions.

What is bid ask spread?

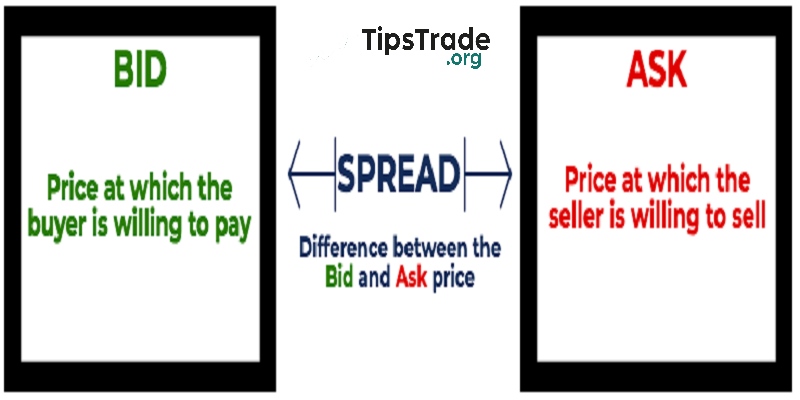

The bid ask spread is one of the most fundamental concepts in the stock market. It represents the difference between the bid price (the highest price a buyer is willing to pay) and the ask price (the lowest price a seller is willing to accept) for a particular asset such as a stock, currency pair, or cryptocurrency.

For example: If a security received a bid of $10 and an ask of $11, an investor would expect to lose $1 or 9% of their investment if they bought at the asking price of $11 and then immediately changed their mind and sold at the bid price of $10.

In simple terms, the bid/ask spread reflects the transaction cost and liquidity of a market. Accordingly, the narrower the spread, the more liquid and active the market is.

>>See more:

- What Are Shares and How Do They Work?

- 1001 Stock Market Terms for Beginners Should Know

- What Are Stock Ticker Symbols? How To Read Stock Ticker Symbols

- What is Stock Market Index? Top 8 Stock Market Index You Should Know About

Importance of the bid ask spread

The bid/ask spread can be used in the following ways:

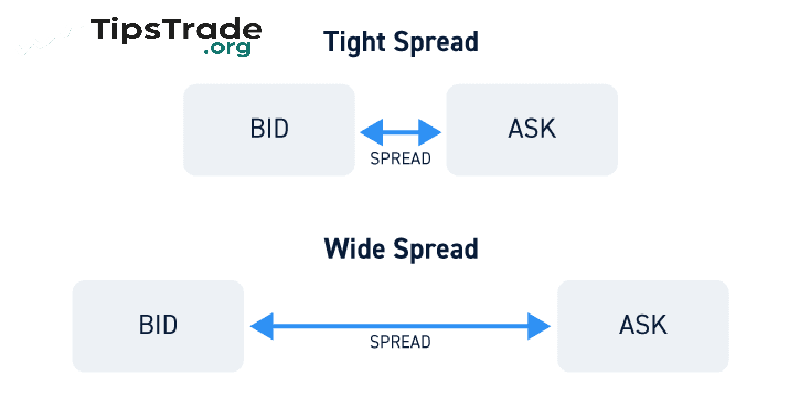

- Liquidity indicator: A narrow bid ask spread indicates high liquidity, while a wide bid ask spread indicates lower liquidity.

- Transaction costs: A wide bid/ask spread indicates that the transaction costs would be higher. On the other hand, a narrow bid ask spread indicates lower transaction costs.

- Volatility indicator: A wide bid/ask spread means the participants in the market are cautious of high volatility. Meanwhile, markets with a narrow bid ask spread indicate low volatility.

- Market efficiency: In efficient markets, the market information flows freely, and due to the low probability of volatile movements, the bid ask spreads are generally narrow. On the other hand, inefficient markets often have a wide bid ask spread.

Bid ask spread formula

The bid ask spread is calculated as the difference between the highest price that a buyer is willing to pay for a security and the lowest price that a seller is willing to accept.

Bid ask spread = Ask price – Bid price

For example, if a stock has a bid price of $100.00 and an ask price of $100.05, the bid-ask spread is ( $100.05 – $100.00 = $0.05 ). This spread can also be expressed as a percentage of the midpoint of the bid and ask prices.

Factors that influence bid ask spread

Several factors contribute to the bid/ask spread are given below:

- Liquidity: Highly liquid stocks, such as those of large, well-known companies, typically have narrower spreads because there are many buyers and sellers in the market. Conversely, less liquid stocks typically have wider spreads because fewer people are trading.

- Market conditions: During periods of high volatility or market instability, spreads may widen as traders are less willing to execute trades at current prices.

- Stock price: High priced stocks typically have larger absolute spreads, although the percentage difference may still be small. Conversely, low priced stocks typically have smaller absolute spreads.

- Trading volume: Stocks with high trading volume typically have tighter spreads due to intense competition between buyers and sellers.

- Time of day: Typically, spreads will be wider at market opening and closing times, due to increased price volatility and reduced liquidity during these periods.

Strategies to minimize the impact of bid ask spread

Investors can use a variety of strategies to minimize the impact of bid ask spread on their trading results. One effective way is to use limit orders instead of market orders. Limit orders allow investors to set the price at which they want to buy or sell, thereby avoiding the unfavorable price caused by the spread.

Another strategy is to trade during active market times, as liquidity is usually higher, resulting in tighter spreads. Additionally, investors should focus on stocks with high liquidity, as they tend to have lower spreads. Monitoring the spread before placing an order also helps investors make more accurate decisions.

Conclusion

Bid ask spread serves as an effective indicator of liquidity, with highly liquid securities having a small spread while less liquid securities will have a larger spread. Investors should pay attention to the spread of any security they wish to buy or sell to understand the frequency of trading and decide which order type to use when executing a trade.

FAQs about bid ask spread

How to profit from bid ask spread?

Investors buy stocks at the bid price and then offer them to the next group of investors. They quote a bid price and an ask price for the stocks. The difference between the bid and ask price is their profit.

What is a good bid ask spread?

The narrower the spread, the higher the demand. This indicates that the difference between the bid and ask price is very small. Conversely, a wider spread reflects less liquidity in the market. On average, the bid ask spread for stocks in the S&P 500 index ranges from 13% to 18%.

Why the bid ask spread is a transaction cost?

Investors buy stocks at the ask price (the selling price on the market) and then sell them at the bid price (the buying price on the market). In this transaction, the ask price is always higher than the bid price, making it impossible for investors to profit from the difference. Instead, this difference becomes a transaction cost for investors and a profit for market makers or brokers.

See more: