Penny stocks are considered by investors to have potential, but they also carry high risks such as low liquidity and a small number of shareholders,…So, what are penny stocks and what are their advantages and disadvantages? Follow the following article from Tipstrade.org for more knowledge on safe and effective investment!

What are penny stocks?

Penny stocks are typically shares of small, low-capitalization companies that trade infrequently. Penny stocks are also known by other names such as: Small Cap, Nano Cap, and Micro Cap Stock. In the US, stocks priced below $5 are considered penny stocks.

>>See more:

- ADR Stocks: A Complete Guide for Global Investors

- Growth Stocks – Definition, Examples, Characteristics

- Preferred Stock – What It Is, How It Works, and Should You Invest?

Features of penny stocks

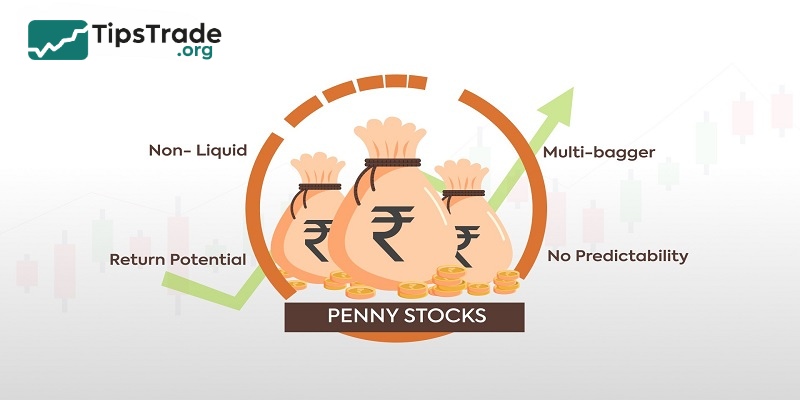

The features of penny stocks are listed below:

- High profit

Penny stocks bring much higher returns than other forms of stocks. Because these stocks are issued by small-sized companies, there is great potential for growth. Therefore, the risk of Penny stocks is high.

- Lack of liquidity

Penny stocks are low priced and have little interest. Although the stock price has increased, the stock has not received much attention. Therefore, the liquidity is relatively low.

- Unpredictable prices

Penny stocks may not attract prices during the sale. This may result in lower or non-existent returns. Likewise, these stocks may also attract prices significantly higher than your cost. This, in turn, results in significant profits.

Are penny stocks a good investment?

“High risk, high value” is a very suitable statement for the Penny stocks. Many investors are willing to accept the risk to put money into this stock. They hope for the growth of the market, which will lead to stock prices and large profits.

Basically, each type of stock has its own advantages and disadvantages. You need to understand these points clearly to make the most accurate investment decision.

Advantages of penny stocks

- Low stock prices: Penny stocks are often very cheap, making them easily accessible to investors with little capital. In addition, this type of stock also offers many choices.

- High growth potential: For small businesses, just one driving factor can help the business break through and increase stock prices in the future.

Disadvantages of penny stocks

- Low liquidity: In fact, many Penny codes are traded on OTC exchanges. Therefore, investors will find it difficult to grasp the situation to make decisions at the right time.

- Not transparent, susceptible to rumors: For small-cap stocks like Penny Stocks, it is not easy for investors to find and verify information about the business.

- Many penny stocks traded on OTC markets: Many penny stocks trade over-the-counter (OTC) and the companies that issue them often do not meet the minimum requirements to be listed. Penny stocks also suffer in terms of their credibility compared to stocks on the centralized stock market.

In short, Penny stocks are quite risky. You should only invest a small portion of your assets in them. Then consider this a speculative product. Penny stocks often have unpredictable spreads in buying and selling prices. Therefore, you must be very alert and quick when investing in these stocks.

In addition, Penny investing can be seen as a gamble with the market. Win all or lose nothing. Because if you have good predictions and are willing to accept the risks, it is entirely possible to reap huge profits.

How to invest in penny stocks safely

Although Penny stocks have many potential risks, they are also a great investment opportunity when you choose the right potential stock code. Remember the following 3 principles to invest in Penny stocks more safely:

- Avoid buying stocks that are falling in price.

In fact, penny stocks almost always go up in price in the short term. Not long after that, they tend to fall sharply and it takes a long time for the next increase in price. So you should not buy penny stocks when they are on a downtrend.

- Don’t average down.

Averaging down requires a substantial amount of capital and may take months, or even a year to implement. Instead of averaging down, it’s better to redirect your funds toward other, more stable types of stocks.

- Take profits confidently when the market rises.

With Penny stocks, investors should not “chase the peak”. When the stock has made a profit, you should close it as soon as possible. Because Penny stocks are very difficult to increase again, the liquidity of this type of stock is inherently low, so it is not easy to find a buyer.

>>See more:

- Long-Term Stock Investing: Benefits and Key Principles to Understand

- How To Buy Stocks in 4 Steps: Quick-Start Guide for Beginners

- ETF Investing: The Ultimate Guide for Beginners

- Day Trading Stocks: Benefits, Risks, and Effective Investing Strategies

Most successful penny stocks in history

Apple Inc. (AAPL)

Once a fledgling tech company with a stock price of less than 80 cents a share, Apple Inc. has grown to become one of the most valuable companies in the world. The company’s stock price bottomed at $6.56 in 2003, but that didn’t stop investors from believing in the potential of Apple – which was then still a near-penny stock.

Apple had a market capitalization of $1.2 billion when it went public in 1980, and has skyrocketed to $2.61 trillion by 2023. If you invest $10,000 into Apple in 1985, that investment will increase to 12.9 million USD, equivalent to more profit 46.750%.

It was a “piece of the apple” that everyone wanted to take a bite of!

Amazon (AMZN)

Imagine a time when e-commerce giant Amazon was a penny stock! The company went public in 1997 with a market capitalization of only 438 million USD. At that time, e-commerce was in its infancy and Amazon was just a small online bookstore.

By 2023, Amazon’s market capitalization will have increased 1.05 trillion USD. From selling only books to selling “everything under the sun,” Amazon has become one of the most influential companies in the world. The transformation from penny stock to trillion-dollar enterprise is a testament to Amazon’s innovative business model and customer-centric thinking.

Monster Beverage Corporation (MNST)

Take a “sip” from the energy drink market. Monster Beverage was once traded under 6 cents/share in the early 2000s. At that time, the company was just a small name in the beverage industry, trying to compete with “big guys” like Coca-Cola and Pepsi.

The company then decided to focus on the growing energy drink market and changed its name to Monster Beverage Corporation. This strategy was a great success, as the stock price rose to 69.000% Monster’s journey from penny stock to beverage giant is truly an admirable success story!

Ford Motor Company (F)

Few companies have a history as rich as Ford Motor. As a pioneer in the auto industry, Ford has had its ups and downs. In 2020, Ford stock was considered a penny stock, but the company quickly recovered and continues to maintain its leading position in the auto industry.

The journey from penny stock back to leadership is a testament to the power of resilient and innovativeFord. From the sample Model T revolutionized the automotive industry until Mustang – the icon of American muscle cars, Ford continues to push the envelope, proving that a penny stock can still become a lasting “legend.”

Advanced Micro Devices (AMD)

The technology industry is always changing, and Advanced Micro Devices (AMD) is a clear testament to that. In 2015, AMD stock was trading under $2/share, and was considered a penny stock at the time.

However, AMD has made a spectacular comeback. Its stock price has soared to nearly 100 USD/share, marking a dramatic transformation from a penny stock to a technology giant.

Nowadays, with Market capitalization 155 billion USD, AMD is one of the leading manufacturers of microprocessors, motherboard chipsets and graphics processors.

Medifast Inc. (MED)

In the field of health and nutrition, Medifast Inc. has made a name for itself. Starting as a penny stock, the company has made its mark with steady and sustainable growth, becoming a prominent brand in the industry.

Medifast capitalizes on the health and fitness trend and applies a model of direct sales, providing a personalized experience to customers. Continuous product expansion and an active support community have helped the company maintain its position and attract more new customers.

True Religion Jeans (TRLG)

True Religion Jeans is a cautionary tale for penny stock investors. In the early 2000s, the company’s shares were trading under $1/share. By 2013, the company was acquired for 32 USD/share, which seemed like a great success.

However, the luck did not last long. After being acquired, the company went bankrupt, showing that not every penny stock leads to long-term success, and emphasizes the importance of Research carefully before investing.

Plug Power Inc. (PLUG)

In the field of clean energy, Plug Power Inc. is a prime example of a “life-changing” penny stock. The company has transformed itself by focusing on hydrogen fuel cell technology.

Plug Power’s stock price has surged after signing several major deals in Europe and South Korea, demonstrating its global expansion strategy. With a market capitalization exceeding 1 billion USD and stock price peaks more than 75 USD, PLUG demonstrates the huge potential of penny stocks in emerging industries like clean energy.

GameStop Corp. (GME)

Journey of GameStop Corp. is a clear demonstration of the unpredictableness of the penny stock market. As a video game retailer, GameStop was once considered a bankrupt business.

However, in January 2021, GameStop’s stock price saw an extraordinary surge, with shares skyrocketing due to speculative trading fueled by discussions on the subreddit r/wallstreetbets. This story shows the extreme volatility of penny stocks and the powerful impact of social networks for the stock market.

Novavax Inc. (NVAX)

The story of Novavax Inc.is a testament to the “roller coaster” that penny stocks can bring. Novavax used to be a penny stock, but has since seen skyrocketing growth – from $3.50 to nearly $300/share just in less than a year.

This spectacular price increase took place during a period of strong market volatility due to COVID-19 pandemic, showing that external factors can profoundly influence the fortunes of a penny stock, both positively and negatively.

Conclusion

Penny stocks can be an attractive way to potentially make quick profits when prices rise. However, these stocks generally carry quite a bit of risk. If you want to invest in penny stocks, you should research penny stocks thoroughly.