Stock risk management plays an extremely important role throughout the trading process, determining the investor’s success. However, many investors don’t know where to start or how to manage risk and minimize the risk of loss. In this article, let’s explore the risks in stock investment and how to manage them to ensure safe investment and the best possible results.3

What are the risks of investing in stocks?

The risks of investing in stocks are understood as unfortunate events that occur to investors when they trade in the stock market. The risks can come from many different sources. If investors don’t fully understand the potential risks and have appropriate coping strategies, they are very likely to incur losses, or even lose everything.

>>See more:

- What is Stock Liquidity? Why It’s Important for Investors

- What is Stock Market Index? Top 8 Stock Market Index You Should Know About

- What Is a Stock Broker? Essential Skills and Average Salary of Being a Stock Broker

- What are stock exchanges and how do they work?

The importance of stock risk management

Here are some of the main reasons to answer the question of the importance of stock risk management:

- Stock risk management helps investors limit maximum losses when the market moves in the opposite direction as predicted.

- A good stock risk management strategy not only minimizes losses but also helps to optimize long-term profits. By controlling risks, investors can maintain a stable mentality and make effective investment decisions, instead of being dominated by emotions.

- The stock market is always uncertain and unpredictable. Stock risk management allows investors to respond flexibly to these fluctuations, avoiding the situation of “burning accounts” when major events occur.

- Building a stock risk management plan forces investors to adhere to clear investment principles, thereby forming professional investment habits, instead of acting emotionally or following the crowd.

- Thanks to stock risk management, investors can allocate capital reasonably among different asset classes, ensuring that the portfolio has a balance between risk and expected return.

Types of risk in the stock market

Understanding the different types of risks will help investors be more proactive in building their portfolios and effectively protecting their capital. Here are some common risks when investing in stocks:

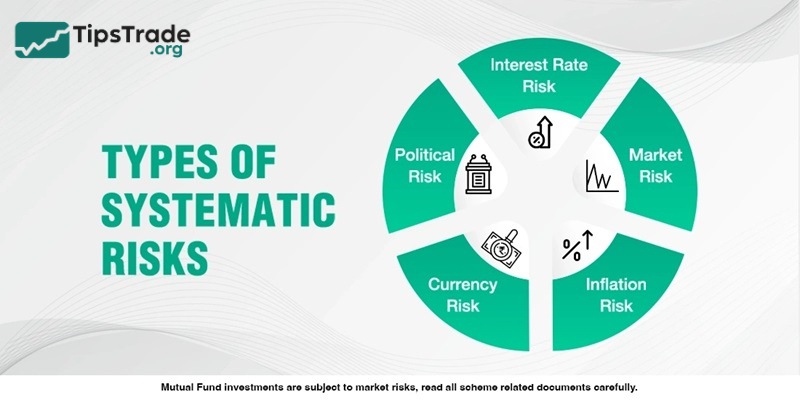

Systematic risk (Market risk)

Systematic risk, also known as market risk, is a type of risk that affects all factors in the stock market, including any industry in the market that is affected by this type of risk. For this type of risk, investors cannot avoid it but can only apply experience and knowledge to prevent and minimize its impact.

Systematic risk includes four main types: Commodity risk; Model risk; Inflation risk and interest rates; Liquidity risk.

Unsystematic risk (Specific risk)

Unsystematic risks are risks in stock investment that occur in each individual industry and field. They do not cover the entire market but only affect a certain group of investors. Investors can completely avoid unsystematic risks by analyzing and identifying them based on learned experience.

Unsystematic risk includes 5 types: Rating Risk; Obsolescence risk; Audit risk; Media risk; Legal risks.

Stock risk management strategies for investors

Anyone who participates in the market must face risks. However, there will be suitable solutions depending on each investor’s knowledge and experience to minimize risks in trading. Here are the most common and effective stock risk management to help new investors hedge against and avoid market risks.

Research the market thoroughly

For newcomers to the stock market, acquiring knowledge about investment risks, factors that affect stock prices, and market-manipulating indicators is essential. This helps investors better understand market trends and fluctuations. Moreover, it allows them to make rational decisions without being swayed by crowd psychology or external influences.

In addition, investors should continuously improve their knowledge and skills in both technical and fundamental analysis to develop an investment strategy that best suits their goals.

Choose a professional brokerage firm

To ensure stability and safety when participating in the stock market, investors should carefully select a reputable and professional brokerage firm. This is a crucial condition for maintaining market transparency, ensuring quick and accurate order execution, timely information updates, and minimizing exposure to price manipulation factors.

Focus on long-term stock investment

Long-term stock investment strategy helps investors minimize the risks in stock investment, including both systematic and unsystematic risks. When investing for the long term, investors will not be affected by short-term fluctuations in the market.

Investing for the long term and generating sustainable and long-term profits from a business is considered a smart form of investment. In addition to receiving regular dividends, long-term investors also benefit from the difference in stock prices caused by the growth and recovery of the business after fluctuations.

Diversify your investments

Investors should diversify their stock portfolios and industry sectors to reduce unsystematic risk. Focusing solely on one or two potential stocks is not advisable, as it increases exposure to ranking risks, obsolescence, and industry-specific news.

However, it’s important to balance the number of stocks and investment channels according to one’s budget and the time available for monitoring. This ensures maximum profitability and prevents over-diversification, which can lead to inefficiency and lack of focus.

Maintain investment discipline

Investors need to establish clear goals and maintain strict investment discipline throughout their journey. The stock market is not a place for impulsive or speculative trading. To invest safely and achieve high profitability, one must commit to long-term investing and adhere to strict investment principles.

Rules regarding stop-loss limits and target prices should be followed rigorously to prevent emotional decision-making in volatile market conditions. This helps investors maintain proper control over their capital according to predetermined rules and ratios, leading to optimal investment efficiency.

Tools for effective stock risk management

- Dollar-Cost Averaging: Dollar-cost averaging is a method where a fixed amount of money is regularly invested in a company, regardless of market conditions. This technique allows investors to benefit from market volatility.

- Fundamental Analysis: It helps in determining a company’s true value by examining its financial statements, industry trends, and other relevant data. The goal is to identify stocks that are undervalued and have potential for growth.

Conclusion

Thus, this article has provided investors with an overview of essential knowledge about stock risk management. Hopefully, this information will be useful and valuable for investors to apply effectively in real-world trading. Wishing all investors successful and profitable trades!

See more articles: